What are Options, and Why Do They Matter?

Imagine you want to go to the movies but aren’t sure which one. You could buy a regular movie ticket and hope for the best, or you could buy an “option” to buy a ticket later. An option gives you the right to buy the ticket at a specific price, even if the price goes up. However, you only pay a small fee for the option rather than the full price of the ticket.

Image: emeraldfg.medium.com

Options trading is similar to this movie ticket example. It allows you to buy the right to buy or sell an asset, such as a stock, at a certain price. This gives you more flexibility and can help you reduce your risk.

The Basics of Options Trading

An option contract is made up of four main parts:

- Call Option: Gives the buyer the right to buy an asset at a certain price (strike price) before a specific date (expiration date).

- Put Option: Gives the buyer the right to sell an asset at a certain price (strike price) before a specific date (expiration date).

- Long Position: Buying an option contract, giving the buyer the rights described above.

- Short Position: Selling an option contract, obligating the seller to fulfill the buyer’s rights if they choose to exercise them.

How to Use Options Trading

Options can be used to trade stocks, currencies, commodities, and other assets. They can be used in various ways, including:

- Hedging: To reduce the risk of losing money on an investment.

- Income Generation: To earn premiums by selling options contracts.

- Speculation: To bet on the future direction of an asset’s price.

The Benefits of Options Trading

Options trading has several benefits:

- Flexibility: Options give traders more flexibility than traditional investing options.

- Risk Management: Options can be used to hedge against risk or limit losses.

- Increased potential returns: Options offer the potential to generate higher returns than traditional investments.

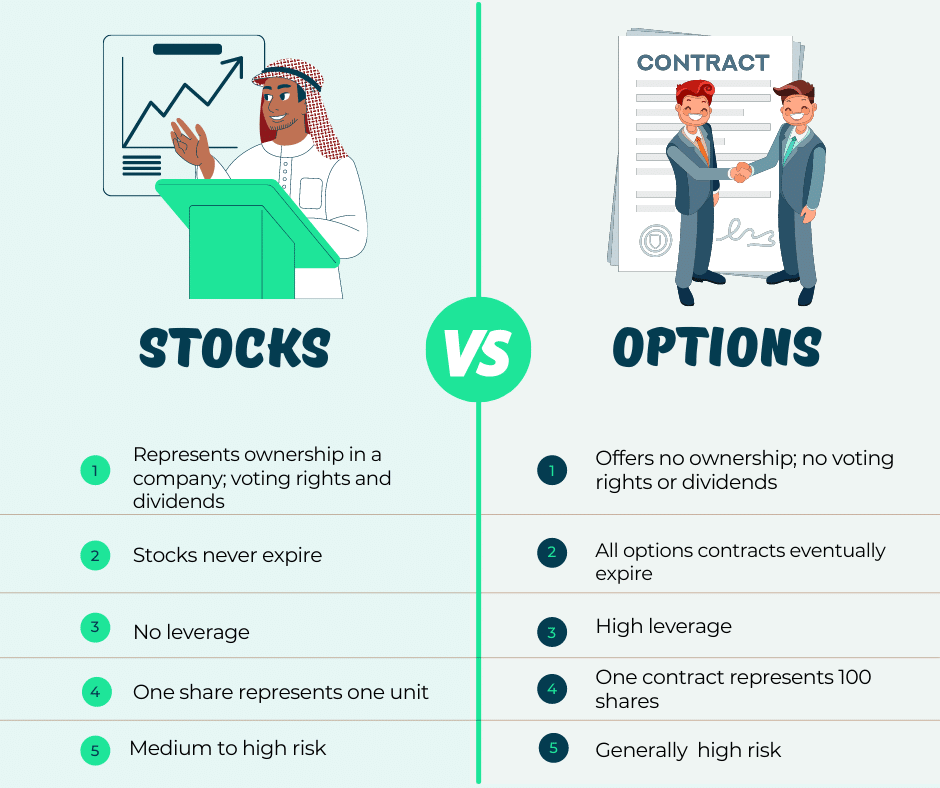

Image: www.chegg.com

The Risks of Options Trading

It’s important to be aware of the risks involved in options trading as well:

- Loss of capital: You can lose money if the underlying asset doesn’t perform as you expected.

- Time decay: The value of options contracts decays over time, even if the underlying asset’s price remains unchanged.

- Volatility risk: Options are sensitive to changes in volatility, and high volatility can increase your risk.

Options Trading Explain It Like I’M 5

Image: www.projectfinance.com

Conclusion

Options trading can be a powerful tool for investors who understand its complexities and are willing to manage the risks involved. By using options, you can increase your flexibility, reduce risk, generate income, and potentially improve your returns. However, before jumping into options trading, it’s essential to do plenty of research and practice with paper trading or low-risk positions until you’re comfortable.