Introduction

In the realm of financial markets, trading options has emerged as a lucrative avenue for generating income. Options, financial instruments that provide the right but not the obligation to buy or sell an underlying asset at a predetermined price, offer traders a diverse array of strategies to capitalize on市場movements. This article delves into the world of options trading, unraveling the intricacies of this dynamic market and empowering you with the knowledge and skills to make informed decisions.

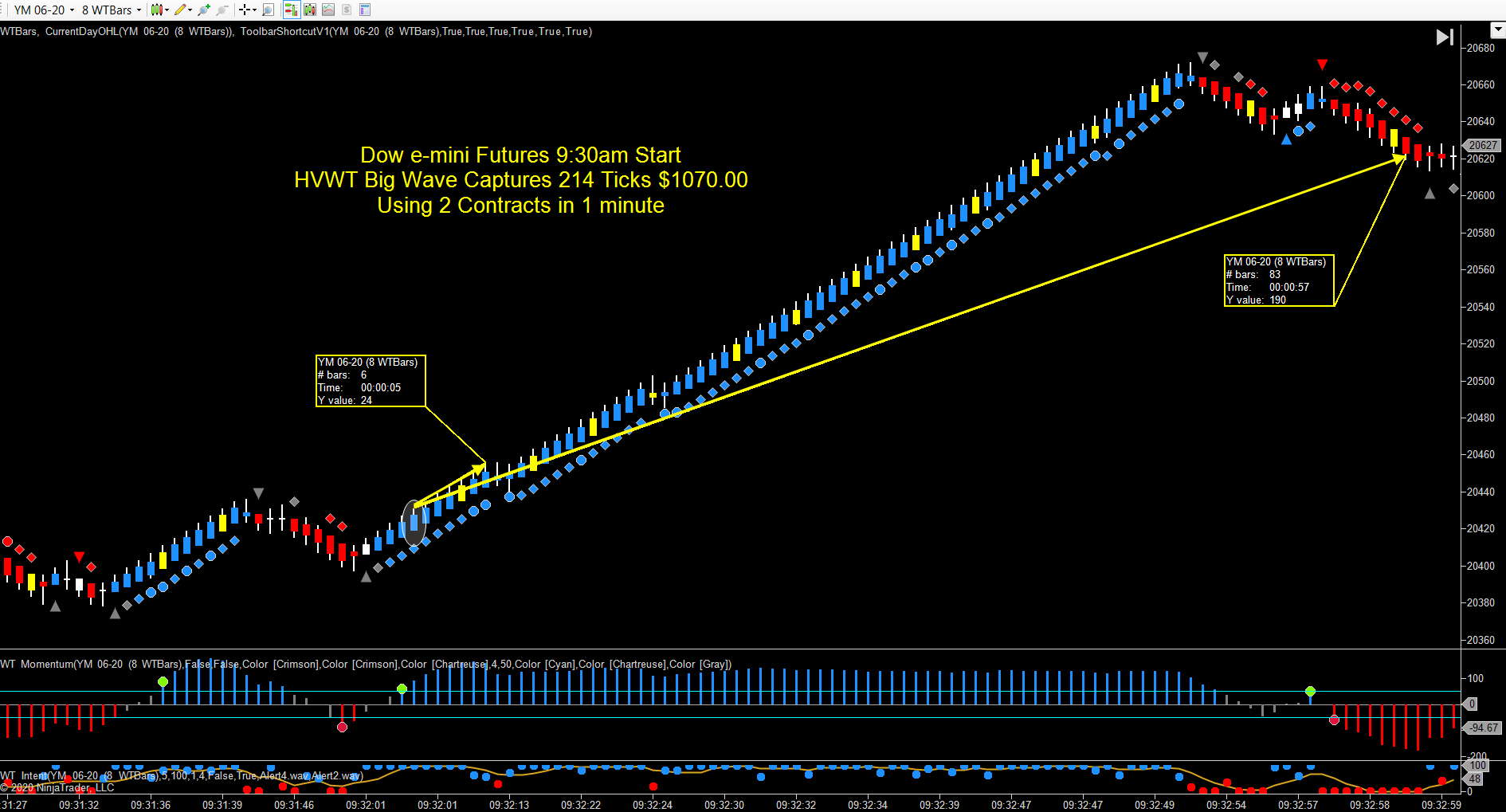

Image: forexsystemdownload.blogspot.com

Understanding Options

An option is a contract between two parties, granting the buyer the right to buy (in the case of a call option) or sell (in the case of a put option) a specified quantity of an underlying asset at a specified price (the strike price) on or before a specified date (the expiration date). Unlike futures contracts, which obligate the holder to buy or sell the underlying asset, options confer the buyer with flexibility and choice. The buyer of an option pays a premium to the seller in exchange for this right.

Options Market: A Brief History

The origins of options trading date back to ancient Greece, where traders engaged in informal agreements to speculate on the price of olive oil. However, the modern options market as we know it today began to take shape in the 1970s on the Chicago Board Options Exchange (CBOE). Since then, options trading has evolved into a global industry, boasting vast liquidity and offering a wide range of underlying assets, including stocks, indices, currencies, and commodities.

Types of Options Strategies

Options traders employ a multitude of strategies to navigate market fluctuations and pursue profit. Some common strategies include:

- Long Call:Buying a call option with the expectation that the underlying asset will rise in price.

- Covered Call:Selling a call option against an existing long position in the underlying asset.

- Long Put:Buying a put option with the expectation that the underlying asset will decline in price.

- Protective Put:Buying a put option to hedge against a potential decline in the price of an existing long position.

- Iron Condor:Selling a call option at a higher strike price than a bought call option and a put option at a lower strike price than a bought put option.

Image: www.optionsplay.com

Factors Influencing Option Prices

The price of an option is determined by several factors including:

- Underlying Asset Price: The price of the underlying asset is the most significant factor influencing option prices.

- Volatility: Options on more volatile assets generally command higher premiums.

- Time to Expiration: As an option approaches its expiration, its time value decays, leading to a decline in its premium.

- Interest Rates: Higher interest rates result in higher option premiums.

- Dividends: Expected dividends can impact option pricing, especially for in-the-money and at-the-money call options.

Risk Management in Options Trading

While options trading offers significant income-generating potential, it also involves inherent risks. Prudent risk management practices are crucial to mitigate these risks:

- Understanding Risk Tolerance: Traders must assess their tolerance for risk and only trade within their financial means.

- Proper Position Sizing: Allocating an optimal amount of capital to each trade reduces the impact of potential losses.

- Hedging Strategies: Employing hedging strategies such as protective puts can mitigate downside risk.

- Limiting Leverage: Excessive leverage can amplify losses, so traders should exercise caution when leveraging their trades.

- Diversification: Diversifying across multiple underlying assets reduces exposure to specific market risks.

Making An Income Trading Options

Image: investingwithoptions.com

Conclusion

Trading options can be a rewarding endeavor, providing traders with the opportunity to generate income and capitalize on market fluctuations. By understanding the fundamentals of options, employing effective strategies, and implementing sound risk management practices, traders can navigate this dynamic market and increase their chances of success. Embark on this financial adventure with knowledge and confidence, and unlock the potential of options trading to augment your income and achieve financial freedom.