Unleash the Power of Trend-Following with Sophisticated Strategies

Momentum trading has become an increasingly popular strategy among traders seeking to capitalize on market trends and maximize profits. By leveraging options, traders can enhance their momentum trading capabilities, empowering themselves with the potential to generate substantial returns. This comprehensive guide will delve into the intricacies of momentum trading with options, providing a thorough understanding of this dynamic approach.

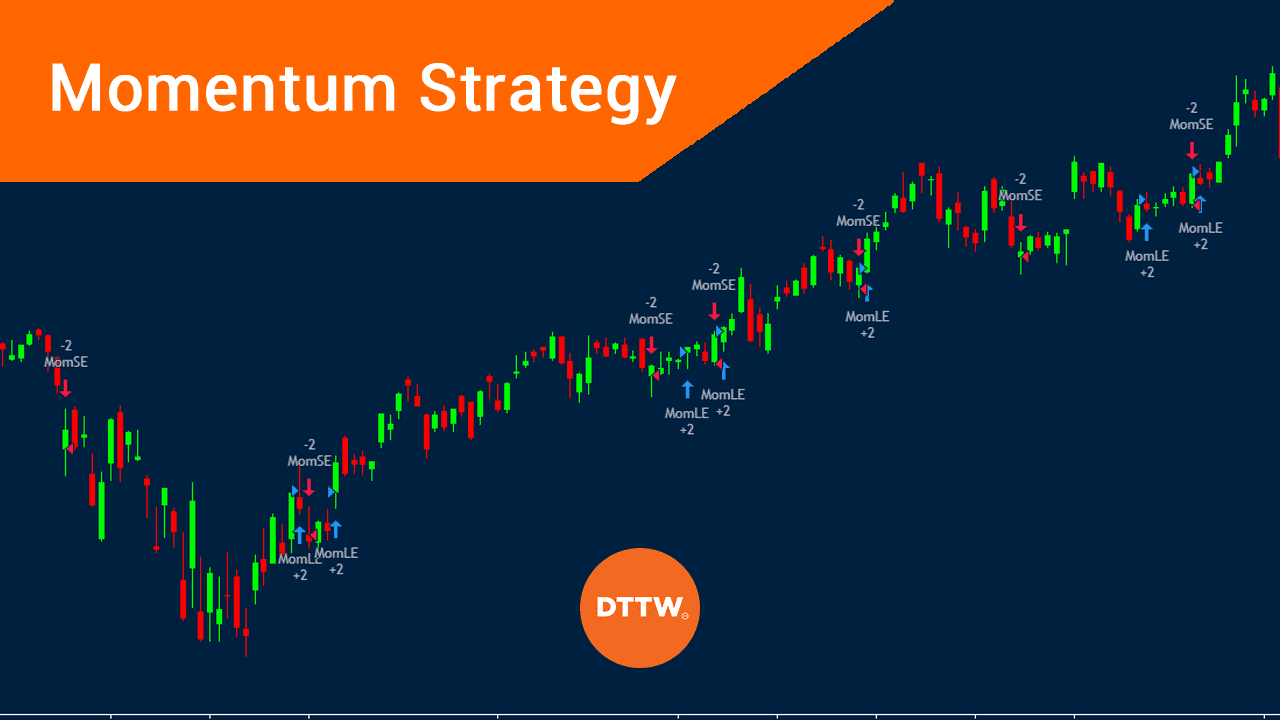

Image: www.daytradetheworld.com

Understanding Momentum Trading

Momentum trading involves identifying and capitalizing on the continuation of a prevailing trend in asset prices. When an asset’s price moves in a consistent direction for an extended period, momentum traders seek to ride the wave by entering positions that align with the trend. This strategy provides traders with opportunities to profit from both upward and downward market swings.

Options: A Versatile Tool for Momentum Traders

Options offer a flexible and multifaceted tool for momentum trading. They allow traders to speculate on the future price of an underlying asset without taking direct ownership. Calls and puts, the two primary types of options, grant traders the right, but not the obligation, to buy (call) or sell (put) the underlying asset at a predetermined strike price. This flexibility enables momentum traders to craft sophisticated strategies tailored to their unique objectives and risk appetite.

Types of Momentum Trading Strategies

There are numerous momentum trading strategies with options, each characterized by its unique parameters and risk-reward profile. Some popular strategies include:

- Moving Average Crossover Strategy: This strategy involves using moving averages to identify trend reversals and momentum shifts. When a short-term moving average crosses above or below a longer-term moving average, a trading signal is generated.

- Relative Strength Index (RSI) Strategy: By analyzing the overbought or oversold conditions of an asset, the RSI strategy seeks to capture momentum at its extremes. When the RSI rises above a predefined overbought threshold, it suggests bullish momentum, while falling below an oversold threshold indicates bearish momentum.

- Bollinger Bands Strategy: Utilizing Bollinger Bands, this strategy identifies potential trend reversals and breakouts. When the price moves outside the upper or lower bands, it signifies a strong momentum swing.

- Ichimoku Cloud Strategy: As a comprehensive technical analysis tool, the Ichimoku Cloud provides multiple indicators that help assess momentum. The cloud itself represents areas of potential support and resistance, while the other components offer insights into trend direction and momentum strength.

Image: currency.com

Managing Risk in Momentum Trading with Options

While momentum trading with options can offer lucrative profit opportunities, it also carries inherent risks that must be carefully managed. Traders should adhere to robust risk management practices, including:

- Setting Clear Entry and Exit Points: Establishing clear entry and exit levels helps avoid impulsive decision-making and ensure a disciplined approach to trading.

- Using Stop-Losses: Limit potential losses by placing stop-loss orders at predetermined levels to automatically exit positions if prices move against expectations.

- Managing Position Size: Prudent position sizing ensures that trades align with your overall risk tolerance and prevent significant drawdowns.

Momentum Trading With Options

Image: tradeciety.com

Conclusion

Momentum trading with options offers a dynamic and potentially rewarding approach to capturing market trends. By embracing a robust understanding of momentum trading strategies and leveraging the flexibility of options, traders can harness the power of trend-following to maximize potential profits. Remember to prioritize comprehensive due diligence, utilize risk management techniques, and adapt to evolving market conditions to optimize your trading outcomes.