Introduction

In the labyrinth of financial markets, options trading has emerged as a versatile tool for seasoned investors and savvy speculators alike. Among its intriguing array of strategies, kurtosis options trading stands out for its unique ability to exploit the shape of the underlying asset’s probability distribution. This advanced technique requires a keen understanding of statistical concepts and an appetite for risk, making it both captivating and potentially lucrative.

Image: www.slideserve.com

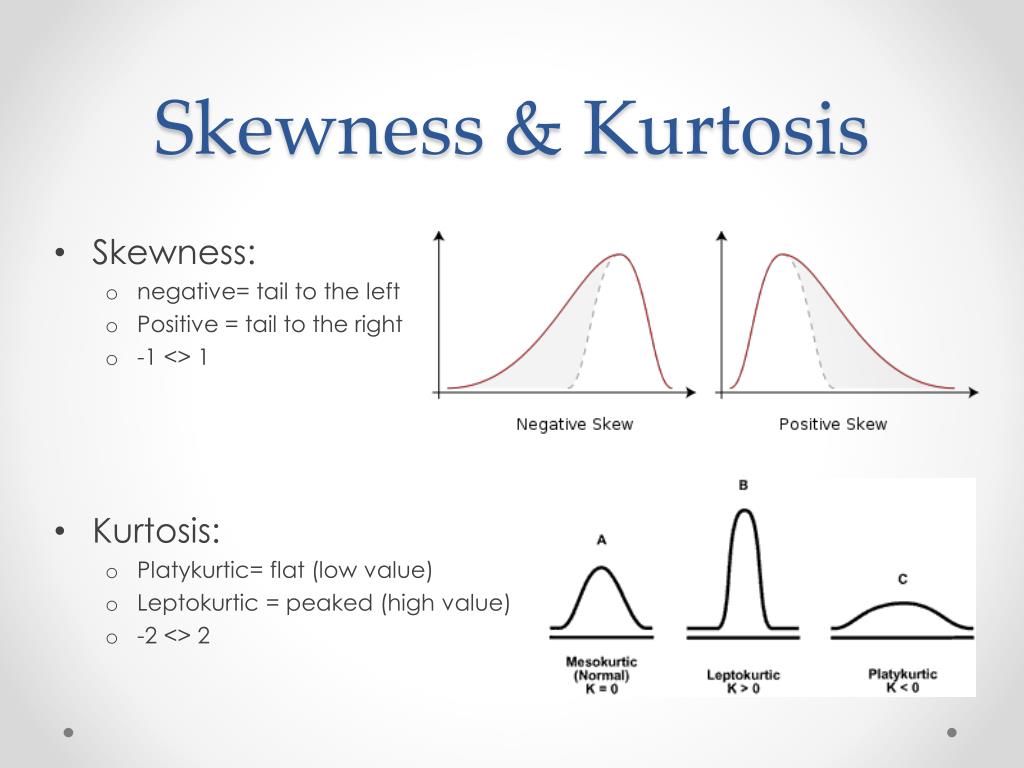

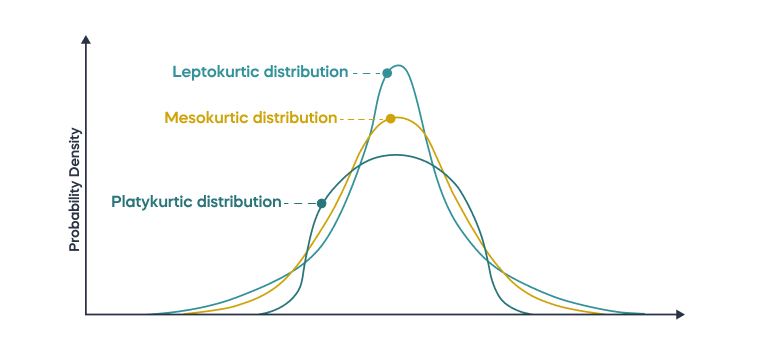

Delving into Kurtosis

Kurtosis measures the peakedness or flatness of a probability distribution, capturing how extreme or concentrated a data set is. A bell-shaped distribution, such as the ubiquitous normal distribution, has a kurtosis value of 3. Distributions with a higher kurtosis value have more pronounced peaks and heavier tails, indicating a greater likelihood of extreme outliers. Conversely, distributions with a lower kurtosis value are flatter and spread out, exhibiting fewer outliers.

Exploiting Kurtosis in Options Trading

Options trading allows investors to bet on the future price movements of an underlying asset, such as stocks or commodities. Traditional options strategies typically focus on the mean, or average, behavior of the asset. However, by incorporating kurtosis into their analysis, traders can potentially identify and capitalize on deviations from this average behavior.

Types of Kurtosis Options

Various types of options can be tailored to exploit kurtosis. For instance, positive kurtosis call options (sometimes referred to as excess kurtosis call options) are designed to profit from extreme price increases in the underlying asset. Conversely, negative kurtosis put options aim to benefit from extreme price decreases.

Image: www.kaggle.com

Strategy Details and Payouts

Positive kurtosis call options typically have higher premiums compared to traditional call options. However, they offer the potential for significantly larger profits if the underlying asset experiences a substantial positive deviation from its mean. Similarly, negative kurtosis put options may fetch lower premiums but provide the opportunity to capture the rewards of extreme negative deviations.

Diverging from Normality

Kurtosis options can be particularly useful when the underlying asset’s probability distribution deviates significantly from the normal distribution. In such cases, kurtosis serves as a valuable indicator of the potential for market inefficiencies that can be exploited through options trading.

Leveraging Market Inefficiencies

By identifying deviations from the normal distribution, kurtosis options traders can seek to profit from inefficiencies in the market. These inefficiencies may arise due to factors such as investor overconfidence, mispricing of assets, or asymmetric information.

Cautions and Considerations

While kurtosis options trading offers the potential for significant rewards, it also carries inherent risks. Traders must be vigilant in managing their positions, understanding the associated risk-reward profiles, and employing appropriate risk management strategies.

Kurtosis Options Trading

Image: www.researchgate.net

Conclusion

Kurtosis options trading empowers investors with a refined tool to navigate the complexities of financial markets. By grasping the nuances of kurtosis and incorporating it into their trading strategies, sophisticated traders can potentially exploit the shape of probability distributions and uncover hidden opportunities. However, it is crucial to approach this advanced technique with a clear understanding of its risks and limitations. As always, thorough research, prudent risk management, and a well-defined trading plan are the hallmarks of successful investing.