Navigating ITR for Options Trading

Investing in options offers the potential for both high rewards and risks. It’s crucial to understand the intricacies of filing your Income Tax Return (ITR) when engaging in options trading to avoid any complications. This guide will delve into the essential aspects of ITR filing for options traders, equipping you with the knowledge and insights to fulfill your tax obligations.

Image: www.pdfprof.com

Comprehending Options Trading

Options are financial contracts that confer upon the holder the right, but not the obligation, to buy (in case of call options) or sell (in case of put options) an underlying asset at a predetermined price (strike price) before a specified date (expiry date). Options trading involves buying and selling these contracts, giving traders the flexibility to speculate on price movements or hedge against potential losses.

When it comes to taxation of options trading profits, the rules may vary depending on the country you reside in. This guide primarily focuses on India, where options trading profits are taxed as per the Income Tax Act, 1961.

Taxation of Options Trading Profits in India

Options trading profits are treated as business income in India and taxed accordingly. The tax liability is calculated as follows:

- **Short-Term Capital Gains (STCG):** If you hold the options contract for less than 12 months, the profit will be subject to STCG tax of 15%.

- **Long-Term Capital Gains (LTCG):** If you hold the options contract for more than 12 months, the profit will be subject to LTCG tax of 10%, provided the total LTCG exceeds Rs. 1 lakh (approximately USD 1,300) in a financial year.

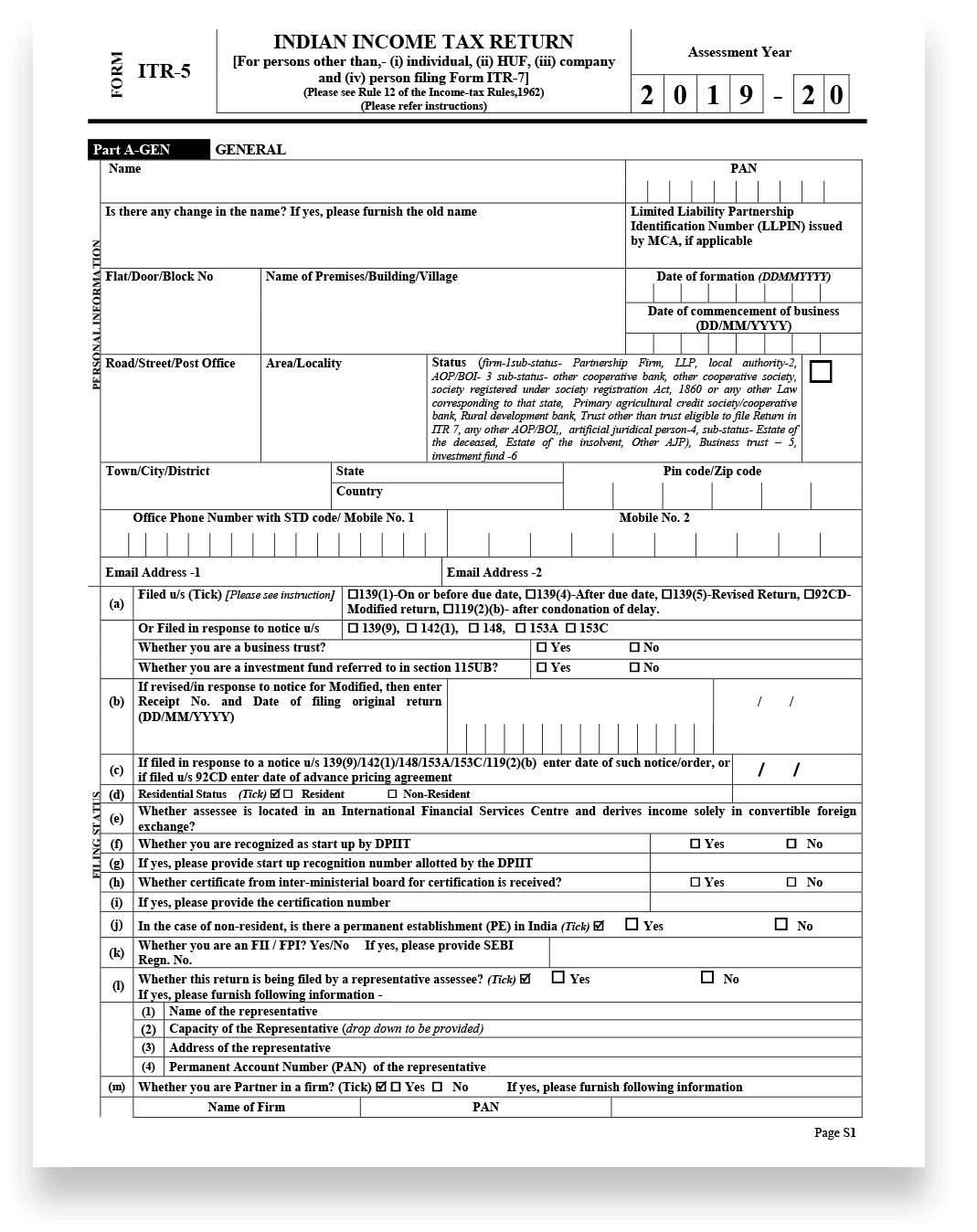

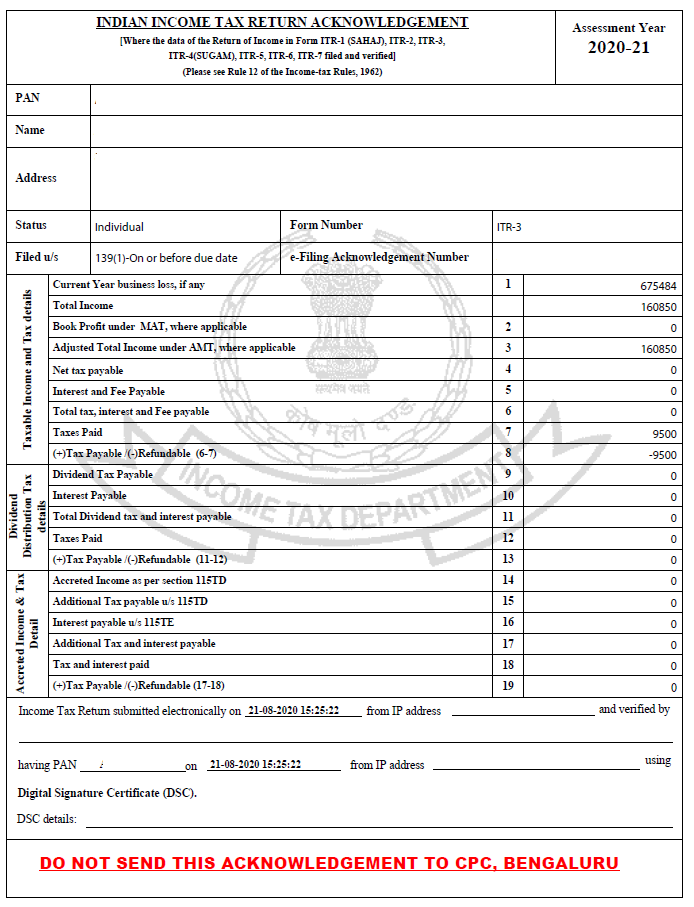

Filing ITR for Options Trading

To file your ITR for options trading, you need to use the ITR-3 form, which is applicable to individuals and Hindu Undivided Families (HUFs) having business or professional income. Here’s a step-by-step guide to filing ITR online:

Image: tradingqna.com

Step 1: Gather Required Documents

- Form 16 (if you are salaried and have opted for Form 16)

- Form 26AS

- Statement of options trading profits from your broker

- Proof of identity and address

Step 2: Register on Income Tax Portal

If you haven’t already, register on the Income Tax Department’s official e-filing portal at **incometaxindiaefiling.gov.in**. Obtain your User ID and password.

Step 3: Log In and Select ITR-3 Form

Log in to the portal using your credentials. Click on ‘e-File’ and select ‘Income Tax Return.’ Choose ‘ITR-3’ and ‘Assessment Year.’ Fill in the relevant details.

Step 4: Enter Income Data

Fill in your income details from various sources, including options trading profits. Calculate your total income and mention it accordingly.

Step 5: Calculate Tax Liability

Calculate your tax liability based on your taxable income and applicable tax rates. You can use the tax calculator provided on the portal for assistance.

Step 6: Submit Return

Review your entered details carefully. Verify your assertions and declarations. Digitally sign your return using your Aadhaar OTP or Net Banking facility.

Remember, you can file your ITR for options trading till July 31st of each fiscal year or face late filing penalties. To avoid any issues, it is advisable to file your return well before the deadline.

FAQs

- Can I offset my options trading losses against other income?

Yes, you can offset your options trading losses against your other income, such as salary or business profits, to reduce your overall tax liability.

- Do I need to report my options trading transactions even if I don’t make any profits?

Yes, you must report all your options trading transactions in your ITR, even if you don’t make any profits. This helps the Income Tax Department track your transactions and assess your overall tax liability.

- What are the consequences of not filing my ITR on time?

Not filing your ITR on time can attract penalties. The penalty amount varies depending on the delay and your income tax liability.

How To File Itr For Options Trading

Image: www.myxxgirl.com

Conclusion

Filing your ITR for options trading can seem daunting, but with the right understanding and guidance, it can be a smooth process. By adhering to the guidelines outlined above, you can ensure that you fulfill your tax obligations accurately and avoid potential penalties. Remember, seeking professional advice from a chartered accountant can further assist you in navigating the complexities of tax laws and maximizing your tax efficiency.

So, grab the opportunity to learn more about ITR filing for options trading. Conquer this task with confidence and ensure a worry-free tax season. Are you ready to delve into the world of tax compliance?