Are you an options trader looking to minimize your tax liability? If so, you may wonder if you can file a loss in options trading income tax. The answer is yes, but it’s important to understand the rules and regulations surrounding this process before proceeding. This article will provide an in-depth look at filing a loss in options trading income tax, exploring its implications and guiding you through the necessary steps to ensure compliance with tax regulations.

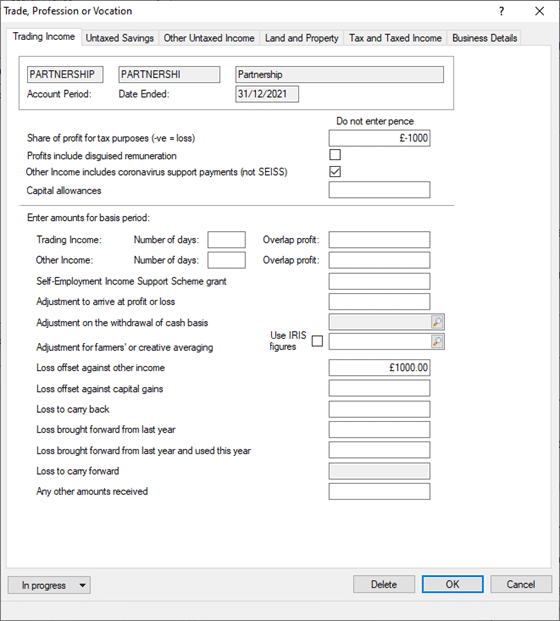

Image: www.iris.co.uk

Defining Loss in Options Trading and Its Implications

Loss in options trading refers to the situation where the total value of your options trading losses exceeds your total gains. This can occur due to various factors such as market fluctuations, poor trading strategies, or unforeseen events. Losses incurred from options trading are treated as capital losses, which can be used to offset capital gains for tax purposes. However, it’s important to note that capital losses cannot be used to offset ordinary income, such as wages or salary.

Steps to Filing Loss in Options Trading Income Tax

To file a loss in options trading income tax, you must follow specific steps:

-

Gather the necessary records: Collect all documentation related to your options trading activities, including trade confirmations, account statements, and tax forms.

-

Calculate your gain or loss: Determine your total gains and losses from options trading for the tax year. You can use a spreadsheet or accounting software to aid in this process.

-

Report your loss on Schedule D: Use IRS Form 8949 to report your capital gains and losses, which should include your options trading activities. The form requires detailed information about each transaction, including the sale or exchange date, description of the asset, proceeds, cost or other basis, and gain or loss.

-

Offset your gains with your loss: If you have any capital gains, you can use your options trading loss to offset these gains on Schedule D. You can carry over any excess loss that exceeds your capital gains to offset future gains.

-

File your tax return: Submit your completed tax return, including Form 8949 and Schedule D, to the IRS by the tax filing deadline. Electronic filing is highly recommended for accuracy and efficiency purposes.

Additional Considerations

When filing a loss in options trading income tax, keep the following in mind:

-

Wash sales: The IRS has wash sale rules to prevent taxpayers from selling a losing security and buying it back within 30 days. If a wash sale occurs, the loss cannot be claimed as a deductible expense.

-

Short-term vs. long-term losses: Losses from options trading are classified as either short-term or long-term, depending on the holding period. Short-term losses are deductible up to the amount of your capital gains, while long-term losses receive more favorable tax treatment.

-

Margin trading: If you engage in margin trading, any losses you incur will be subject to the same tax rules as regular options trading losses.

Image: saginfotech.com

Can I File Loss In Options Trading Income Tax

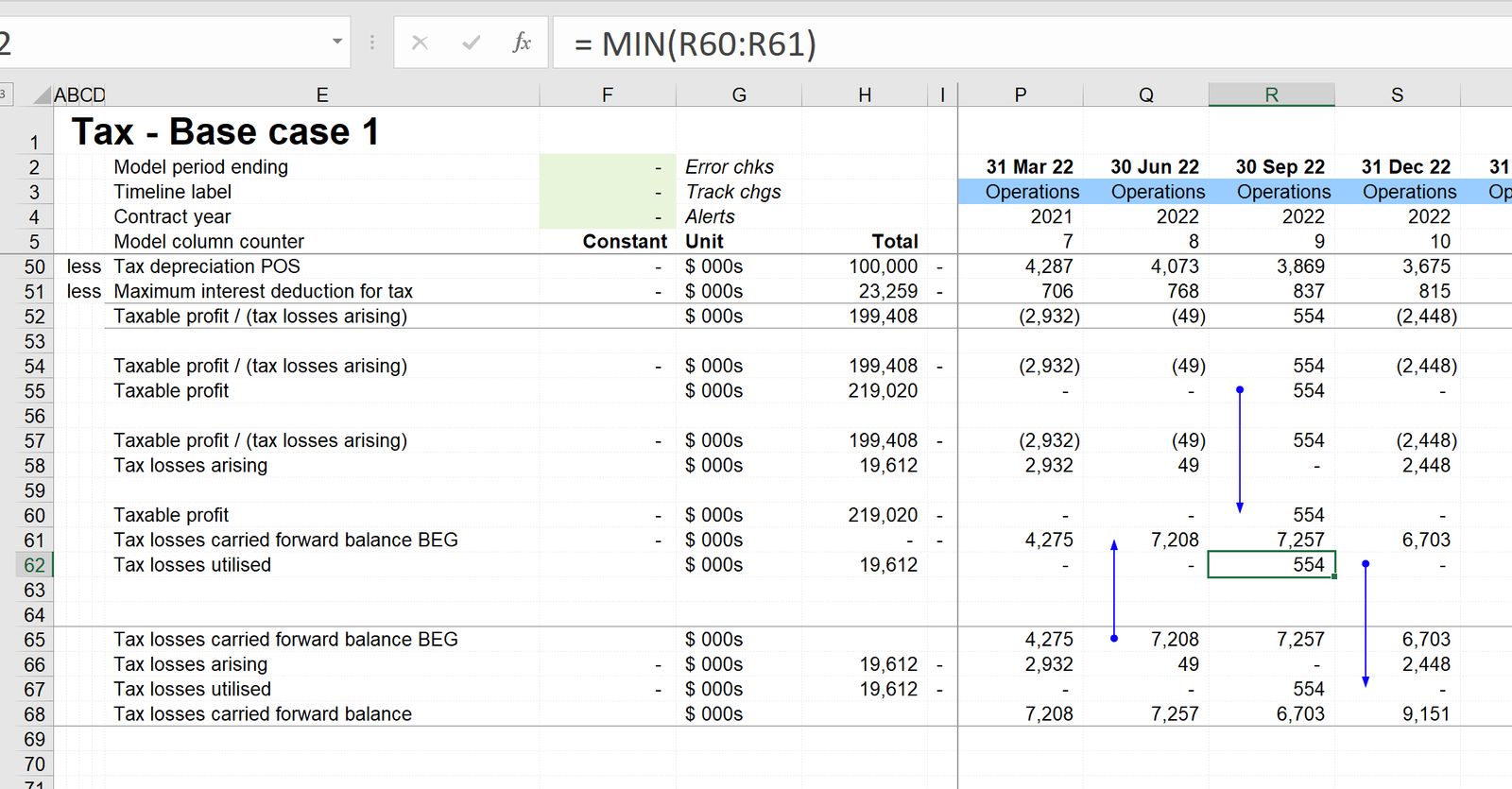

Image: www.financialmodellinghandbook.org

Conclusion

Filing loss in options trading income tax can be an effective way to reduce your tax liability. However, it’s crucial to understand the rules and regulations surrounding this process to ensure compliance and maximize your tax savings. By following the steps outlined in this article, you can successfully file your options trading losses and minimize your tax burden. Additionally, consulting with a tax professional can provide personalized guidance