Introduction

In the labyrinthine world of finance, there lurk shadowy practices that distort markets, undermining the integrity of our economic system. One such practice is the rampant use of market distorting trading options, a sophisticated form of speculation that has the power to manipulate prices and undermine investor confidence. This article delves into the depths of this insidious phenomenon, exposing its insidious nature and equipping readers with the knowledge to safeguard their financial well-being.

Image: www.slideserve.com

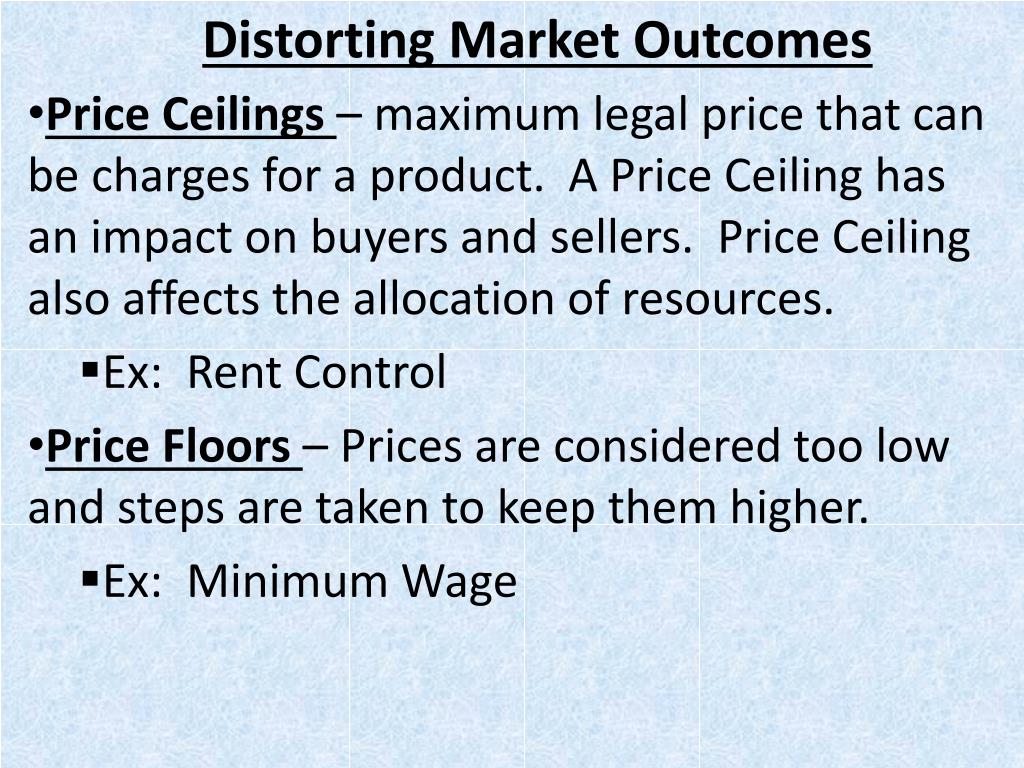

Understanding Market Distorting Trading Options

Simply put, trading options are financial contracts that grant the holder the right (but not the obligation) to buy or sell an underlying asset at a predetermined price during a specified period. While options serve legitimate purposes, such as hedging against risk and utilizing volatility, they have been twisted into tools of market manipulation by some unscrupulous traders.

By cornering the market for specific options contracts, these traders create artificial demand and supply imbalances that drive prices to unjustifiable levels. This distorts the true value of the underlying assets, misleading investors and disrupting the efficient functioning of capital markets.

Consequences of Market Distorting Options Trading

The consequences of market distorting trading options are far-reaching and devastating. Small investors, seeking a steady return on their hard-earned savings, are often unwittingly swept away by these deceptive tactics. When prices are manipulated, genuine investors suffer losses while the manipulators reap ill-gotten gains.

Moreover, this unethical practice undermines the credibility of our financial markets, casting doubt and reluctance in the minds of investors. The trust that underpins the smooth functioning of capital markets is eroded, deterring investments, stifling innovation, and damaging the economy as a whole.

Spotting Manipulation: Warning Signs

To safeguard against the pitfalls of market distorting options trading, investors must be equipped to recognize the warning signs. Some telltale indicators include:

- Unusual spikes in trading volume for specific options contracts.

- Unrealistic disparities between the market price and the fair value of the underlying asset.

- Sudden shifts in the price of thinly traded options.

- Patterns of suspicious trading activity, such as wash trades or manipulative quotes.

- Declarations of large option holdings by individuals or entities with a vested interest in influencing market prices.

Image: learn.tradimo.com

Protecting Against Manipulation: Strategies for Investors

Armed with the knowledge of market distorting options trading, investors can take proactive steps to protect their wealth. Here are some essential strategies:

-

Diversify investments across various asset classes and strategies to mitigate risk.

-

Exercise caution when investing in thinly traded options or those with unusual price patterns.

-

Conduct thorough research and consult with reputable financial advisors before making investment decisions.

-

Stay informed about market news and developments to stay ahead of potential manipulation attempts.

-

Report any suspicious trading activities to regulatory authorities.

Expert Insights: Navigating the Market Pitfalls

“Market distorting trading options are a threat to the integrity of our capital markets,” warns Professor Emily Carter, an expert in financial ethics. “It is essential that regulatory bodies strengthen their surveillance systems and impose severe penalties on those who engage in such deceptive practices.”

“Investors need to be vigilant and educate themselves about the risks involved,” adds financial analyst Thomas Peterson. “By recognizing the warning signs and adopting sound investment strategies, they can mitigate losses and protect their financial well-being.”

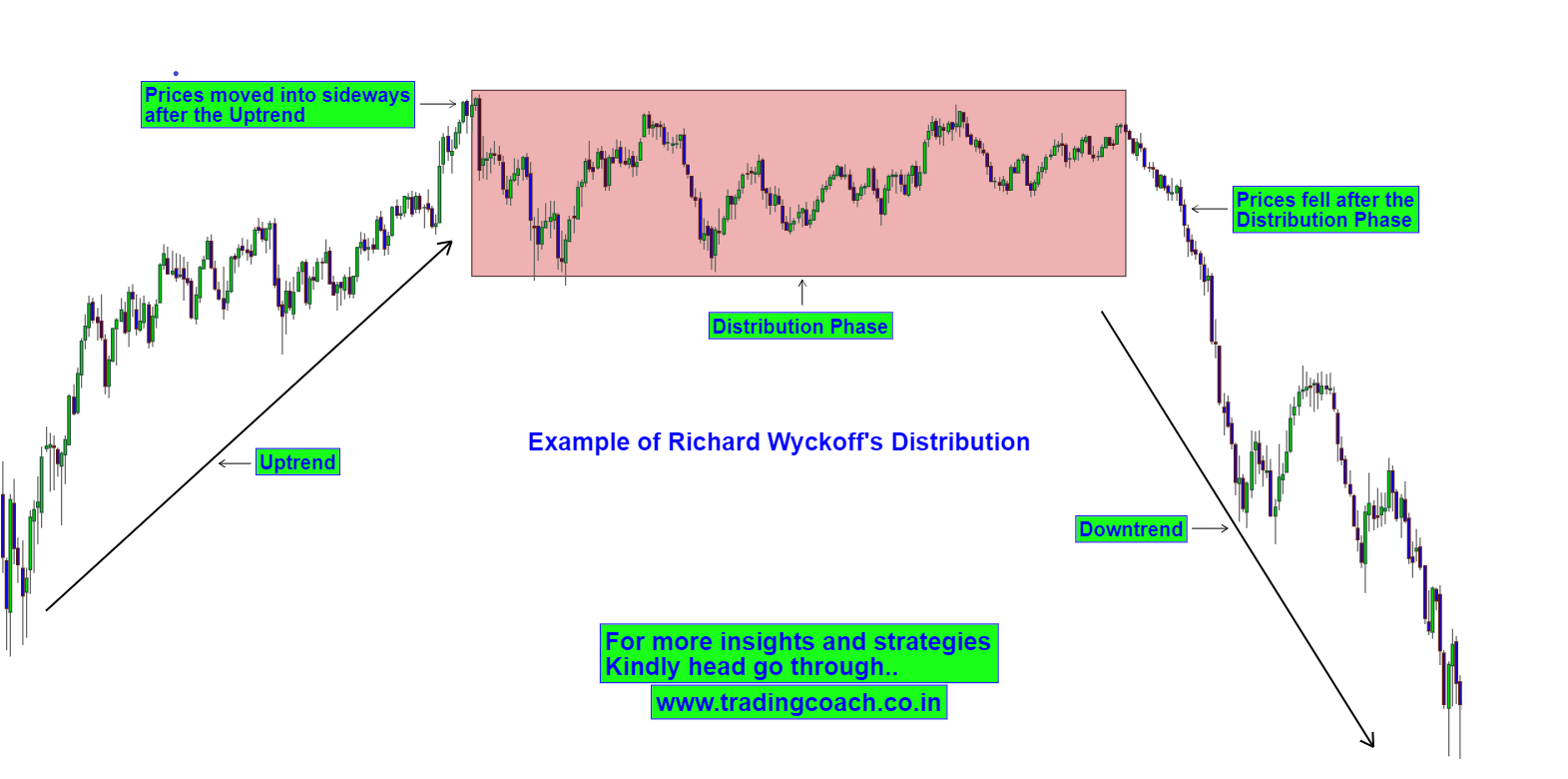

Market Distorting Trading Options

Image: tradingcoach.co.in

Conclusion

Market distorting trading options are a sinister practice that has no place in a fair and equitable financial system. By understanding the mechanics and consequences of this manipulation, discerning investors can safeguard their wealth and protect the integrity of our markets. It is imperative that regulatory authorities, industry professionals, and the public at large unite to combat this insidious threat, ensuring that our financial institutions serve the greater good rather than the selfish interests of a few.