Introduction

In the realm of financial markets, where risks and rewards dance in delicate equilibrium, option trading stands as a powerful instrument for astute investors seeking to navigate volatility. An option contract, akin to a potent financial spell, grants the holder the right, not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset, such as a stock or commodity, at a predetermined strike price within a specified expiration period. Harnessing the transformative potential of option trading requires a keen understanding of market dynamics, fundamental analysis, and strategic entry analysis techniques.

Image: www.pinterest.com

The Art of Entry Analysis: Unlocking Market Timing

Entry analysis, the cornerstone of successful option trading, empowers traders with the ability to identify opportune entry points in the market’s ceaseless ebb and flow. By deciphering market patterns, gauging market sentiment, and employing technical indicators, traders can time their entry into option contracts with the same precision as a maestro conducting an orchestra.

A Glimpse into Technical Indicators: The Traders’ Toolkit

Technical indicators, those indispensable tools in the trader’s arsenal, are mathematical formulas that process historical price data to reveal market trends, momentum, and potential turning points. A veritable Rosetta Stone for option traders, these indicators translate the cryptic language of charts into actionable insights. The Moving Average, Bollinger Bands, and Relative Strength Index (RSI) are but a few of the many indicators that illuminate the path of price action, guiding traders toward informed entry decisions.

Market Sentiment Analysis: Decoding the Crowd’s Psyche

The pulse of the market, ever-changing and enigmatic, holds sway over the trajectory of option prices. Option traders who delve into the uncharted depths of market sentiment, seeking to unravel its intricate tapestry, gain a distinct advantage in discerning crowd psychology and anticipating market shifts. By monitoring social media sentiment, tracking news flow, and gauging investor sentiment indicators, traders can align their entry strategies with the collective wisdom of the market.

Image: blog.dhan.co

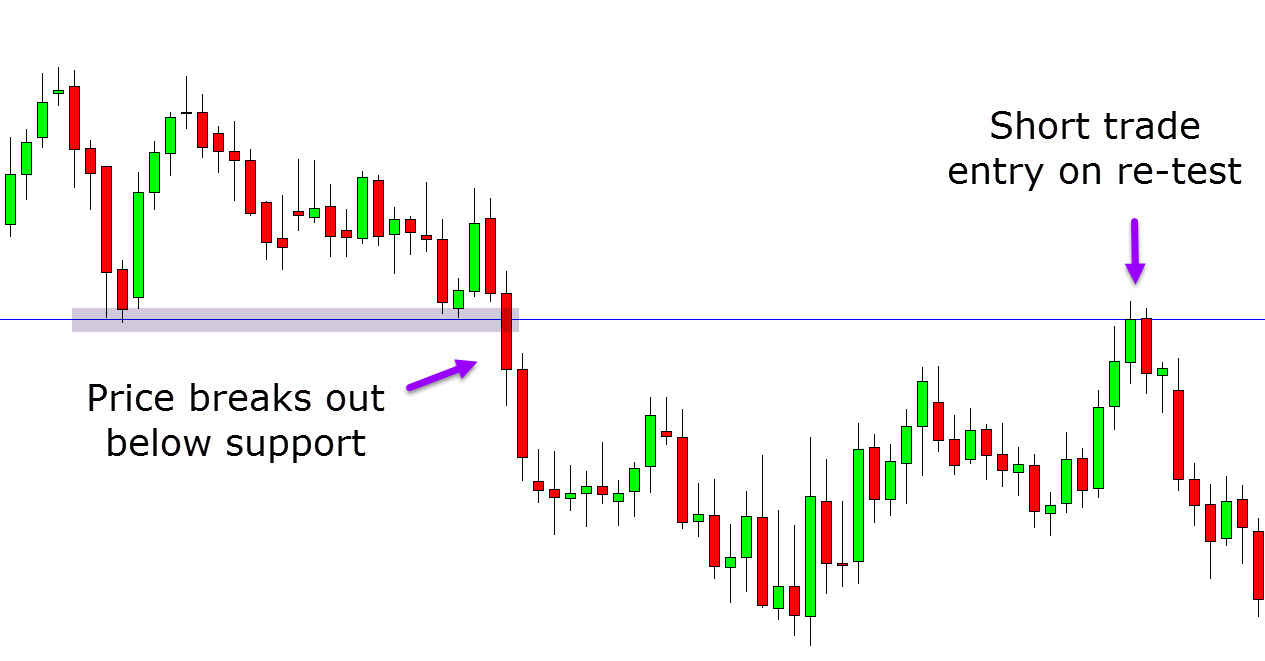

Chart Patterns: Unraveling the Market’s Narrative

Price charts, the visual heartbeat of the market, record the symphony of price fluctuations over time. By meticulously scrutinizing these charts, option traders decipher recurring patterns that reveal underlying market forces and potential future price movements. Head and shoulders patterns, double tops and bottoms, and the ever-elusive pennants are just a few of the patterns that emerge from the labyrinth of price data, offering glimpses into the market’s intentions.

Risk Management: Navigating the Perils of Option Trading

In the world of option trading, risk is an ever-present companion, a force that must be tamed if profits are to be reaped. Prudent option traders employ a comprehensive suite of risk management strategies to mitigate potential losses and preserve their precious capital. Strict adherence to position sizing, effective hedging techniques, and disciplined stop-loss orders form the bedrock of sound risk management, allowing traders to venture into the market’s tempestuous waters with confidence.

Option Trading Entry Analysis

Image: learnpriceaction.com

Conclusion

Option trading entry analysis is an intricate art, a meeting ground where market knowledge, analytical prowess, and strategic thinking converge. Embarking on this path is akin to unraveling a captivating mystery, where each step brings new revelations and challenges. By mastering the techniques outlined in this comprehensive guide, you, too, can navigate the labyrinth of option trading with the precision of a seasoned navigator, maximizing profit potential while nimbly sidestepping potential pitfalls. So, embrace the allure of option trading entry analysis, and witness the transformative power of unlocking market timing secrets.