The realm of options trading presents traders with a multi-tiered system, with Level 2 and Level 3 standing as two prominent gateways to unlocking advanced trading strategies and sophisticated market insights. Level 2 and Level 3 options trading offer traders an expanded playing field, encompassing specialized tools, in-depth market data, and a suite of advanced order types that cater to their dynamic trading needs – but what exactly sets these levels apart? In this comprehensive guide, we delve into the intricate depths of Level 2 and Level 3 options trading, exploring their fundamental differences, unraveling the advantages they present, and guiding traders in making an informed choice that aligns with their trading objectives.

Image: fairvaluegaps.com

Deciphering the Levels: Navigating the Options Trading Landscape

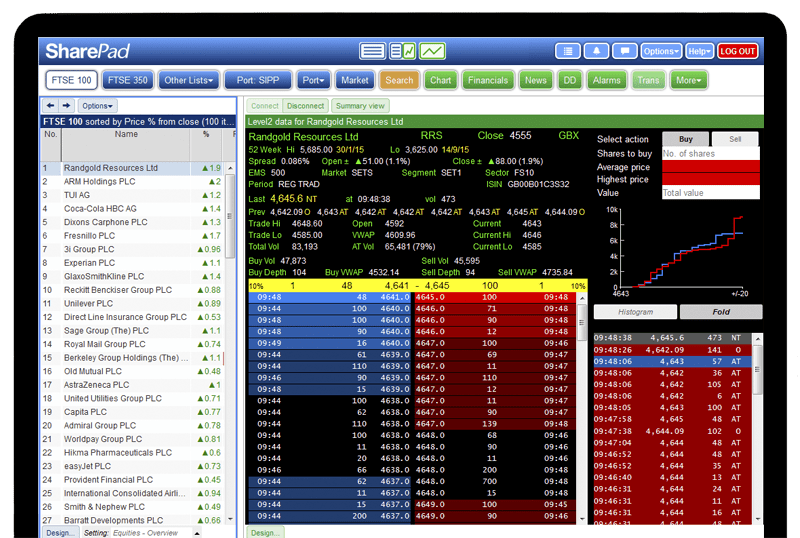

Level 2 options trading grants traders access to an exclusive realm of real-time market data, empowering them with the ability to witness the ebb and flow of the market in real-time. This unfiltered vantage point unveils a tapestry of crucial information, including Level 2 quotes, order book depth, and historical trade data, arming traders with the insights necessary to discern market sentiment, anticipate price movements, and execute trades with greater precision. Embracing Level 2 options trading empowers traders to outmaneuver market fluctuations, identify trading opportunities with enhanced clarity, and fine-tune their strategies to capitalize on market inefficiencies.

Venturing beyond Level 2, traders encounter Level 3 options trading, the pinnacle of options market access. This exclusive tier grants traders a dominion over a full spectrum of advanced order types, entrusting them with the power to tailor their trading strategies with unparalleled flexibility and precision. Complex order types, such as one-cancels-the-other (OCO) orders, fill-or-kill (FOK) orders, and stop-limit orders, become instrumental tools in the trader’s arsenal, enabling them to execute complex trading strategies that cater to specific market conditions. Moreover, Level 3 options trading bestows upon traders the privilege of direct access to market makers, facilitating personalized negotiations and customized pricing, elevating their trading experience to unparalleled heights.

Image: www.shiftingshares.com

Level 2 Vs Level 3 Options Trading

The Pros and Cons: Unveiling the Advantages and Considerations

Delving into the intricacies of Level 2 and Level 3 options trading unveils a spectrum of advantages that cater to traders seeking to amplify their trading prowess and delve into advanced market strategies. Level 2 options trading unlocks a treasure trove of actionable market data, empowering traders with the insights necessary to discern market trends, anticipate price movements, and execute trades with greater precision. Traders can capitalize on fleeting market opportunities, identify trading imbalances, and refine their strategies to navigate market complexities. Embracing Level 2 options trading elevates the trader’s decision-making process, fostering a data-driven approach that enhances their overall trading performance.

Ascending to Level 3 options trading unveils an even more expansive array of advantages. The mastery of advanced order types grants traders unrivaled control over their trading strategies, enabling them to execute complex trades with precision and finesse. This newfound flexibility empowers traders to safeguard their positions against adverse market conditions, optimize profit potential, and navigate market complexities with an unprecedented level of sophistication. Furthermore, direct access to market makers fosters personalized negotiations and customized pricing, providing traders with an unparalleled edge in the competitive trading landscape.

However, it is imperative to acknowledge the potential drawbacks associated with Level 2 and Level 3 options trading. These advanced trading levels demand a sophisticated understanding of options trading strategies and a deep comprehension of market dynamics. Novice traders may find the complexities of Level 2 and Level 3 options trading overwhelming, potentially leading to substantial losses. Moreover, these advanced levels often entail higher trading costs, including platform fees and data subscription charges, which may erode profitability, particularly for traders with limited capital.