The world of options trading is an intriguing dance between risk and reward, where the ability to accurately calculate profit is crucial for success. My initial foray into this realm was fraught with uncertainty, but I soon realized the importance of grasping the complexities of profit calculation.

Image: www.youtube.com

To that end, I embarked on a journey of learning, delving into the depths of options theory and trading strategies. Now, I share my insights with you to empower you with the knowledge you need to master the art of options trading profit.

What is Options Trading Profit?

Options trading profit is the sum of all successful gains made from buying and selling options contracts. It represents the net income earned after deducting the cost of the contracts and any commissions or fees.

Types of Options Trading Profit

There are two primary types of options trading profit:

1. Market Profit: Profit obtained by selling or exercising an option at a higher price than the purchase or premium paid.

2. Time Decay Profit: Profit earned from the decrease in the intrinsic value of an option as it approaches its expiration date.

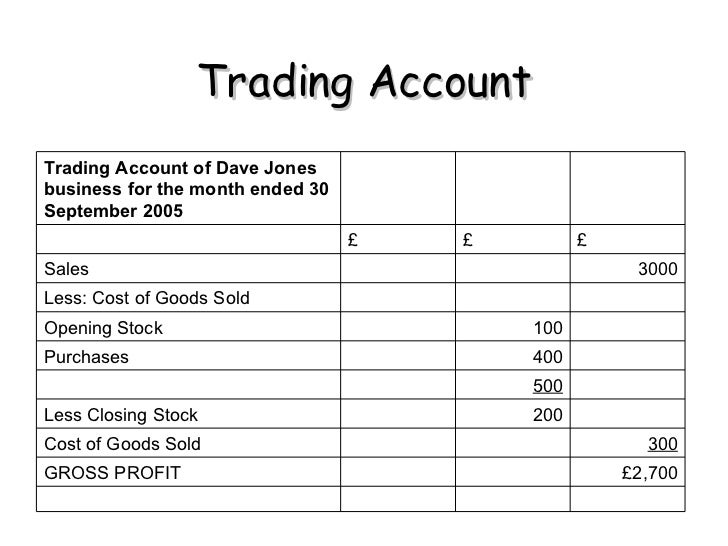

Calculating Options Trading Profit

Calculating options trading profit is a multi-faceted process that depends on the type of option, its strike price, and the underlying asset’s price. The following formula provides a general overview:

Options Trading Profit = (Selling Price – Purchase Price) – Commissions/Fees

Image: yzypohu.web.fc2.com

Examples of Profit Calculations

Example 1: Call Option

- Purchase Price: $2.50

- Selling Price: $3.50

- Commissions: $0.25

Options Trading Profit = ($3.50 – $2.50) – $0.25 = $0.75

Example 2: Put Option

- Purchase Price: $3.00

- Underlying Asset Price: $100 (exercised at $95)

- Commissions: $0.30

Options Trading Profit = ($95 – $100) + $3.00 – $0.30 = $2.70

Tips and Expert Advice for Maximizing Profit

1. Choose Liquid Options: Liquid options with high trading volume provide greater flexibility for entry and exit, reducing potential slippage and increasing profit opportunities.

2. Identify Trend Direction: Accurately assess the underlying asset’s trend to predict its future price and choose options that align with your predicted direction.

3. Manage Risk: Employ risk management strategies such as position sizing, stop-loss orders, and margin risk management to mitigate potential losses.

4. Seek Professional Guidance: Consider seeking guidance from experienced options traders or financial advisors to leverage their expertise and enhance your trading decisions.

FAQs on Options Trading Profit

Q: What factors influence options trading profit?

A: The option’s type, strike price, underlying asset’s price, market volatility, and time to expiration are key factors.

Q: How can I improve my options trading profit?

A: By implementing the tips and expert advice discussed earlier, including choosing liquid options, identifying trend direction, managing risk effectively, and seeking professional guidance.

How To Calculate Options Trading Profit

Image: www.youtube.com

Conclusion

Understanding options trading profit is vital for success in this exciting and potentially lucrative arena. Through a comprehensive understanding of profit calculation, types, and effective strategies, you can embark on your options trading journey with confidence. By embracing continuous learning, implementing best practices, and seeking expert advice when needed, you can harness the power of options trading to achieve your financial goals.

Are you ready to unlock the secrets of options trading profit? Sharpen your trading skills today and experience the transformative power of knowledgeable investing.