The realm of option trading tantalizes investors with its potential for exponential returns. Interactive Brokers (IB), a leading online broker, has emerged as a preferred destination for options traders, offering a comprehensive suite of trading tools and competitive pricing. Embarking on an options trading journey with IB requires a thorough understanding of its cost structure, empowering traders to optimize their profits.

Image: www.youtube.com

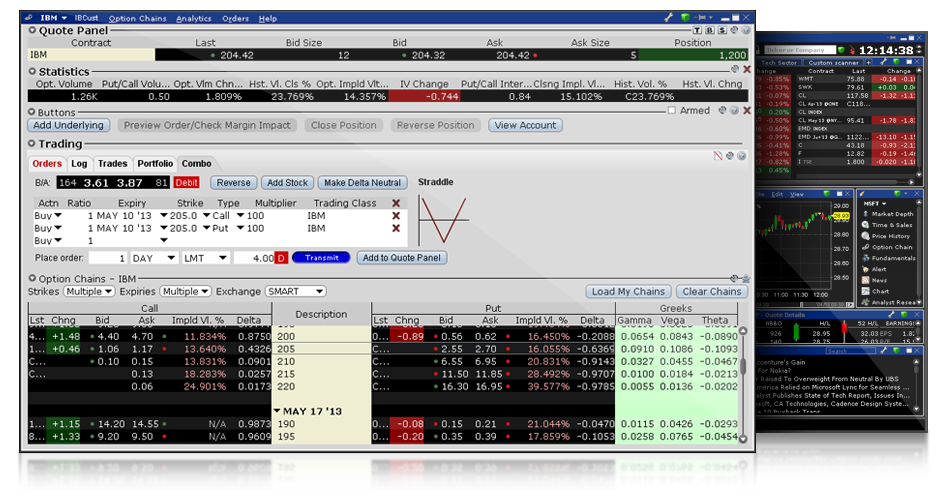

Interactive Brokers: A Vanguard in Options Trading

Interactive Brokers stands as an industry trailblazer, renowned for its robust trading platform, advanced charting capabilities, and global reach. Its customizable interface caters to traders of all experience levels, whether novice or seasoned veterans. IB’s extensive product offerings encompass stocks, bonds, forex, futures, and the vast universe of options.

Comprehending the Anatomy of Option Trading Costs

Navigating the landscape of options trading costs with IB demands a nuanced understanding of its multifaceted nature. These costs typically encompass several components:

-

Commission: A brokerage fee charged per contract traded, varying based on the type of option and the trading volume. IB employs a tiered pricing structure, offering discounts for higher trading volumes.

-

Option Premium: The price paid upfront to acquire an option contract, representing its intrinsic value and time value. Option premiums fluctuate dynamically, influenced by factors such as the underlying asset’s price, volatility, and time to expiration.

-

Exchange Fees: Additional charges levied by the exchange where the option contract is traded. These fees typically consist of a per-contract fee and a regulatory fee.

-

Other Fees: Occasional charges may arise, such as exercise fees, assignment fees, or early termination fees. Understanding these ancillary costs is crucial to accurately estimating overall trading expenses.

IB’s Competitive Option Trading Costs

In the fiercely competitive arena of options trading, IB has carved a niche for itself with its attractive pricing. Its commission structure, tailored to cater to various trading strategies, deserves particular attention:

-

Single-Leg Options: Traders executing single-leg option trades enjoy competitive per-contract commissions starting at $0.65.

-

Multi-Leg Options: Complex option strategies involving multiple legs, such as spreads and combinations, are subject to reduced commissions, providing cost savings for sophisticated traders.

-

Volume Discounts: High-volume traders are rewarded with substantial discounts, fostering economies of scale and maximizing profitability.

Image: www.interactivebrokers.com

Choosing the Ideal Option Trading Plan with IB

Selecting an option trading plan with IB involves a careful evaluation of trading frequency, strategy complexity, and overall trading volume. Tailoring a plan to one’s specific needs ensures cost optimization and enhanced trading performance.

-

Fixed-Rate Plan: Ideal for low-frequency traders with modest trade volume, the fixed-rate plan offers predictable commissions regardless of volume.

-

Tiered-Rate Plan: Designed for active traders with higher trade volume, the tiered-rate plan provides progressively lower commissions as volume increases.

-

Volume-Based Plan: High-volume traders can leverage the volume-based plan to unlock substantial discounts, significantly reducing commission expenses.

Unlocking Additional Savings with IB

Beyond its competitive commission structure, IB offers a myriad of opportunities for traders to further minimize costs and maximize profits:

-

Rebates and Credits: IB rewards traders for providing liquidity to the market, offering rebates on executed orders and credits for posting limit orders.

-

Tiered Membership Program: Traders who maintain higher account balances are eligible for exclusive benefits, including reduced commissions and priority access to IB’s support services.

-

Referral Program: Existing IB clients can earn referral bonuses by introducing new traders to the platform, further offsetting trading expenses.

Interactive Broker Option Trading Cost

Image: www.youtube.com

Conclusion

Navigating the intricacies of Interactive Broker’s option trading cost structure empowers traders to make informed decisions, optimize their trading strategies, and maximize their returns. IB’s competitive pricing, coupled with its robust trading platform and extensive educational resources, provides a compelling value proposition for options traders seeking success in the financial markets. Embrace the insights outlined in this comprehensive guide to unlock the full potential of IB’s option trading platform and embark on a rewarding trading journey.