Introduction

In the realm of financial markets, options trading stands as a potent tool for investors seeking to navigate the complexities of risk and reward. While its intricacies hold immense potential, understanding the tax implications can be paramount to maximizing gains and safeguarding against unforeseen liabilities. In this comprehensive guide, we delve into the nuances of tax on options trading in India, dispelling common misconceptions and empowering you with a clear roadmap to mitigate potential tax burdens.

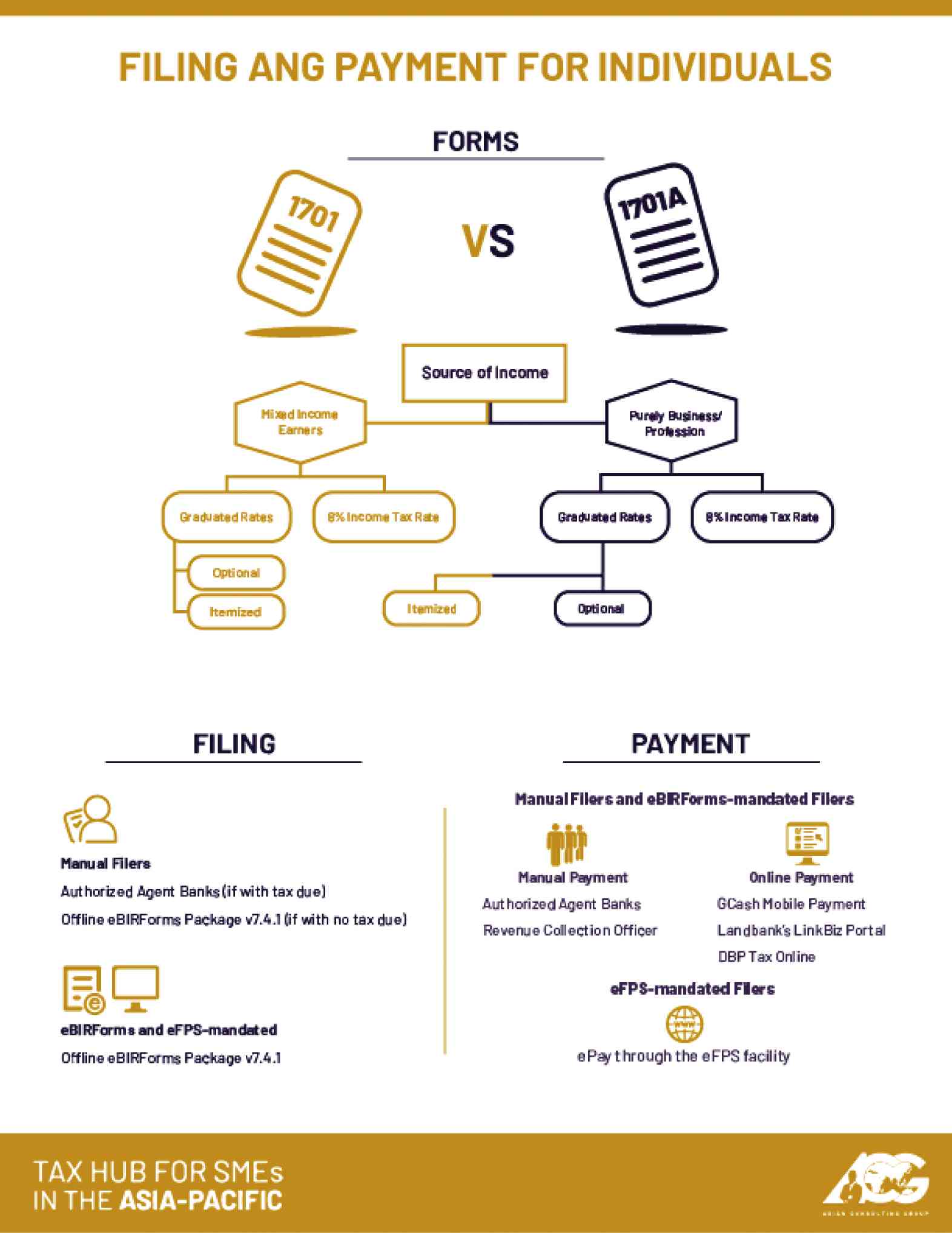

Image: business.inquirer.net

Taxability of Options Trading in India

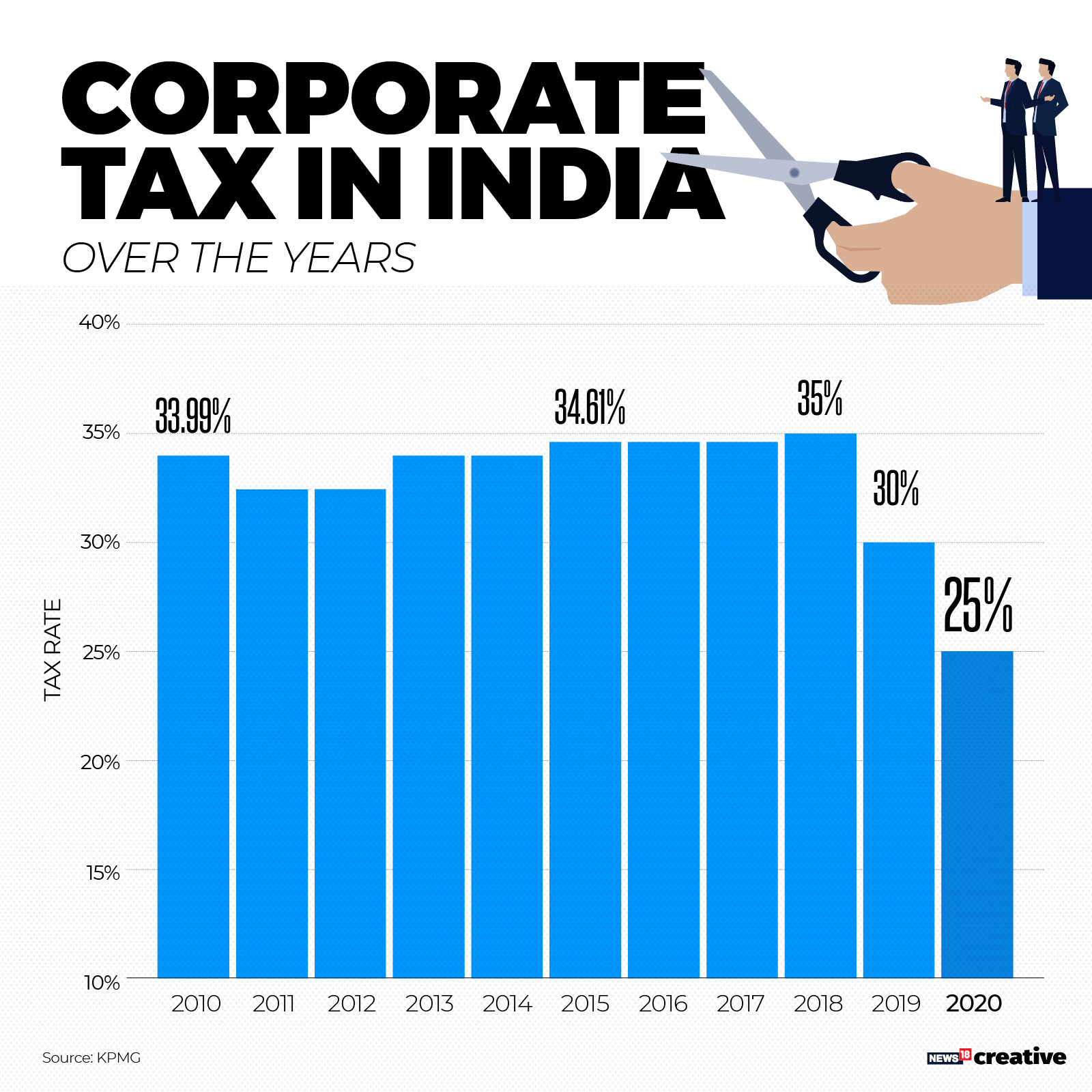

In the Indian context, options trading activities fall under the purview of “speculative income” and are thus subject to a flat 30% tax without the benefit of any indexation or set-off against losses. This tax liability extends to all options contracts, including shares, indices, and currencies, regardless of their underlying asset. It is crucial to note that this tax is applicable at the time of execution of the contract, irrespective of any future gains or losses realized.

Exemptions and Concessions

While the general tax rate for options trading remains at 30%, there exist certain exemptions and concessions that offer relief to specific entities:

-

Agricultural Producers: Agricultural producers are exempt from paying tax on options trading income derived from agricultural commodities, provided their primary source of income is farming activities.

-

Individuals with Turnover Below Specified Threshold: Individuals whose turnover from options trading does not exceed the notified threshold of Rs. 10 lakhs in a financial year are exempt from paying tax on such income.

Taxation of Premiums and Exercise Profits

When an options contract is executed, the premium paid by the buyer is considered as speculative income and taxed at 30%. Conversely, for the seller of the contract, the premium received constitutes taxable income and is subject to the same tax rate. Additionally, if the option is exercised, any profit realized from the transaction (known as exercise profit) is also taxed at 30%.

Image: www.forbesindia.com

Filing Income Tax Returns

All entities engaged in options trading are required to file their income tax returns. In the case of individuals and HUFs, the income from options trading should be declared under the head of “Income from Other Sources.” For corporates, it falls under the category of “Income from Business or Profession.” Accurate and timely filing is crucial to avoid penalties and ensure compliance with tax regulations.

Tax Planning Strategies

While it is imperative to comply with tax obligations, there are several strategies that can be employed to minimize the tax burden on options trading income:

-

Intraday Trading: Engaging in intraday trading, where positions are squared off within the same day, can help avoid the 30% tax liability.

-

Options Spreading: Using options spreading techniques, where multiple options contracts are traded simultaneously, can reduce the overall tax impact.

-

Hedging: Incorporating hedging strategies to mitigate risks can potentially offset potential losses and reduce taxable income.

-

Tax Loss Harvesting: Selling loss-making positions before they expire can offset gains, resulting in lower tax liability.

Tax On Options Trading In India

Conclusion

Navigating the tax landscape of options trading in India requires a clear understanding of the applicable regulations and a grasp of the various exemptions and concessions available. By following the guidelines outlined in this comprehensive guide, individuals and entities can stay compliant with their tax obligations while minimizing their tax burden. Remember, knowledge is the key to unlocking the full potential of options trading while ensuring financial prudence and maximizing returns.