In the vast and ever-evolving financial landscape, option trading stands out as a sophisticated yet lucrative endeavor. Complex strategies within this realm of investing offer immense potential for profit maximization, but they also carry intricate mechanics that demand a thorough understanding. This article aims to guide you through the intricacies of these advanced tactics, providing you with the knowledge and insights necessary for navigating this dynamic market.

Image: marketsmuse.com

Defining Complex Option Trading Strategies

At their core, option trading strategies involve contracts that confer upon their holders the right to buy or sell an underlying asset, such as a stock or commodity, at a specified price within a predetermined timeframe. Complex strategies extend beyond the fundamental option types (calls and puts) to encompass intricate combinations that exploit market dynamics and leverage position tailoring. By employing these strategies, traders seek to amplify returns, enhance risk management, and adapt to varying market conditions.

Unveiling the Spectrum of Complex Strategies

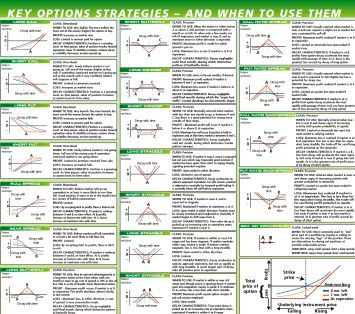

Delving into the world of complex option trading strategies reveals a vast tapestry of methodologies, each with its unique strengths and applications. At the heart of these strategies lies the fundamental concept of combining multiple option positions to create bespoke risk and return profiles. Some prominent examples include:

-

Bull Call Spread: A bullish strategy involving the purchase of a lower-priced call option and the simultaneous sale of a higher-priced call option, resulting in a capped profit potential and limited downside risk.

-

Bear Put Spread: The bearish counterpart of the Bull Call Spread, utilizing the sale of a lower-priced put option and the purchase of a higher-priced put option to profit from declining underlying assets.

-

Iron Condor: A combination strategy employing a Bear Call Spread and a Bull Put Spread simultaneously, creating a profit zone within a specific range of the underlying asset’s price.

-

Calendar Spread: A strategy that capitalizes on the time decay of options by purchasing a short-term option (closer to expiration) and selling a longer-term option (further from expiration), capturing the difference in time premiums.

Harnessing the Power of Option Trading Tools

To unlock the full potential of complex option trading strategies, harnessing specialized tools is imperative. Volatility analysis plays a pivotal role in gauging market expectations and identifying potential trading opportunities. Risk management techniques like delta hedging and position sizing enable traders to calibrate their strategies according to their risk tolerance.

Seeking Expert Guidance in the Option Trading Maze

Navigating the intricacies of complex option trading strategies can be a daunting task for even seasoned investors. Seeking guidance from experienced experts can significantly enhance your comprehension and execution of these advanced tactics. Seasoned professionals possess a deep understanding of market dynamics, strategy selection, and risk mitigation, enabling you to tap into their expertise and optimize your trading outcomes.

Conclusion: Mastering Complex Option Trading Strategies

Unveiling the mysteries of complex option trading strategies requires a blend of knowledge, meticulous planning, and strategic positioning. By grasping the fundamental concepts, exploring various strategies, and leveraging specialized tools, you can craft and implement tailored trading plans that cater to your investment goals and risk appetite. Remember, mastering these advanced tactics demands a commitment to continuous learning, analytical rigor, and the vigilance to adapt to the ever-changing market landscape.

Image: www.learningmarkets.com

Complex Option Trading Strategies

Image: www.pinterest.com