Introduction

The allure of day trading and the promise of hefty profits attract many to the financial markets. Yet, the path to success in this fast-paced arena is fraught with challenges and requires a strategic approach. Options day trading, a specialized technique that leverages options contracts, offers a unique opportunity to profit from market movements within a single trading session. This comprehensive guide will delve into proven options day trading strategies that work, empowering you to navigate this complex landscape with confidence.

Image: seekingalpha.com

Understanding Options Day Trading

Options contracts are financial instruments that confer the right, not the obligation, to buy or sell an underlying asset (such as a stock or ETF) at a predetermined price on or before a specific date. Day trading involves buying and selling these contracts within the same trading day, capitalizing on short-term price fluctuations.

Proven Options Day Trading Strategies

1. Scalping Strategies

Scalping involves making numerous small profits by trading options very quickly, often within minutes or seconds. This strategy requires lightning-fast execution, sharp technical analysis skills, and a high level of discipline.

Image: www.analyticssteps.com

2. Momentum Trading

Momentum traders ride the wave of market trends by buying options in assets that are exhibiting strong upward momentum or selling options in assets experiencing downward momentum. This strategy involves identifying assets with clear momentum patterns and timing entries and exits accordingly.

3. Range Trading

Range trading capitalizes on price movements within a defined range. Traders buy options when the price approaches the bottom of the range and sell when it nears the top. This strategy is well-suited for markets with well-defined trading ranges and requires patience and a disciplined approach.

4. Iron Condor Strategy

This neutral strategy involves selling options at different strike prices and different expiration dates to create a profit zone. The objective is to profit from a stable or slightly fluctuating market within the defined price range.

5. Butterfly Spreads

Butterfly spreads are complex multi-leg strategies that involve buying and selling options at three different strike prices with the same expiration date. This strategy targets a specific price movement and requires careful calculation and risk management.

Expert Insights and Actionable Tips

- “In options day trading, timing is everything. Focus on identifying precise entry and exit points to maximize profits,” advises David W. Penn, a renowned options trading expert.

- “Risk management is paramount. Use stop-loss orders and carefully monitor market conditions to limit potential losses,” cautions Lisa M. Kramer, a veteran options trader.

- “Emotional control is essential. Avoid making impulsive trades based on fear or greed. Stick to your strategy and manage your emotions,” emphasizes John F. Carter, a widely respected options trading instructor.

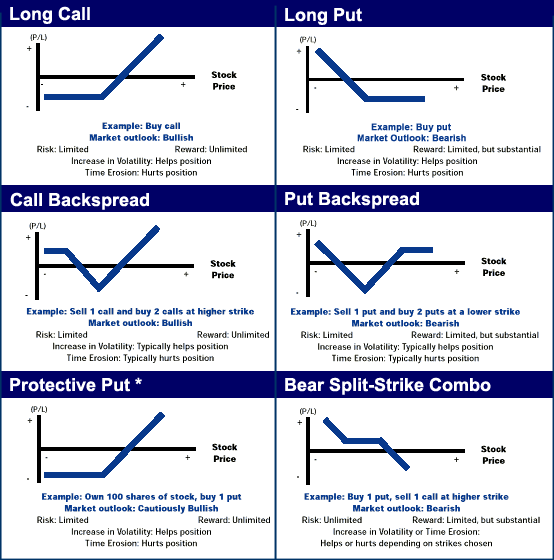

Options Day Trading Strategies That Work

Image: www.pinterest.co.uk

Conclusion

Options day trading offers a lucrative but challenging path to market profits. By understanding proven strategies, seeking expert guidance, and practicing disciplined trading habits, you can increase your chances of success in this fast-paced arena. Remember that success comes with consistent practice, a keen eye for market opportunities, and a sound understanding of risk management. Embrace these strategies, leverage actionable tips, and begin your journey towards profitable options day trading.