Introduction

Call option trading can be a daunting concept, especially if you’re not familiar with it. But if you do your research, it can be a great way to potentially boost your trading returns. In this article, we’ll take a look at call option trading and provide some tips for getting started.

Image: mappingmemories.ca

But before we dive in, let’s address what Dave Ramsey, a well-known financial expert and radio host, has to say about call option trading.

Dave Ramsey’s Insights

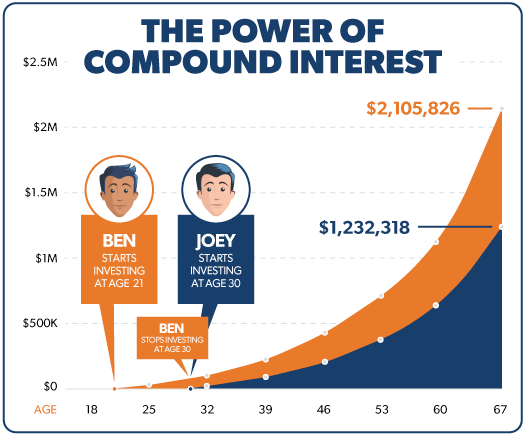

Dave Ramsey strongly advises against options trading, especially for beginners. He believes it’s a risky and dangerous way to invest your money. He argues that people often misunderstand or overestimate their knowledge when trading options, potentially leading to significant losses.

Ramsey emphasizes the importance of investing for the long term and not getting caught up in short-term, potentially risky investments like option trading. He advocates for a diversified investment approach that aligns with your financial goals and risk tolerance.

Call Option Trading Defined

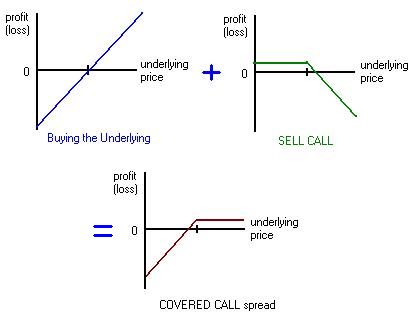

A **call option** gives the buyer the right, not the obligation, to buy an underlying asset, such as a stock, at a predetermined price (strike price) on or before a specific date (expiration date).

By purchasing a call option, you’re speculating that the price of the stock will go up, allowing you to profit by exercising the option (buying the stock) at the strike price. If the stock price doesn’t increase sufficiently, you can let the option expire and forfeit the premium paid.

Factors Affecting Call Option Pricing

Several factors influence the pricing of call options:**

- Stock price: Higher stock prices generally lead to higher option prices.

- Time to expiration: The closer the option is to expiring, the lower its price.

- Strike price: In-the-money options (where the stock price is above the strike price) are usually more expensive than at-the-money or out-of-the-money options.

- Volatility: Options on highly volatile stocks tend to be more expensive.

- Interest rates: Higher interest rates can lead to lower option prices.

Image: urisofod.web.fc2.com

Tips for Option Trading Success

If you’re considering incorporating call option trading into your investment strategy, keep these tips in mind:

- Do your research: Understand the risks and rewards of option trading and ensure you have a clear trading plan.

- Start small: Trade with small amounts initially until you become more comfortable with the process.

- Set clear exit strategies: Determine your profit targets and stop-loss points before entering a trade.

- Pay attention to risk management: Diversify your trades and never risk more than you can afford to lose.

- Seek continued education: Attend trading webinars, read financial news, and stay abreast of market trends.

FAQs about Call Option Trading

Q: What is the difference between a call option and a put option?

A: A call option gives you the right to buy an asset, while a put option gives you the right to sell it.

Q: Can you lose more money than you invested with call options?

A: Yes, it is possible to lose more money than initially invested by selling (writing) call options, where you have an obligation to sell an asset.

Q: Do I have to exercise a call option?

A: No, you are not obligated to exercise a call option. You can let it expire worthless if the underlying stock price does not reach the strike price.

Call Option Trading Dave Ramsey

Image: prounifi.com

Conclusion

Call option trading can be a potentially lucrative way to invest, but it also involves significant risk. If you’re new to option trading, it’s best to start small and consider the guidance of a financial professional. By understanding the concepts, managing risk, and seeking continued education, you can increase your chances of success in this dynamic and potentially rewarding investment arena.

Are you interested in learning more about call option trading?