In the ever-evolving realm of investing, options trading has emerged as a powerful tool that can amplify both your gains and risks. Webull Desktop, with its comprehensive suite of features and intuitive interface, offers a prime platform for traders seeking to navigate the complexities of options markets. This guide delves into the intricacies of trading options on Webull Desktop, unraveling the key concepts, strategies, and practical tips necessary for success.

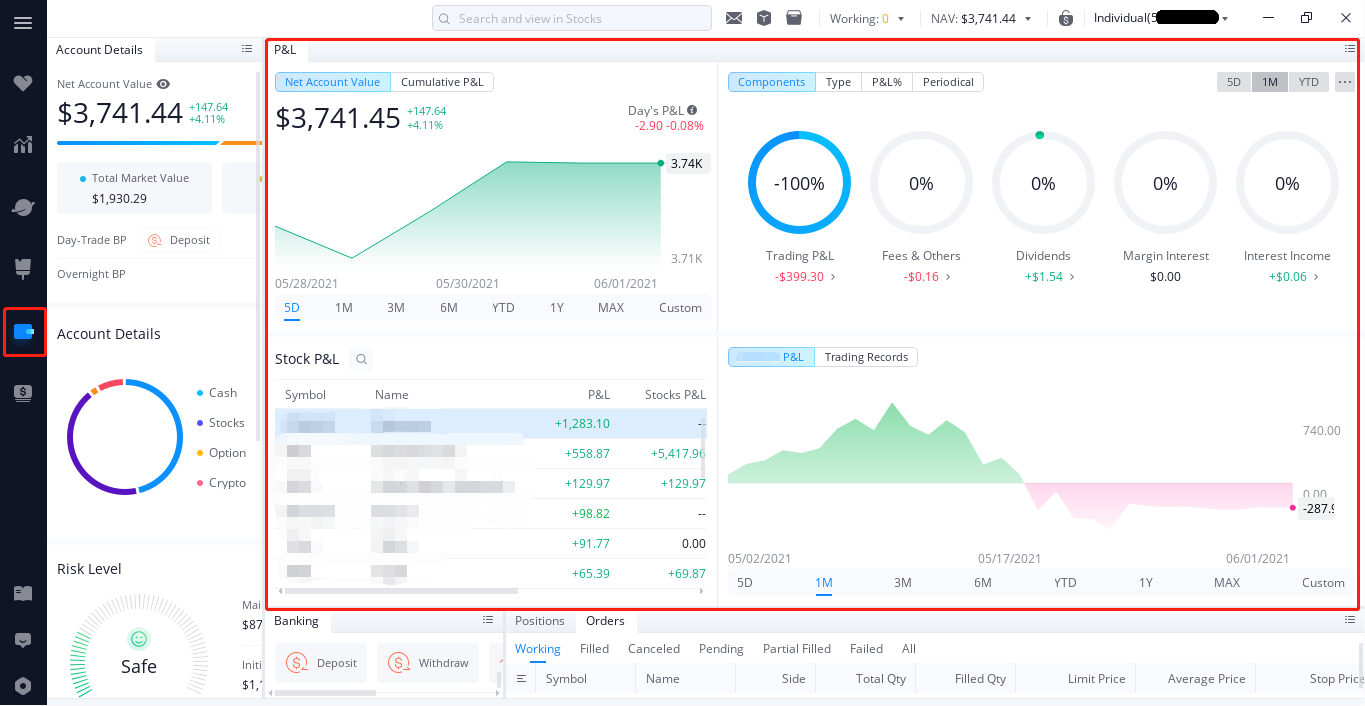

Image: www.webull.com

Trading options involves the buying or selling of contracts that grant you the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price on or before a predetermined date. These contracts introduce leverage, allowing you to control larger positions with lower capital investment. However, this leverage comes with heightened risk, so a thorough understanding of options trading is paramount before venturing into this arena.

Navigating the Webull Desktop Platform for Options Trading

Webull Desktop offers an unparalleled trading experience, seamlessly integrating real-time market data, advanced charting capabilities, and intuitive order execution. Its Options Chain feature provides a comprehensive overview of available options contracts for a given underlying asset, including strike prices, expiration dates, and Greek values. This information empowers traders with the insights necessary to make informed decisions.

The platform’s charting tools enable you to analyze price movements, identify trends, and pinpoint potential trading opportunities. Customizable indicators and overlays allow for comprehensive technical analysis, empowering traders with the ability to tailor their charts to their specific strategies. The ease of placing and managing trades on Webull Desktop further enhances the user experience. Options orders can be executed with just a few clicks, and advanced order types, such as limit orders and stop-loss orders, provide traders with granular control over their risk management.

Deciphering the Language of Options

A fundamental aspect of options trading is understanding the terminology used to describe these instruments. Key terms include:

-

Call Option: Confers the right to buy an underlying asset at a set price.

-

Put Option: Grants the right to sell an underlying asset at a set price.

-

Strike Price: The price at which you can exercise your option to buy (call) or sell (put).

-

Expiration Date: The date on which the option contract expires and becomes worthless.

-

Premium: The price paid or received to enter into an options contract.

-

Greek Values: Metrics that measure an option’s sensitivity to various factors, such as price movement, time decay, and implied volatility.

Unlocking Options Trading Strategies

Options offer a versatile range of strategies to suit different risk appetites and investment goals. Covered calls and cash-secured puts are two common strategies that provide income generation through premium selling. For those seeking more aggressive approaches, strategies like bull calls and bear puts leverage directional bets on underlying asset prices. Advanced strategies such as straddles and strangles involve combining multiple options contracts to create customized risk-reward profiles.

Image: beachbmtrading.com

Practical Tips for Successful Options Trading

To navigate the nuances of options trading effectively, consider these practical tips:

-

Educate Yourself: Options trading requires a thorough grounding in both theoretical concepts and practical applications. Utilize reputable resources, attend webinars, and consult with experienced traders to deepen your knowledge.

-

Start Small: Begin trading with small positions and gradually increase your exposure as you gain experience and confidence.

-

Manage Risk: Employ stop-loss orders to limit potential losses and consider hedging strategies to mitigate risk.

-

Monitor Your Positions: Track the performance of your options trades regularly, adjusting your strategy as market conditions evolve.

-

Stay Informed: Stay abreast of economic news and market trends that can influence option prices.

Embracing these principles can enhance your proficiency and decision-making in options trading on Webull Desktop.

Trading Options On Webull Desktop

Conclusion

Trading options on Webull Desktop empowers traders with a potent tool to enhance their investment strategies. By harnessing the platform’s robust features, understanding the concepts and strategies involved, and implementing sound risk management practices, you can navigate the options market with greater confidence and reap the potential benefits it offers. Remember, options trading entails heightened risks, so thorough research, ongoing education, and a well-defined trading plan are crucial for long-term success.