As a seasoned swing trader, I’ve witnessed firsthand the transformative impact that option chain analysis can have on strategic decision-making. It transforms the market into a tapestry of opportunities, empowering you to navigate market volatility with finesse.

Image: blog.elearnmarkets.com

Option Chain Analysis: A Gateway to Market Dynamics

Option chain analysis delves into the intricate network of option contracts associated with a particular underlying asset. By scrutinizing this data, traders uncover valuable insights into market sentiment, volatility expectations, and potential trading opportunities.

Decoding the Option Chain

Each option contract represents a contract between two parties, conferring the right (not the obligation) to buy or sell an underlying asset at a specified price on or before a specified date.

The option chain displays the available option contracts with varying strike prices and expiration dates. The strike price represents the price at which the underlying asset can be bought (call option) or sold (put option), while the expiration date signifies the contract’s validity period.

Analyzing the Option Chain Landscape

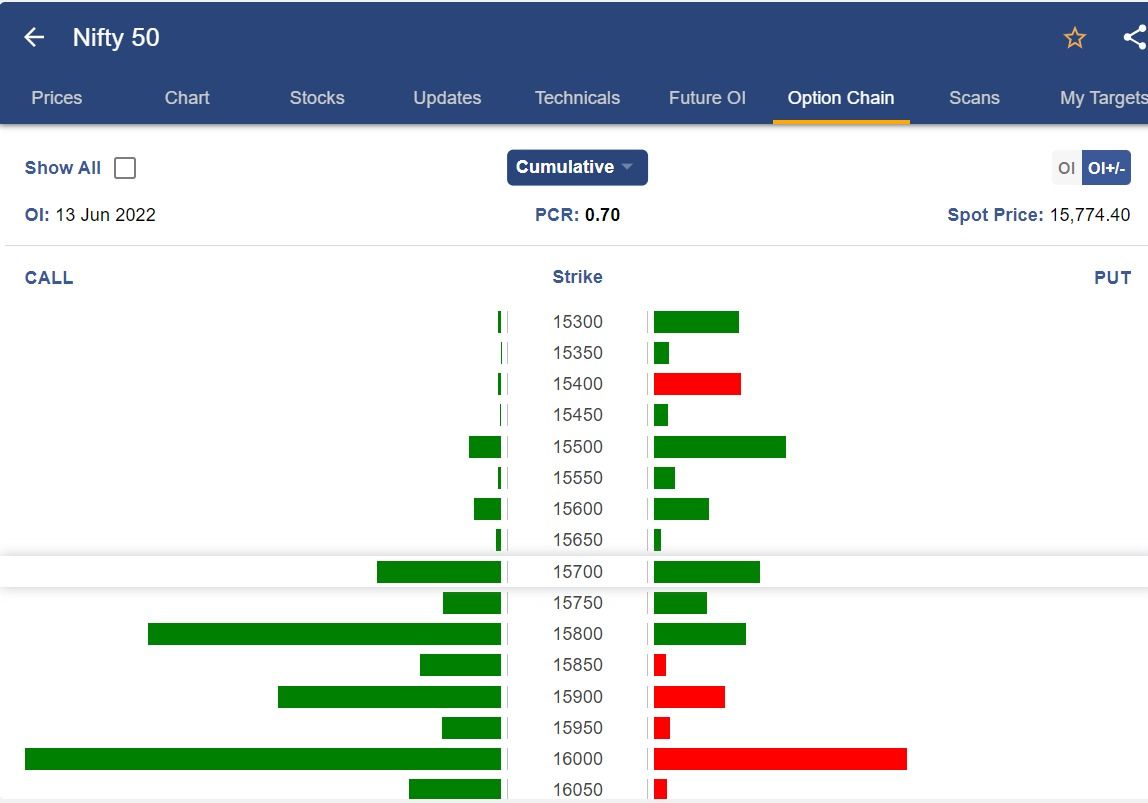

- Open Interest: Reflects the number of outstanding option contracts. High open interest indicates market consensus regarding price movement expectations.

- Volume: Quantifies the number of option contracts traded. Spikes in volume can signal shifts in market sentiment or impending price movements.

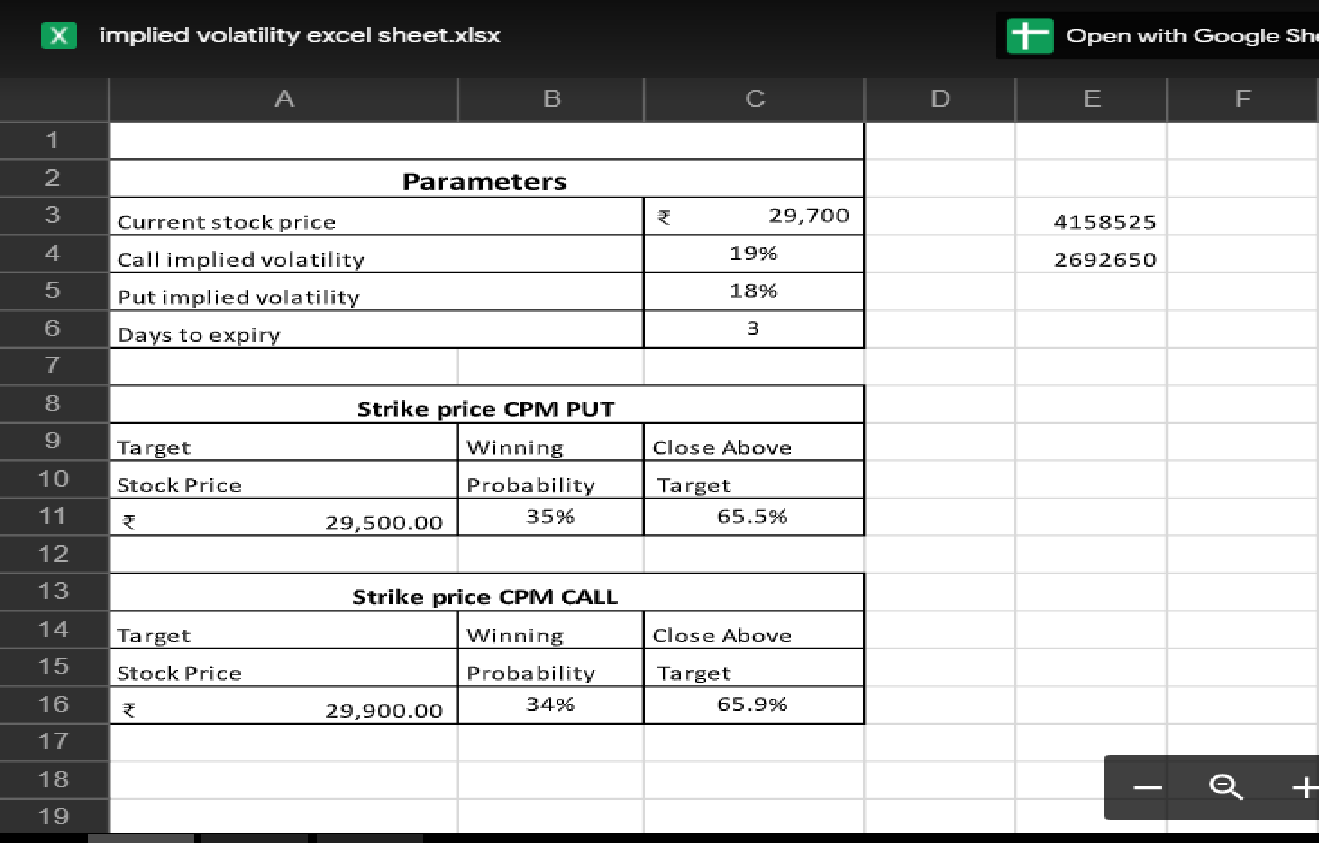

- Implied Volatility: Portrays the market’s perception of potential asset price volatility. Higher implied volatility translates to increased premiums and suggests greater price movement expectations.

- Skew: Measures the difference in option premiums between calls and puts of similar strike prices and expiration dates. It unveils market expectations of price movements in a particular direction.

- Concentration: Pinpoints strike prices with the largest open interest or volume. Identifying areas of concentration provides insight into potential price targets or support/resistance levels.

Image: dotnettutorials.net

Tips and Expert Insights

To harness the power of option chain analysis effectively, embrace these expert tips:

- Identify Trading Opportunities: Scan option chains for anomalies in open interest, volume, or implied volatility that could signal potential trend reversals or impending price breakouts.

- Gauge Market Sentiment: Analyze the distribution of call and put options to pinpoint areas of market consensus or divergence in price movement expectations.

- Measure Volatility Expectations: Implied volatility levels provide insights into the market’s anticipation of future price fluctuations. Higher volatility often translates to greater trading opportunities.

- Utilize Technical Indicators: Integrate technical analysis techniques, such as support/resistance levels, moving averages, and momentum indicators, with option chain analysis to enhance your trading strategies.

Frequently Asked Questions

- Q: What are the benefits of using option chain analysis?

- A: Enhanced market insights, improved trading strategies, and the ability to identify potential opportunities with greater accuracy.

- Q: How do you interpret option chain data?

- A: Scrutinize open interest, volume, implied volatility, skew, and concentration levels to identify patterns and deviations that unveil market sentiment and potential price movements.

- Q: Can option chain analysis be used for short-term trading?

- A: Yes, option chain analysis is highly effective for swing trading and other short-term trading strategies, as it provides valuable insights into near-term market dynamics.

Option Chain Analysis For Swing Trading

Image: stockfuturesnse.blogspot.com

Conclusion

Option chain analysis is a powerful tool that empowers swing traders to unlock the hidden potential within market fluctuations. By deciphering the complexities of option chain data, you can gain a deeper understanding of market sentiment, volatility expectations, and potential trading plays, thereby enhancing your decision-making abilities and maximizing your profitability in the dynamic trading arena.

Are you intrigued by the world of option chain analysis and its potential to transform your trading strategies? Dig deeper into this fascinating topic to uncover its full power.