Introduction

Image: www.newtraderu.com

In the dynamic world of finance, finding investment strategies that balance risk and reward can be a daunting task. Options trading, often perceived as a high-risk endeavor, can offer potential returns with calculated risk management. This article delves into low-risk options trading strategies, empowering you to navigate the market with confidence and increase your chances of success.

What is Options Trading?

Options trading involves derivative contracts that give traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific period. Understanding the basics of options trading, including calls, puts, and option chains, is crucial for devising low-risk strategies.

Low-Risk Options Trading Strategies

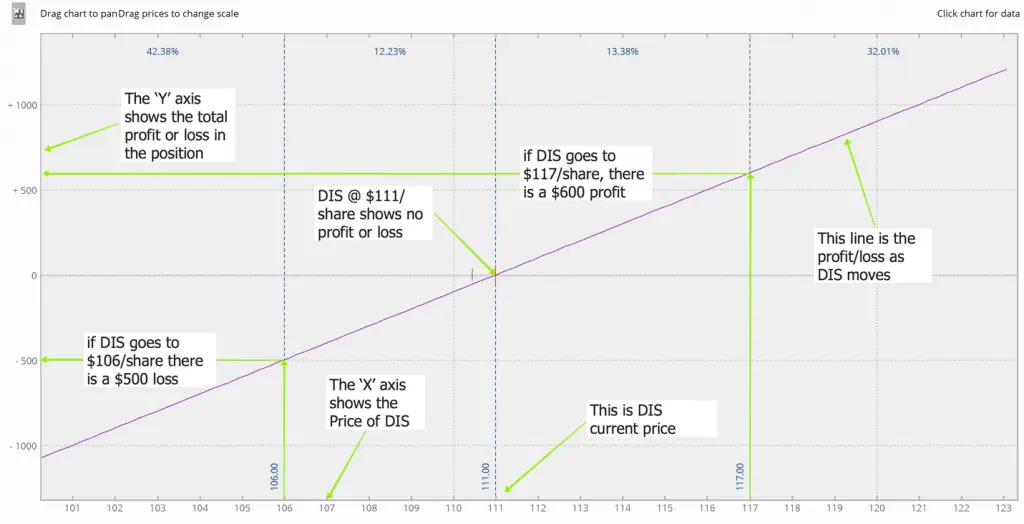

1. Covered Calls:

This strategy involves selling (writing) call options while owning the underlying asset. The writer of the call grants the right to another trader to purchase the asset at a higher price if it reaches a certain threshold. The premium received for selling the call option adds to the trader’s profit.

2. Protective Puts:

Protective puts offer downside protection by giving the trader the right to sell an asset at a predetermined price below the current market value. This mitigates potential losses if the asset’s price declines substantially. The cost of purchasing the put option reduces the overall profit, but it provides peace of mind against market downturns.

3. Cash-Secured Puts:

Similar to protective puts, cash-secured puts require the seller to set aside a specified amount of cash equivalent to the potential sale price of the asset. Unlike protective puts, however, this strategy generates income through option premiums. Although the cash is tied up throughout the option’s life, it reduces the risk of having to buy the asset at a loss.

4. Spreads:

Spreads involve combining multiple options contracts with different strike prices and expiration dates. Popular spreads include bull call spreads, where traders buy a call option at a lower strike price and sell one at a higher strike price, creating a potential upside for limited risk. Bear put spreads, on the other hand, present a bearish view with potential profits capped within a range.

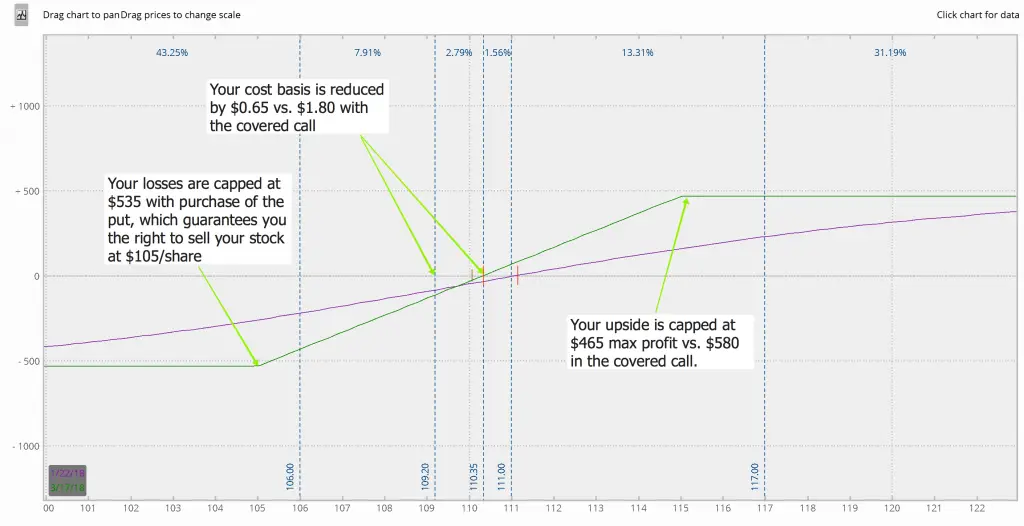

5. Collar Strategies:

Collar strategies combine covered calls with protective puts, limiting both upside potential and downside risk. By granting the right to sell the asset at a higher price with a call and protecting against a substantial drop with a put, traders can create a trade with a capped profit potential and reduced downside exposure.

Expert Insights and Actionable Tips

“Low-risk options trading is not about avoiding risk altogether, but about managing it effectively,” says Dr. James Boyle, a renowned options trading expert. “By understanding the different strategies and underlying asset dynamics, traders can mitigate their risks and increase their odds of success.”

- Start small and gradually increase your position size as you gain experience.

- Use technical indicators and fundamental analysis to determine market trends and identify potential opportunities.

- Monitor your trades regularly and adjust your strategy if market conditions change.

- Consult with experienced traders or financial advisors for guidance and support.

Conclusion

Low-risk options trading strategies provide a valuable path for investors seeking potential returns with controlled risk exposure. By understanding and implementing these strategies, you can navigate the markets with greater confidence and increase your chances of achieving financial goals. Remember, investing involves inherent risks, and thorough research and knowledge is paramount for successful trading.

Image: www.newtraderu.com

Low Risk Options Trading Strategies

https://youtube.com/watch?v=UnIxdXl-SQU