Navigating the Maze of Trading Costs and Maximizing Profits

In the realm of financial markets, where every penny counts, traders are constantly seeking ways to minimize their expenses and enhance their returns. Among the various costs associated with trading, option trading fees play a significant role, profoundly impacting traders’ profitability. This comprehensive guide will delve into the intricacies of the cheapest option trading fees, providing invaluable insights into strategies, platforms, and best practices for lowering transaction costs.

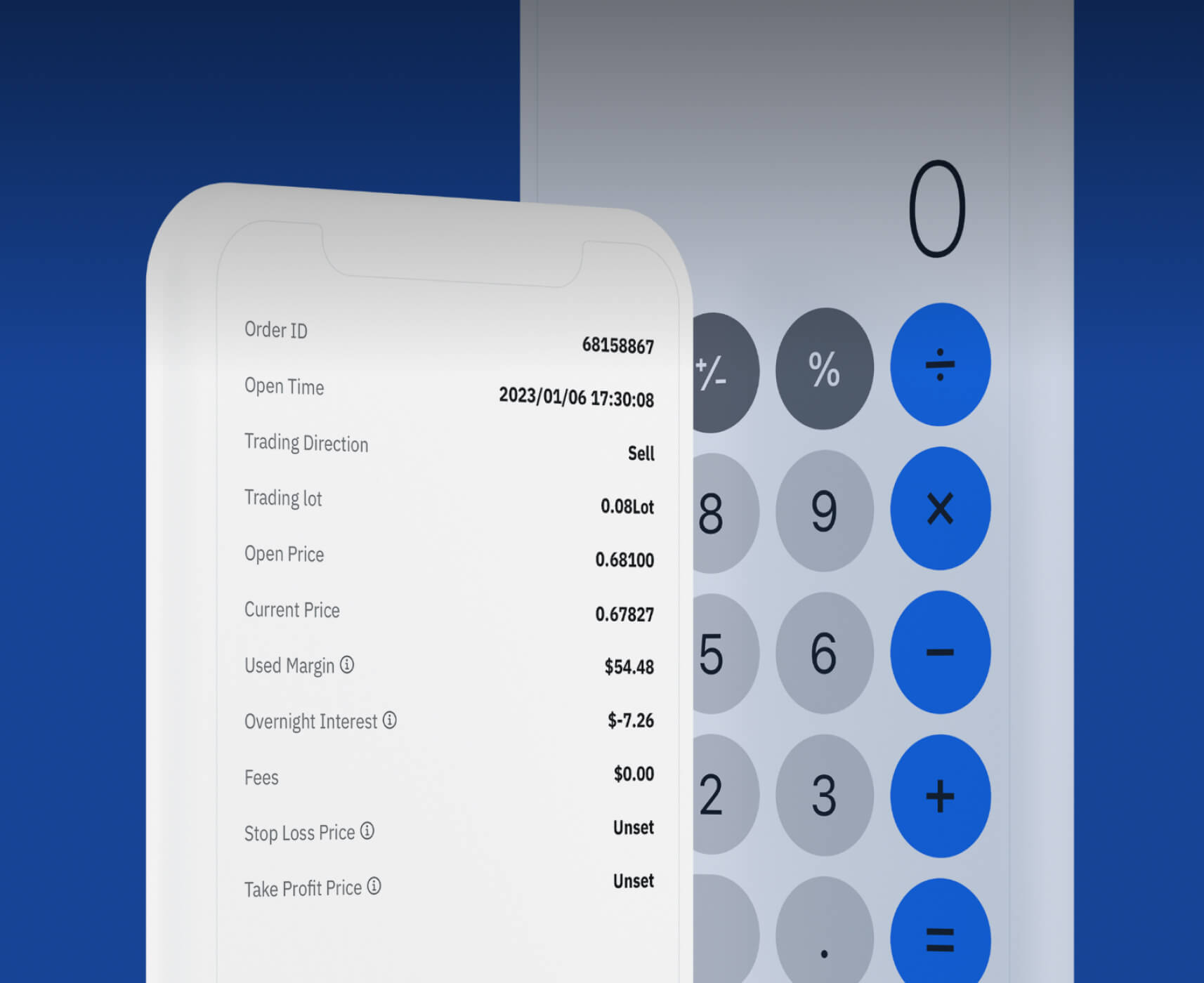

Image: www.top1markets.com

Defining Option Trading Fees and Their Impact

Option trading involves the buying and selling of contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predefined time frame. Each transaction in option trading incurs fees known as option trading fees, which vary depending on several factors, including the trading platform, the complexity of the options contract, and the regulatory framework.

These fees can significantly chip away at traders’ profits, particularly for frequent traders or those executing large volumes. Therefore, it is imperative to understand the structure and components of option trading fees, enabling traders to make informed decisions and select the most cost-effective approach for their trading style and objectives.

Component Fees and Fee Structures

The landscape of option trading fees can be complex, comprising various components that may vary across different trading platforms and jurisdictions. The most common components of option trading fees include:

Trading Commission: This fee compensates the broker or trading platform for executing the trade. It is typically charged on a per-contract basis and can range from a few dollars to hundreds of dollars or more, depending on the underlying asset, contract size, and broker’s fee schedule.

Exchange Fees: In addition to trading commissions, traders may also incur fees charged by the exchange where the trade is executed. These fees help cover the costs associated with maintaining the trading platform, providing market data, and ensuring regulatory compliance. Exchange fees vary across different exchanges and can vary based on the type of option contract and the trading volume.

Regulatory Fees: A portion of option trading fees is allocated to regulatory bodies to fund their oversight and enforcement activities. These fees contribute to the overall stability and integrity of the financial markets and ensure traders’ interests are protected.

Other Fees: Some trading platforms or brokers may impose additional fees, such as account maintenance fees, data fees, or technology fees. These fees are typically charged on a recurring basis and can add to the overall trading costs.

Understanding the fee structure of the trading platform you intend to use is essential in selecting a cost-effective option. A thorough comparison of different trading platforms, taking into account the fee structure and overall trading experience, can help traders identify the platform that best aligns with their trading style and financial goals.

Strategies for Minimizing Option Trading Fees

In an era of highly competitive trading platforms and fee structures, traders have several strategies at their disposal to minimize the impact of option trading fees on their profitability:

Selecting a Discount Broker: Discount brokers typically offer lower trading commissions compared to traditional or full-service brokers. These brokers often have a simplified fee structure with lower per-contract trading fees, making them a cost-effective option for traders seeking to minimize their trading costs.

Negotiating Lower Fees: For traders with significant trading volume, it may be possible to negotiate lower trading fees with their broker or trading platform. This can involve discussing bulk discounts, tiered pricing structures, or rebates based on trading volume or account balance.

Bundling Options Trades: Some trading platforms offer discounted pricing for bundled option trades, where traders execute multiple contracts within a single transaction. This can result in lower per-contract fees and is particularly beneficial for traders who regularly trade options with similar underlying assets or expiration dates.

Utilizing Fee Rebates: Certain trading platforms or brokers may offer fee rebates or cash-back programs to traders who meet specific criteria, such as exceeding a certain trading volume or maintaining a specific account balance. These programs can help traders recoup a portion of their trading fees, reducing their overall trading costs.

Monitoring Fee Structures: The trading industry is constantly evolving, with fees and fee structures subject to change. Traders should routinely monitor the fee structures of their trading platforms to ensure they remain competitive and aligned with their trading needs. Additionally, being aware of industry trends and innovations can help traders identify new opportunities to minimize their trading costs.

Image: www.myoptionsedge.com

Factors to Consider When Choosing an Option Trading Platform

Selecting a suitable option trading platform is crucial for cost optimization and overall trading success. Traders should evaluate several key factors when choosing a platform, including the fee structure, trading tools and features, regulatory compliance, customer support, and reputation:

Fee Structure: The fee structure of the trading platform should be a primary consideration, taking into account trading commissions, exchange fees, regulatory fees, and any additional fees that may apply. Traders should carefully compare fee structures across different platforms and choose the one that best fits their trading style and budget.

Trading Tools and Features: The trading platform should provide the necessary tools and features to support traders’ trading strategies effectively. These features may include advanced charting capabilities, real-time market data, options pricing models, and risk management tools, among others.

Regulatory Compliance: It is essential to ensure that the trading platform is fully regulated and complies with all applicable laws and regulations. This ensures the platform operates in a fair and transparent manner and that traders’ interests are protected.

Customer Support: The quality and availability of customer support can significantly impact the overall trading experience. Traders should choose a platform that provides reliable and responsive customer support, particularly during market volatility or technical difficulties.

Reputation: The reputation of the trading platform is a valuable indicator of its trustworthiness and reliability. A well-respected platform with a positive reputation among traders is more likely to provide a dependable and cost-effective trading environment.

By considering these key factors, traders can make informed decisions and choose an option trading platform that not only minimizes their trading costs but also supports their unique trading requirements and goals.

Cheapest Option Trading Fees

The Future of Option Trading Fees

The future of option trading fees is driven by technological advancements, regulatory changes, and evolving market dynamics:

Technological Advancements: Advancements in technology, such as the advent of automated trading platforms, have led to reduced trading costs and increased efficiency in the option trading landscape. The continued development of new technologies is expected to further drive down fees and enhance the overall trading experience for traders.

Regulatory Changes: Regulatory bodies worldwide are continuously reviewing and updating regulations governing financial markets, including those related to option trading fees. These changes aim to strike a balance between protecting investors, fostering market integrity, and promoting competition. Such regulatory shifts can impact the fee structures of trading platforms, and traders should stay abreast of any upcoming changes to prepare for their potential impact on their trading costs.

Market Dynamics: Market dynamics, such as changes in market volatility, liquidity, and trading volume, can influence the fee structures of option trading platforms. Traders should be aware of these dynamics and how they may affect their trading costs over time.

In conclusion, understanding the complexities of option trading fees and implementing strategies to minimize their impact is of paramount importance for traders seeking to maximize their profitability. By carefully selecting a low-cost trading platform, utilizing fee rebates, monitoring fee structures, and staying informed about industry developments, traders can position themselves to reduce their overall trading costs and enhance their trading performance.

This comprehensive guide has provided in-depth insights into the cheapest option trading fees, empowering traders to navigate the financial markets with confidence and efficiency. By embracing the principles outlined in this article, traders can unlock greater profitability and achieve their financial objectives in the dynamic world of option trading.