Introduction

Have you ever wondered how to make a fortune in the financial markets? Options trading might be your golden ticket. Options, complex financial instruments derived from stocks, indices, and commodities, offer traders the potential for substantial profits. But before you jump in headfirst, it’s crucial to understand the complexities of options trading. Dive into this comprehensive guide and equip yourself with the knowledge and strategies you need to maximize your chances of success.

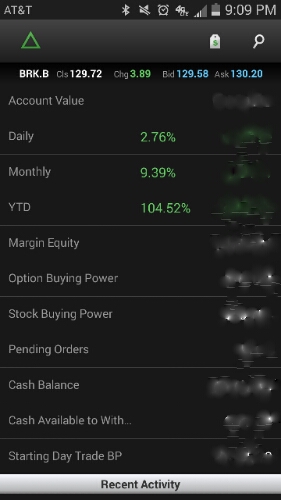

Image: kuyaenterprises.com

Understanding Options

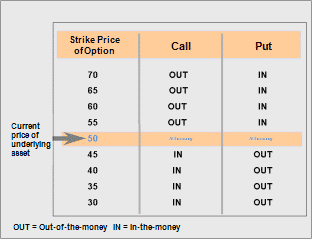

Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. They come in two flavors: calls and puts. Calls offer the right to buy the underlying asset, while puts provide the right to sell. By leveraging options’ flexibility, traders can potentially profit from a wide range of market scenarios, from bullish to bearish trends.

The Power of Leverage

One of the most alluring aspects of options trading is the potential for high profits with relatively small capital. Unlike buying stocks outright, options require a fraction of the investment, making them more accessible to traders. This leverage allows traders to control a larger position in the underlying asset, amplifying their potential returns. However, it also magnifies potential losses, so use leverage judiciously.

Types of Options Strategies

The versatility of options lies in the numerous strategies they facilitate. Covered calls involve selling call options while owning the underlying asset, generating income while potentially keeping the underlying asset if prices rise. Cash-secured puts, on the other hand, involve selling put options while holding cash, collecting premiums and ultimately acquiring the asset if prices fall below the strike price.

Image: optionstradingiq.com

Risk Management

While options offer high potential rewards, they also carry significant risks. Implementing robust risk management strategies is paramount. This includes diversifying your portfolio, setting appropriate stop-loss levels, and carefully monitoring market conditions. It’s also advisable to stick to your trading plan and avoid chasing losses or trading on emotions.

Mastering Options Trading

To become a successful options trader requires dedication and continuous learning. Start by educating yourself through books, online courses, and seminars. Practice on a paper trading account to refine your strategies without risking real capital. Consult experienced traders or seek guidance from reputable financial advisors whenever necessary.

Making A Ton Of Money On Options Trading

Image: www.youtube.com

Conclusion

Options trading presents an exciting opportunity for traders seeking substantial profits. By understanding the workings of options, employing effective strategies, and implementing sound risk management practices, you can increase your chances of success in this dynamic market. Remember, patience, discipline, and continuous learning are key to unlocking the full potential of options trading.