Options trading, with its complex web of strategies, can be an intriguing and potentially lucrative venture. For savvy investors seeking to venture beyond basic option strategies, exploring the intricacies of complex options trading strategies offers a path toward maximizing returns.

Image: seekingalpha.com

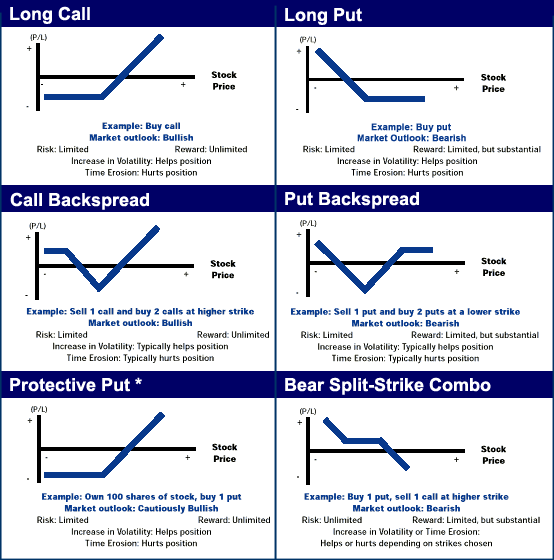

Complex options involve advanced combinations in which multiple options contracts are employed to gain specific market exposures and risk-reward profiles. These strategies cater to seasoned traders with a deep understanding of options dynamics and a willingness to delve into the intricacies of advanced trading techniques.

Catching Butterflies: The Convergence Strategy

The butterfly spread is a versatile strategy that allows traders to position themselves for a specific range movement in the underlying asset. It involves buying one option below the current price (put option) and selling two options out-of-the-money at higher strike prices. The butterfly spread provides maximum profit if the underlying asset’s price stays within a predefined range, making it suitable for volatile markets.

Variations of the butterfly spread include the iron butterfly and the fly, which increase the number of options contracts and adjust the strike prices to suit different market conditions and risk profiles.

Riding the Wave: Trend Following with Condors

Iron condors capitalize on directional price movements while maintaining a neutral to slightly bullish bias. This strategy entails selling one out-of-the-money call option, buying one out-of-the-money put option, and selling two further out-of-the-money options in both directions at lower and higher strike prices, respectively.

Iron condors are particularly effective in trending markets, earning a profit from the passage of time as the market moves in the anticipated direction. This strategy offers a balanced risk-reward profile, suitable for both income-generating strategies or taking on directional market bets.

Expert Insights: Guiding Your Options Odyssey

Navigating complex options strategies requires a solid foundation and continued learning. Here are some tips from seasoned traders:

1. Thorough Research and Education: Invest time in understanding the nuances of options trading, including different strategies, risk management techniques, and technical analysis. This knowledge forms the backbone of successful complex options trading.

2. Discipline and Risk Management: Never overtrade or exceed your risk tolerance. Always plan trades in advance, setting clear objectives and target profit levels. Discipline and risk management are crucial for navigating the market’s complexities.

Image: www.quantifiedstrategies.com

Frequently Asked Questions (FAQs) on Complex Options

- How do I choose the right complex options strategy for me?

Determine your market outlook, risk tolerance, and investment goals. Conduct thorough research and analysis to identify strategies that align with your objectives. - What is monitoring complex options strategies?

Regularly track your options positions, pay attention to market conditions, and respond to any changes. Manage your risk by adjusting positions or exiting trades when necessary.

Complex Options Trading Strategies

Conclusion: Unveiling the Complexities of Options Trading

Complex options trading empowers investors with advanced strategies that can unlock significant profit potential. However, it’s paramount to approach these strategies with a deep understanding, risk management, and a commitment to continuous learning. Remember, the key to success in complex options trading lies in knowledge, vigilant monitoring, and embracing the intricacies of the investment landscape. Embark on this financial adventure with a passion for exploration, and unlock the full spectrum of opportunities that complex options trading offers.

Are you intrigued by the world of complex options trading? Share your thoughts and start a discussion below!