Options trading can be a lucrative opportunity for both experienced investors and aspiring traders alike. Among the various options available, Nifty options stand out as one of the most popular choices due to their flexibility and potential for high returns. However, to be successful in Nifty option trading, it is crucial to follow certain rules and strategies to mitigate risks and increase the chances of profitability. In this article, we’ll explore the essential Nifty option trading rules and provide actionable tips to help you navigate the market effectively.

Image: tradesmartonline.in

Understanding Nifty Options Trading

Nifty options are financial contracts that derive their value from the underlying Nifty index. They grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a certain number of Nifty shares at a predefined strike price on or before a specified expiry date. This dynamic allows traders to speculate on the price movements of the Nifty index, potentially generating significant profits if their predictions align with market trends.

Nifty Option Trading Rules

-

Choose the Right Trading Strategy

The first step towards successful Nifty option trading is identifying a trading strategy that aligns with your risk appetite, time horizon, and investment goals. Some popular strategies include buying calls, buying puts, selling covered calls, and selling cash-secured puts. Each strategy has its unique advantages and risks, so it’s important to understand them thoroughly before making any trades.

-

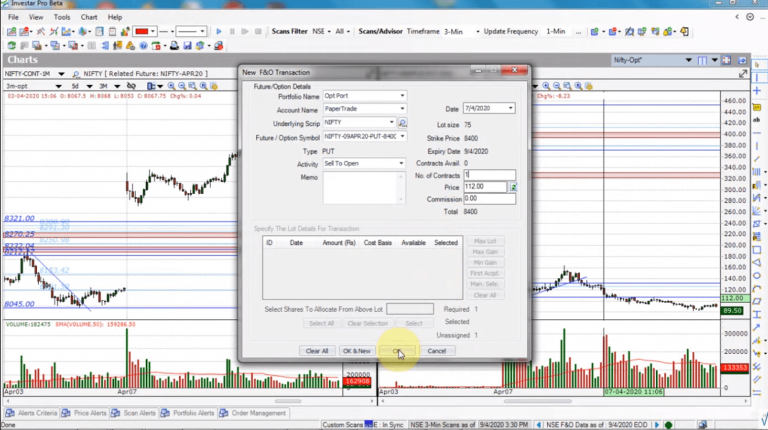

Image: investarindia.comSet Clear Entry and Exit Points

Before entering an option trade, determine your entry and exit points based on technical analysis, market sentiment, or predetermined price levels. Establishing clear parameters helps you maintain discipline, avoid emotional trading, and secure profits while limiting losses.

-

Manage Your Risk-to-Reward Ratio

Risk management is paramount in option trading. Always evaluate the potential rewards in relation to the risks involved. Aim for a favorable risk-to-reward ratio, where the potential profits significantly outweigh the potential losses.

-

Control Your Positions

Avoid overtrading or taking large positions that exceed your financial capabilities. Proper position sizing helps mitigate risks and allows you to maintain flexibility in volatile market conditions.

-

Monitor the Market Continuously

Option prices are constantly fluctuating based on market movements and changing expectations. Monitor the market conditions closely, track the Nifty index’s behavior, and stay updated with news and events that could impact option valuations.

-

Understand Volatility and Time Decay

Nifty options are highly sensitive to volatility and time decay. Volatility refers to the implied fluctuations in the Nifty index’s price, while time decay represents the erosion of an option’s premium as its expiry date approaches. Consider these factors when selecting options and adjusting your trading strategies.

-

Use Stop-Loss Orders

Stop-loss orders are essential risk management tools that help prevent excessive losses. Set stop-loss levels at predetermined price points to automatically exit trades if the market moves against you, limiting your potential downside.

-

Learn from Experienced Traders

Connect with successful traders, seek guidance from mentors, and engage in online forums or discussion groups. Seasoned traders can provide valuable insights, strategies, and emotional support, helping you navigate the complexities of Nifty option trading.

-

Practice with Paper Trading

Before venturing into real-world trading, practice your strategies using paper trading platforms that simulate market conditions. It allows you to make trades without risking real capital while gaining valuable experience and refining your approach.

-

Emotional Discipline

Emotions can be detrimental to your trading decisions. Stay emotionally disciplined during market fluctuations, avoid panic selling or buying, and stick to your predetermined trading plan. Maintaining a level-headed approach can help you capitalize on opportunities and minimize losses.

Nifty Option Trading Rules

Image: investarindia.com

Conclusion

Nifty option trading offers numerous opportunities for financial growth, but it also comes with inherent risks. By adhering to the rules outlined above, you can increase your chances of success in this dynamic and rewarding market. Remember to conduct thorough research, manage your risk, and develop a sound trading strategy that aligns with your objectives. With patience, discipline, and a commitment to continuous learning, Nifty option trading can be an empowering tool to achieve your financial aspirations.