Introduction

Image: amabroad.com

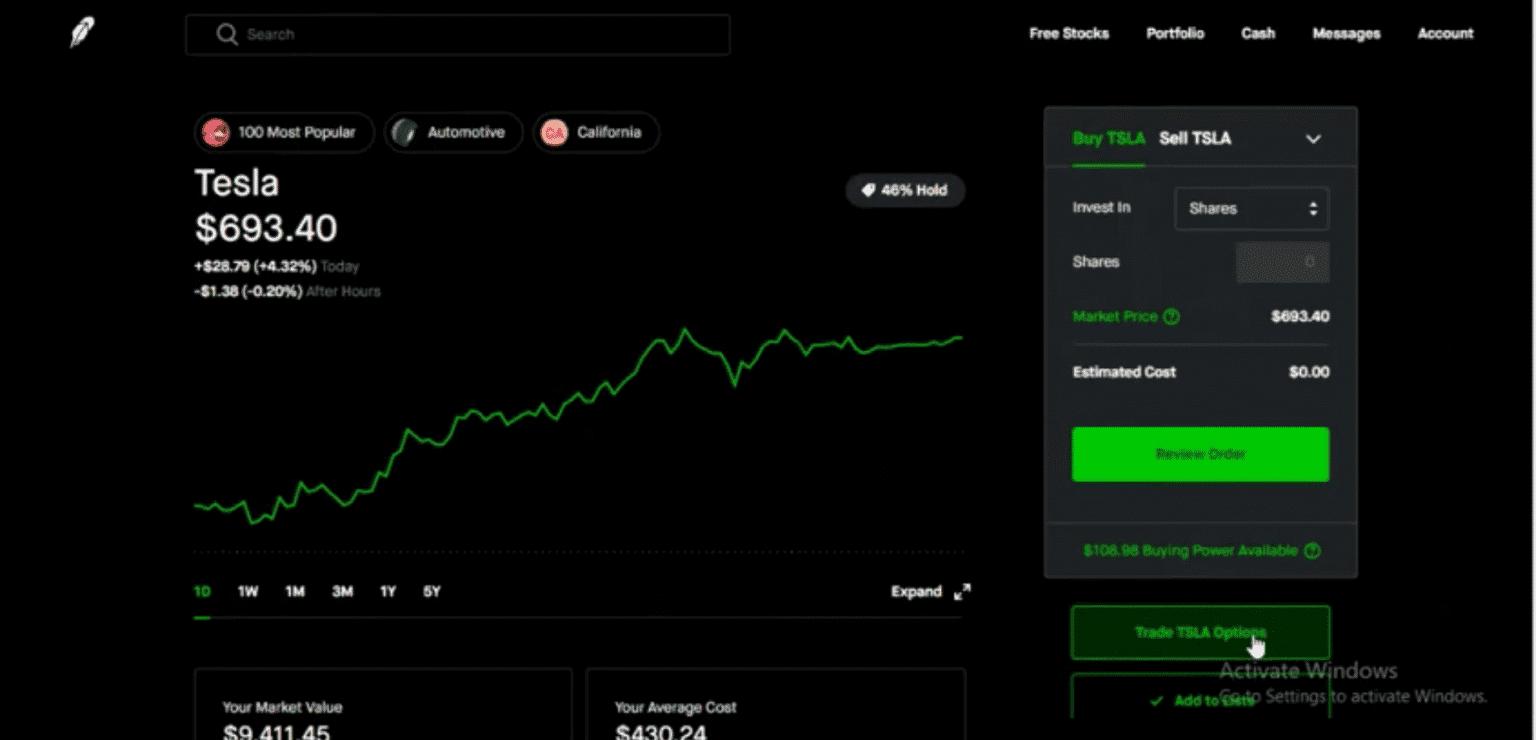

The allure of day trading options has captivated countless investors, offering the tantalizing promise of quick profits in the fast-paced world of financial markets. Among the many platforms available, Robinhood has emerged as a popular choice, especially for beginners. Armed with a user-friendly interface and commission-free trading, Robinhood has made it easier than ever before to access the exhilarating realm of options. However, navigating the complexities of options trading requires a multifaceted approach, encompassing both knowledge and strategy.

Understanding Options and Their Peculiarities

Options, in their essence, are financial instruments that confer the right, not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a particular date. They are multifaceted instruments that can be employed to diverse ends, ranging from speculation to risk management. Unlike stocks, options derive their value from a combination of factors, including the price of the underlying asset, the strike price (the price at which the option can be exercised), the time to expiration, and volatility.

Day Trading Options

Day trading options epitomizes a high-octane approach, where traders buy and sell options contracts within a single trading day with the intent of profiting from short-term price fluctuations. Time is of the essence in day trading, as options decay in value over time and can expire worthless if not executed before the end of the day. Mastering the art of day trading options hinges on understanding the nuances of options pricing, market dynamics, and risk management.

Robinhood’s Role in Options Trading

Robinhood has fundamentally changed the accessibility of options trading, democratizing it for a broader audience. Its intuitive interface and commission-free structure have removed barriers to entry, making it easier for novice traders to get their feet wet in the world of options. However, it is crucial to exercise caution as Robinhood’s features, particularly its instant settlement and limited order types, may not be suitable for every trader.

Anatomy of an Options Trade

To illustrate the interplay of factors involved in options trading, let us dissect a hypothetical trade. Imagine a trader purchases a call option on Apple stock with a strike price of $150. The option expires in two weeks, and the current price of Apple stock is $145. The trader pays $2.50 (the premium) for the option. If Apple’s stock price rises above $152.50 (the strike price plus the premium) before the expiration date, the trader can exercise the option and buy the stock at $150, potentially realizing a profit. Conversely, if Apple’s stock price falls or remains below $152.50, the option will expire worthless, and the trader will lose the premium paid.

Essentials of Day Trading Options

- Strategize: Develop a coherent trading plan that outlines your goals, risk tolerance, and trading strategies.

- Understand Volatility: Volatility is the lifeblood of options trading, as it significantly impacts option premiums and profit potential.

- Manage Risk Prudently: Options trading carries inherent risk, so it is essential to implement robust risk management techniques.

- Master Technical Analysis: Technical analysis provides valuable insights into price patterns and trends, aiding in decision-making.

- Stay Informed: Stay abreast of market news and economic events that may influence the underlying asset’s price.

Conclusion

Day trading options on Robinhood can be an exhilarating and potentially rewarding endeavor, but it requires a thoughtful and informed approach. By understanding the intricacies of options, mastering day trading strategies, and leveraging Robinhood’s features judiciously, aspiring traders can equip themselves to navigate the fast-paced world of options and capture its profit-generating potential. However, it is crucial to exercise caution, manage risk prudently, and continuously enhance your trading knowledge and skills to succeed in the dynamic realm of options trading.

Image: marketxls.com

Day Trading Options On Robinhood