In the dynamic world of financial markets, option trading offers traders the potential to amplify their returns, but selecting the most accurate strategy can be a daunting task. This comprehensive guide delves into the complexities of option trading and unravels the secrets of finding the strategy that will optimize your success.

Image: tme.net

A Journey into Option Trading: The Basics and Beyond

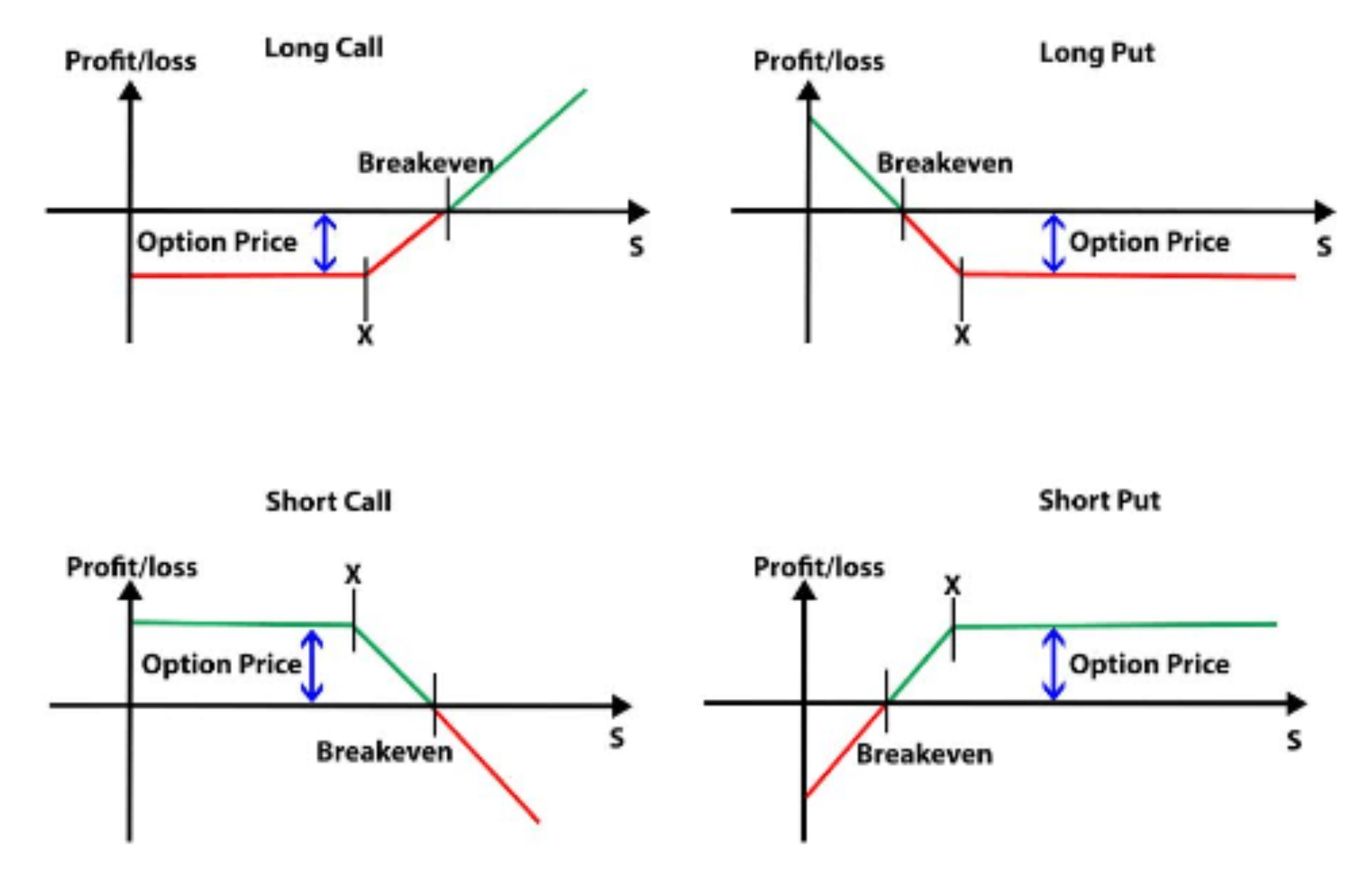

Option trading involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy (in the case of a call option) or sell (put option) a specific asset at a predetermined price on or before a particular date. This powerful tool empowers traders with the ability to speculate on future price movements, hedge against market volatility, and potentially enhance their portfolio returns.

Accuracy Unveiled: The Quest for the Perfect Strategy

Identifying the most accurate option trading strategy is a multi-faceted endeavor that requires a deep understanding of market dynamics, technical analysis, and risk management. Various approaches exist, each with its strengths and limitations, including:

-

Statistical Arbitrage: This approach harnesses historical price data and statistical models to identify mispricing anomalies in option contracts.

-

Technical Analysis: Traders study price charts and patterns to predict future price movements, guiding their option trading decisions.

-

Fundamental Analysis: This strategy involves analyzing a company’s financial health, industry trends, and economic factors to assess the underlying asset’s value and project its performance.

The Wisdom of Experts: Insights from Seasoned Traders

Option trading luminaries have dedicated years to refining their strategies, and their insights can illuminate your path. Consider implementing the following advice from industry professionals:

-

Master Risk Management: Options can amplify both potential gains and losses. Prudent traders establish clear risk limits and implement strategies like stop-loss orders to mitigate downside risks.

-

Embrace Flexibility: Markets are constantly evolving, and successful traders adapt their strategies accordingly. Be willing to adjust your approach based on market conditions.

Image: www.pinterest.com

Empowering Traders: A Strategic Blueprint for Success

Equipped with the knowledge of various option trading strategies and the wisdom of experts, you now hold the power to enhance your decision-making. Consider the following actionable steps:

-

Research and Education: Immerse yourself in the intricacies of option trading. Read books, attend webinars, and consult with industry experts to deepen your understanding.

-

Practice and Simulation: Practice trading strategies using paper trading or simulation platforms to gain experience without risking real capital.

-

Discipline and Emotional Control: Maintaining discipline and composure in the face of market volatility is crucial. Avoid impulsive trading and adhere to your predefined strategy.

Most Accurate Option Trading Strategy

Conclusion: A Path to Precision in Option Trading

Finding the most accurate option trading strategy is an ongoing pursuit that requires dedication, knowledge, and a willingness to adapt. By following the principles outlined here, you can embark on a journey of empowerment in the world of options, increasing your chances of achieving financial success and navigating the market’s complexities with confidence. Remember, embarking on this journey is about more than financial gains; it’s about continuously expanding your knowledge, honing your skills, and embracing the challenges that come with mastering the art of option trading.