Introduction

In the ever-shifting landscape of modern-day trading, the ability to harness the power of options has become an indispensable skill for seasoned traders and aspiring day traders alike. Options offer traders unique opportunities to profit from both rising and falling markets, while also providing a versatile tool for risk management. With a plethora of strategies to choose from, identifying the best option strategy for day trading can be a daunting task. In this comprehensive guide, we will delve into the intricacies of various option strategies, equipping you with the knowledge and insights to navigate the complexities of day trading and optimize your trading outcomes.

Image: www.pinterest.co.uk

Understanding the Basics of Option Strategies

Options are derivative instruments that provide the holder with the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (strike price) on or before a certain date (expiration date). Option strategies involve combining multiple options in a strategic manner to achieve specific trading objectives.

Types of Option Strategies

-

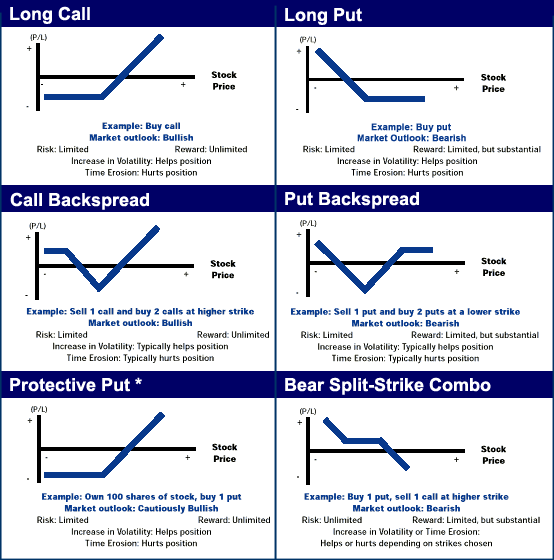

Long Call: Involves buying a call option, giving the trader the right to buy the underlying asset at the strike price on or before expiration. This strategy is suitable for bullish market expectations.

-

Long Put: Buying a put option provides the trader with the right to sell the underlying asset at the strike price on or before expiration. This strategy is beneficial in bearish market scenarios.

-

Short Call: Selling a call option transfers the obligation to sell the underlying asset at the strike price upon exercise. This strategy is appropriate for neutral to bearish market conditions.

-

Short Put: Selling a put option carries the obligation to buy the underlying asset at the strike price upon exercise. This strategy is commonly employed when expecting the asset’s price to remain stable or increase.

-

Call Spread: This involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price with the same expiration date.

-

Put Spread: Similar to call spread but involves buying a put option at a higher strike price and selling a put option at a lower strike price with the same expiration date.

-

Iron Condor: Involves simultaneous buying of a call spread and a put spread at different strike prices.

Selecting the Best Option Strategy

The choice of the most effective option strategy for day trading is influenced by several factors, including:

-

Market Conditions: Bullish markets favor long call strategies, while bearish markets lend themselves to long put strategies.

-

Volatility: High volatility favors short-term strategies like straddles or strangles, while low volatility necessitates longer-term strategies like calendar spreads.

-

Holding Period: For day trading, strategies with short holding periods, such as scalp trading or day trading, are preferable.

-

Style: Individual traders should tailor their strategy to align with their risk tolerance and market outlook.

Image: seekingalpha.com

Tips for Effective Implementation

-

Technical Analysis: Leverage technical indicators like moving averages, support and resistance levels to enhance decision-making.

-

Risk Management: Strictly adhere to stop-loss orders to limit potential losses.

-

Backtesting: Test strategies on historical data to validate performance before implementing them live.

-

Education: Continuously stay abreast of market trends and option trading advancements through ongoing education.

The Best Option Strategy In Day Trading

Image: www.youtube.com

Conclusion

Mastering option strategies is a key ingredient for successful day trading. By understanding the various types of strategies, considering market conditions, and adopting sound risk management practices, traders can optimize their trading outcomes. This comprehensive guide has equipped you with the knowledge and insights to navigate the intricacies of option trading and enhance your profitability in the dynamic world of day trading. Remember, consistent practice, ongoing education, and a commitment to excellence will pave the way for sustained success in this demanding but rewarding field.