Imagine yourself standing at the threshold of a bustling oil exchange, surrounded by traders’ voices echoing the latest market updates. The lifeblood of the global economy, crude oil, is traded here with the precision of a chess game. Enter the realm of crude oil options trading, where fortunes can be made and lost with a single calculated move.

Image: www.youtube.com

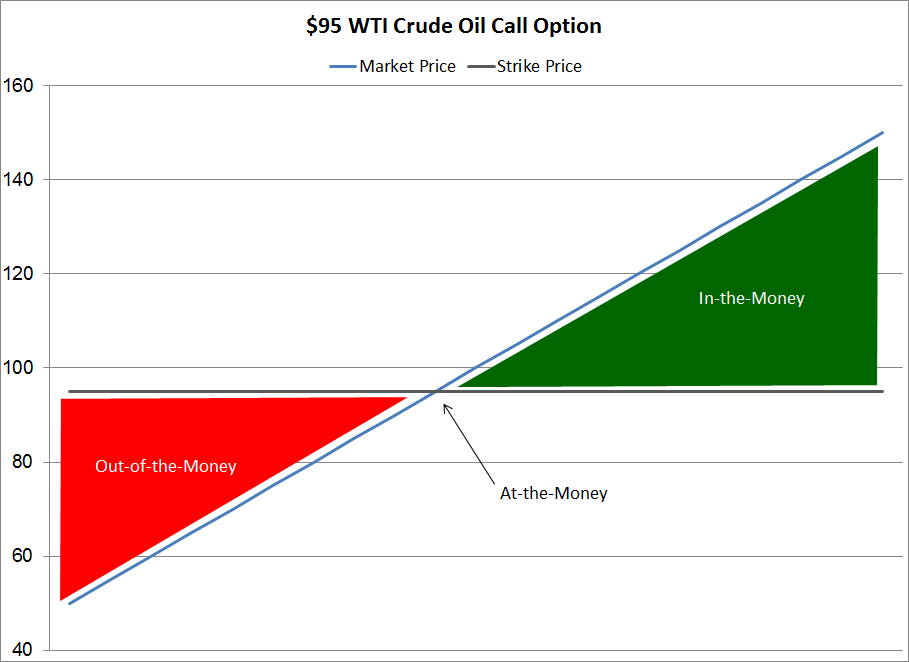

Options, intricate financial instruments that grant the buyer the right but not the obligation to buy or sell an underlying asset at a predetermined price, form the cornerstone of crude oil options trading. Within this dynamic arena, traders wager on the future direction of oil prices, seeking to outmaneuver market volatility and secure a lucrative payoff.

Delving into the Oil Options Arena

The history of crude oil options trading dates back to the 1970s, when the oil crisis ignited a surge in hedging activities. Today, these contracts offer a versatile tool for a diverse array of market participants, from energy companies locking in favorable prices to hedge funds seeking speculative gains.

Understanding the foundational concepts of options trading is paramount for navigating this complex landscape. Calls confer the right to buy an underlying asset, while puts grant the right to sell. The underlying asset’s price at the time of exercise determines the contract’s payoff. Moreover, each option possesses an expiration date, beyond which it becomes worthless.

Mapping the Crude Oil Contract Landscape

The global crude oil market encompasses several prominent contracts, each representing a specific grade of oil. Brent Crude, the benchmark for European and global markets, and West Texas Intermediate (WTI), serving as the benchmark for the U.S. market, stand as the most influential. Traders strategically utilize these contracts depending on their specific investment objectives and risk tolerance.

Monitoring market trends and economic indicators is an integral aspect of successful crude oil options trading. Factors such as global demand, supply disruptions, and geopolitical events can significantly influence oil prices. Savvy traders astutely analyze this information, formulating informed trading strategies.

Exemplary Insights and Practical Guidance

“The key to thriving in crude oil options trading lies in recognizing the intricate interplay between market fundamentals and technical indicators,” elucidates Thomas Carter, renowned energy analyst at Carter Analytics. “Traders must harness a data-driven approach while staying grounded in sound risk management principles.”

Industry veterans emphasize the significance of diversification in crude oil options trading. “Spreading your risk across multiple contracts mitigates exposure to unforeseen market shocks,” advises Sarah Jones, trader at Pinnacle Commodities. “Moreover, maintaining a disciplined trading plan is imperative for long-term success.”

Image: www.mercatusenergy.com

Navigating the Crossroads of Risk and Reward

Like any financial endeavor, crude oil options trading carries both rewards and risks. The potential for substantial gains is inherent to this demanding arena, yet the possibility of losses should never be overlooked. Carefully evaluating one’s risk tolerance and adhering to a prudent risk management strategy is vital.

Options provide traders with the flexibility to tailor their investments according to their specific risk appetite. Protective put options can safeguard against downside risks, while speculative call options offer the potential for amplified returns when market conditions align favorably.

Crude Oil Options Trading

Empowering the Informed Trader

With the right knowledge, skills, and strategic mindset, individuals can harness the power of crude oil options trading to pursue financial success. This comprehensive guide has enlightened you with the intricacies of this dynamic realm. Now, the choice is yours: Will you become a master of the oil options market, or will you let this opportunity slip through your fingers?