Unveiling the Options Trading Universe: A Personal Journey

In the realm of investing, I discovered the allure of options trading, a world where sophisticated strategies intertwine with the pulsating heartbeat of the market. Like a seasoned navigator, I delved into the uncharted waters of Robinhood, seeking to empower my financial horizons. Along the way, I realized the paramount importance of mastering the art of enabling options trading on this platform. Thus, I embark on this voyage to unveil the intricacies of this process, guiding you through the steps to unlock the world of options trading on Robinhood.

Image: marketxls.com

Enlightening the Uninitiated: Options Trading Demystified

Options trading presents a unique opportunity for investors to navigate the labyrinthine landscape of financial markets. Simply put, options are contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, known as the strike price, within a specified time frame, referred to as the expiration date. These versatile instruments empower investors to express their market sentiments, hedge against potential losses, or even amplify their returns.

Navigating the Robinhood Platform: Enabling Options Trading

To embark on your options trading odyssey on Robinhood, you must first satisfy certain eligibility criteria. Ensure that you possess a margin account, as options trading inherently involves leverage. Subsequently, you will need to complete an options trading application, which entails providing personal and financial information. Upon submission, Robinhood will evaluate your suitability based on your investment experience and knowledge. Patience is a virtue, as the approval process can take several business days.

Once approved, you will have access to a myriad of options strategies at your fingertips. Robinhood offers a range of options types, including calls, puts, and spreads, empowering you to craft tailored trading strategies that align with your risk tolerance and investment objectives. It is crucial to approach options trading with a measured and prudent mindset, meticulously weighing the potential rewards against the inherent risks.

Embracing the Latest Trends: Options Trading in the Digital Era

The advent of digital platforms like Robinhood has revolutionized options trading, making it more accessible to a broader spectrum of investors. These platforms provide user-friendly interfaces, intuitive tools, and educational resources, rendering options trading more manageable for both novice and experienced traders alike. Additionally, the integration of artificial intelligence and machine learning algorithms enhances trading experiences, offering personalized recommendations and real-time market insights.

Image: streetfins.com

Expert Insights: Unlocking the Secrets of Options Trading

As you embark on your options trading journey, wisdom can be gleaned from the experiences of seasoned traders. Here are a few invaluable tips to equip you for success:

-

Embrace Continuous Education: Immerse yourself in the vast reservoir of knowledge available through books, articles, and online courses. The pursuit of knowledge is an ongoing endeavor in the dynamic world of options trading.

-

Practice Patience and Discipline: Options trading necessitates patience and discipline. Avoid impulsive decisions and meticulously evaluate market conditions before executing trades.

-

Manage Risk Effectively: Employ sound risk management strategies by diversifying your portfolio, setting stop-loss orders, and thoroughly understanding the potential risks associated with each trade.

Frequently Asked Questions: Clarifying Common Queries

Q: Is Options Trading Right for Me?

A: Options trading can be a potent tool for experienced investors seeking advanced strategies and the potential for amplified returns. However, it is imperative to assess your risk tolerance and investment goals before venturing into this realm.

Q: How Much Capital Do I Need to Start Options Trading?

A: The capital requirement for options trading varies depending on the strategies employed and the underlying assets involved. It’s advisable to start with a small amount and gradually increase your investment as you gain experience and confidence.

Q: Can I Lose More Money than I Invest in Options Trading?

A: Yes, options trading carries the potential for significant losses. The value of an option can fluctuate rapidly, and there is always the risk that the option will expire worthless.

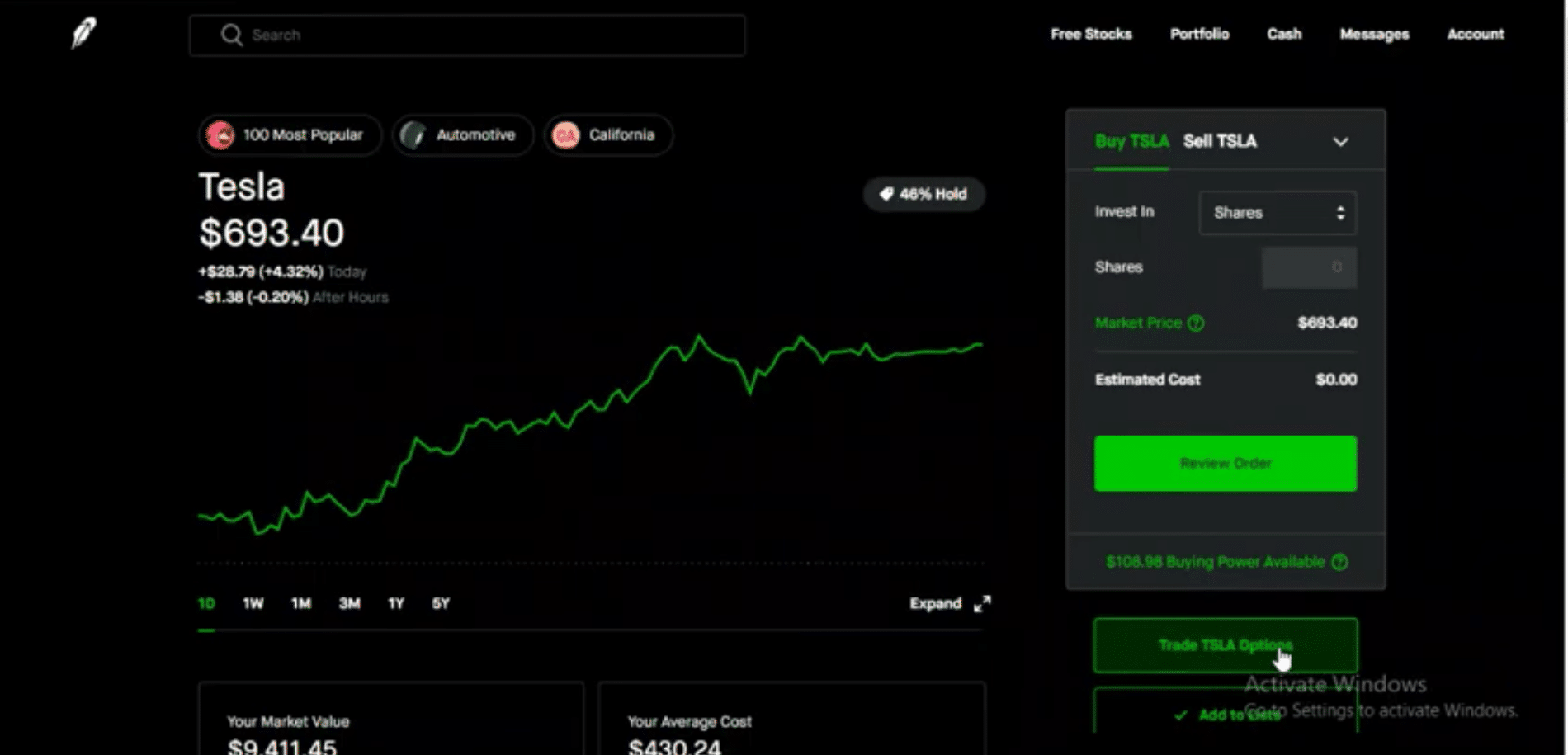

How To Turn On Options Trading On Robinhood

Image: www.youtube.com

Conclusion: Embracing the Options Trading Landscape

Options trading unlocks a world of possibilities for investors, offering sophisticated strategies and the potential for substantial returns. By mastering the techniques outlined in this article, you will be well-equipped to navigate the complexities of options trading on Robinhood and pursue your financial aspirations.

Whether you’re an options trading aficionado or just beginning to explore this intriguing domain, I invite you to delve further into the vast resources available. Knowledge is power, and by embracing continuous learning and seeking expert guidance, you will empower yourself to make informed decisions and confidently navigate the ever-evolving landscape of options trading.