Understanding Contract Volume in Option Trading

Option trading has become an increasingly popular investment strategy for traders seeking to maximize their returns. Options contracts provide a unique opportunity to leverage market fluctuations and potentially generate significant profits. However, understanding the intricacies of option trading is crucial, particularly regarding the number of contracts purchased. This article delves into the factors influencing contract volume in option trading, providing invaluable insights for traders of all levels.

Image: thetemplates.art

1. Trading Strategy and Risk Tolerance

The number of contracts purchased is largely determined by the trader’s overall trading strategy and risk tolerance. Scalpers, who typically execute numerous short-term trades, may purchase a lower volume of contracts to minimize their exposure to market volatility. In contrast, swing traders, who hold positions for several days or weeks, opt for moderate contract volume to balance risk and potential returns. Conversely, long-term investors with a higher risk tolerance may enter larger positions with a substantial number of contracts.

2. Option Type and Contract Multiplier

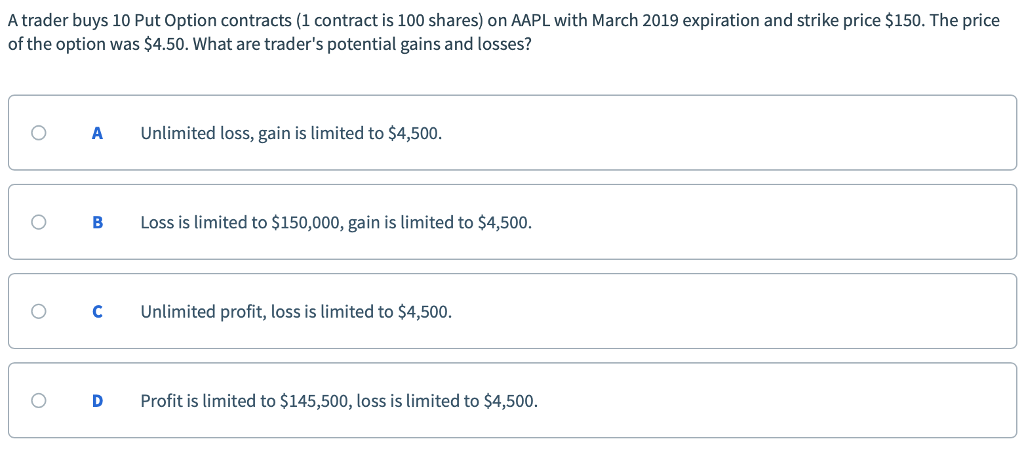

The type of option contract also plays a role in determining contract volume. Call options, which grant the right to buy an underlying asset, typically involve a higher contract multiplier than put options, which provide the right to sell an underlying asset. For instance, one call option contract on Apple stock typically represents 100 shares, while a put option contract represents 100 shares. Therefore, traders must consider the contract multiplier and adjust their contract volume accordingly.

3. Position Sizing and Account Capital

Traders should carefully manage their contract volume to maintain a prudent risk-reward ratio. Position sizing, which involves determining the appropriate amount of capital to allocate to a single trade, is essential. Traders must strike a balance between maximizing potential profits and limiting potential losses. It is generally recommended to commit no more than 5-10% of an account balance to a single contract, although this may vary based on individual circumstances.

Image: theverybestballoonblog.blogspot.com

4. Market Conditions and Volatility

Market conditions and expected volatility significantly influence contract volume decisions. In highly volatile markets, traders may choose to purchase a lower number of contracts to mitigate risk and preserve capital. On the other hand, in calmer markets, traders may be inclined to increase their contract volume to capture potential opportunities.

5. Time Value and Liquidity

Time value decay is a crucial factor to consider when determining contract volume. Options contracts lose time value as they approach their expiration date. Therefore, traders who intend to hold positions for an extended period may opt for a larger contract volume to compensate for potential time value erosion. Similarly, traders should assess the liquidity of the option market. Higher-volume options typically offer greater liquidity and tighter spreads, enabling traders to execute trades more efficiently.

How Many Contracts Do People Buy Option Trading

Image: www.chegg.com

Conclusion

The number of contracts purchased in option trading is a critical decision that directly impacts a trader’s potential returns and risk exposure. By considering their trading strategy, risk tolerance, option type, position sizing, market conditions, and liquidity, traders can optimize their contract volume and enhance their chances of success. Remember, option trading involves inherent risks, and traders are strongly advised to conduct thorough research, gain a comprehensive understanding of the markets, and approach trading with prudence and discipline.