Financial navigation can be an intricate maze, particularly when venturing into the realm of options trading. Amidst this landscape, financial institutions emerge, offering access to this specialized market for a fee. To empower you as a savvy investor or curious bystander, this article embarks on an in-depth exploration of these institutions, their services, and the nuances of options trading.

Image: www.finder.com

Options Trading: Unveiling Its Essence

Options trading, a sophisticated financial strategy, involves contracts granting the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. These contracts, known as options, provide investors with a unique blend of flexibility and leverage, enabling them to potentially capitalize on market movements or hedge against potential risks.

Financial Institutions: Your Gateway to Options Trading

Recognizing the growing interest in options trading, discerning financial institutions have stepped forward, offering specialized services tailored to this niche market. These institutions assume the role of intermediaries, facilitating access to options exchanges and providing vital tools and resources to support informed trading decisions.

Accessing options trading through these established institutions brings forth a host of advantages. Investors benefit from:

- Regulatory Oversight: Licensed and regulated institutions adhere to strict industry standards, ensuring transparency and protecting investors’ interests.

- Access to Exchanges: Institutions maintain memberships in reputable options exchanges, granting traders direct access to the markets where options are traded.

- Trading Platforms: Sophisticated trading platforms offered by institutions empower traders with real-time market data, charting tools, and order execution capabilities.

- Educational Resources: Renowned institutions often provide comprehensive educational materials, webinars, and seminars to enhance traders’ knowledge and skills.

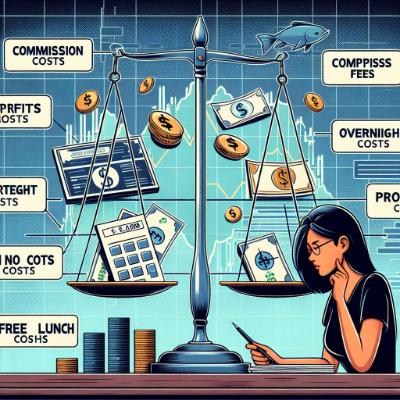

Options Trading Fees: Demystifying the Costs

While recognizing the value provided by financial institutions, it’s crucial to understand the fee structure associated with options trading. These fees, typically charged per contract traded, vary across institutions and depend on factors such as account type, trading volume, and contract complexity.

Comprehending the fee structure allows investors to make informed decisions and select the most suitable institution that aligns with their trading strategies and financial circumstances.

Image: www.royaloakfinancialgroup.com

Navigating the Complexity of Options Trading

Embracing options trading requires a thorough grasp of its underlying complexities. Options contracts are characterized by various components that influence their value and potential outcomes:

- Underlying Asset: Options can be based on stocks, indices, commodities, or other financial instruments whose movements impact the value of the contracts.

- Strike Price: This predetermined price represents the level at which the option buyer can exercise their right to buy or sell the underlying asset.

- Expiration Date: Options contracts have a finite lifespan, expiring on a specific date when the option holder’s rights expire.

- Option Premium: The price paid to purchase an options contract, reflecting its value and the market’s perception of the underlying asset’s potential price movements.

Understanding these elements empowers investors to make informed decisions when trading options.

Embarking on Options Trading: A Journey into Informed Decision-Making

Options trading, with its inherent risks and rewards, demands a diligent approach and sound understanding of market dynamics. Before venturing into this realm, investors are encouraged to:

- Educate Themselves: Seek knowledge through reputable sources, delve into books, attend workshops, and consult industry experts to gain a thorough understanding of options trading nuances.

- Practice on Simulated Platforms: Leverage online simulators or paper trading accounts to hone skills and test strategies without risking real capital.

- Start Small: Begin with modest trades to gain experience and develop a feel for options trading dynamics, gradually increasing positions as confidence and understanding grow.

- Monitor the Market: Stay abreast of economic indicators, news events, and market trends that can impact options prices and trading strategies.

Financial Companies That Offer Options Trading For A Fee

Image: booksfromdusktilldawn.blog

Conclusion: Options Trading – A Path to Potential Rewards and Informed Choices

Options trading presents a potent financial tool, empowering investors with flexibility, leverage, and the potential for substantial returns. By partnering with reputable financial institutions, investors can gain access to this specialized market and capitalize on its unique opportunities.

However, it’s imperative to approach options trading with a deep-seated understanding of its intricacies, potential Risiken, and the fees associated with these strategies. Through diligent research, education, and informed risk management, investors can harness the power of options trading as a means to achieve their financial aspirations.