As I delved into the world of finance, the concept of money multiplier options trading piqued my curiosity. Intrigued by its potential to amplify my financial gains, I embarked on an exploration to unravel its intricacies. Join me as I share my discoveries and provide a comprehensive guide to this captivating trading strategy.

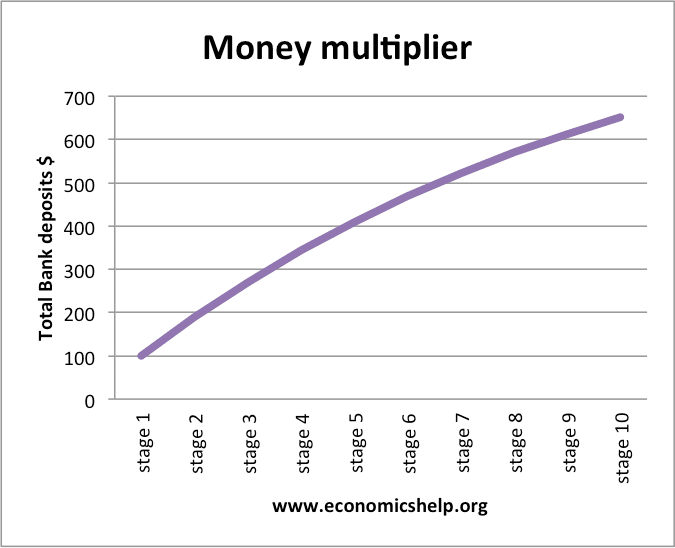

Image: www.economicshelp.org

What is Money Multiplier Options Trading?

Money multiplier options trading involves a unique combination of options strategies designed to optimize profit potential while limiting risk. At its core, it entails simultaneously buying a lower-priced option contract (the “multiplier” option) and selling a higher-priced option contract with the same underlying asset and expiration date.

The key to this strategy lies in selecting options with a spread – the difference between the two strike prices – that allows for a favorable reward-to-risk ratio. By selling the more expensive option, traders collect a premium that can fund the purchase of multiple “multiplier” options, effectively increasing their potential profit margin.

Harnessing the Power of Leverage

Money multiplier options trading offers the advantage of leverage, amplifying potential profits with a relatively small initial investment. By utilizing the premium received from selling the higher-priced option, traders gain the ability to control a larger number of “multiplier” options, multiplying their potential returns.

For instance, by selling a call option with a premium of $2,000 and using that premium to purchase four “multiplier” options with a premium of $500 each, traders effectively quadrupled their potential profit.

Key Trends and Developments

The world of options trading is constantly evolving, influenced by market fluctuations and technological advancements. Here are some notable trends and developments in money multiplier options trading:

- Increased popularity of synthetic strategies: Traders are combining different options strategies, such as money multiplier options trading, to create customized positions tailored to their risk tolerance and market outlook.

- Rise of algorithmic trading: Automated trading systems powered by sophisticated algorithms are becoming increasingly prevalent, executing trades at lightning speed based on pre-defined parameters.

- Growing accessibility: Online trading platforms and mobile applications have made options trading more accessible to a broader range of investors.

Image: daytradereview.com

Expert Tips for Success

Based on my experience and insights from renowned traders, here are valuable tips for maximizing your success in money multiplier options trading:

- Thorough research: Conduct extensive research on the underlying asset, market conditions, and historical volatility to make informed decisions.

- Risk management: Establish a comprehensive risk management plan to define your risk tolerance and strategies for mitigating potential losses.

- Understanding Greeks: Greeks, such as delta and theta, play a crucial role in assessing option pricing and risk. A thorough understanding of these Greeks is essential for successful trading.

- Discipline and patience: Options trading requires discipline and patience. Avoid making hasty or impulsive decisions and stick to your well-defined trading plan.

- Continuous learning: The world of options trading is constantly evolving. Continuously educate yourself to stay abreast of the latest strategies, market trends, and regulatory changes.

Applying the Tips

These tips can be applied to your money multiplier options trading strategies to enhance your success:

- Calculate risk-to-reward ratios: Before executing a trade, always determine the potential profit and loss to assess the risk-to-reward ratio.

- Consider volatility and market trends: Analyze the historical volatility of the underlying asset and factor in current market trends to make informed decisions about options pricing and strategy selection.

- Monitor your positions closely: Regularly monitor your open positions to track their performance and make adjustments as needed.

FAQ on Money Multiplier Options

Q: What is the difference between “multiplier” and “short” options in money multiplier options trading?

A: “Multiplier” options are those purchased with the premium received from selling a higher-priced option, while “short” options are those sold to collect that premium.

Q: How do I determine the right spread between the two options’ strike prices?

A: The ideal spread depends on your risk tolerance and market outlook. Higher spreads reduce risk but may limit potential profit, while narrower spreads offer higher potential profits with increased risk.

Q: What are the potential risks involved in money multiplier options trading?

A: The potential risks include substantial losses, rapid market movements, and illiquidity. Effective risk management is crucial to mitigate these risks.

Money Multiplier Options Trading

Image: rftp.com

Conclusion

Money multiplier options trading offers a compelling strategy with the potential to magnify profits through the strategic use of leverage. However, it is crucial to approach this strategy with a thorough understanding of its principles, risks, and latest trends. By following the tips and expert advice provided in this guide, you can harness the power of money multiplier options and navigate the market with greater confidence.

Are you ready to explore the world of money multiplier options trading and unleash its potential for financial gains?