The allure of wealth and financial freedom has captivated the hearts of countless individuals. In today’s rapidly evolving financial landscape, options trading has emerged as a potent catalyst for unlocking these aspirations. This article delves into the intricate world of options trading, empowering you with the knowledge and strategies to embark on a path of financial prosperity.

Image: bullishbears.com

Options trading, in essence, is a form of contract that grants you the right, not the obligation, to buy or sell an underlying asset, such as stocks or commodities, at a predetermined price and within a specified time frame. Unlike traditional stock trading, where you directly own the underlying asset, options trading involves speculating on its price movements.

By understanding the fundamentals of options trading, such as types of options, market dynamics, and trading strategies, you can harness its potential for generating significant financial returns. Options offer distinct advantages over traditional stock trading, notably their flexibility and leverage potential, allowing you to amplify your gains with relatively modest capital.

Just as in any endeavor, venturing into options trading requires a judicious approach and a firm understanding of the associated risks and rewards. This article aims to equip you with a comprehensive understanding of options trading, empowering you to make informed decisions and mitigate potential pitfalls.

Navigating the Options Market: A Comprehensive Guide

The options market is a dynamic and multifaceted realm. To navigate its complexities successfully, a thorough understanding of its foundational concepts is essential.

Types of Options: Call vs. Put

Options contracts fall into two primary categories: call options and put options:

- Call Options: Confer the right to buy an underlying asset at a pre-determined price (known as the strike price) on or before a specific date (known as the expiration date).

- Put Options: Grant the right to sell an underlying asset at the strike price on or before the expiration date.

Market Dynamics: Understanding Volatility and Liquidity

The options market is heavily influenced by market dynamics, particularly volatility and liquidity.

- Volatility: Measures the rate of change in the underlying asset’s price. Higher volatility increases the value of options contracts.

- Liquidity: Refers to the ease with which options contracts can be bought or sold. High liquidity ensures efficient trading and minimizes execution risk.

Image: www.gotradingasia.com

Trading Strategies: A Toolkit for Success

Successful options trading involves implementing a diverse array of strategies, each catering to different market conditions and investor objectives.

- Covered Call: Involves selling a call option when you own the underlying asset. This strategy generates income but limits your upside potential.

- Cash-Secured Put: Selling a put option while holding cash to cover the potential obligation to buy the underlying asset. This strategy earns income but requires a higher capital outlay.

- Iron Condor: A combination of four options contracts (two call options, two put options) that seeks to profit from low volatility.

- Straddle: Buying both a call and a put option with the same strike price and expiration date. This strategy benefits from high volatility but can be capital-intensive.

Expert Insights: Tapping into the Wisdom of Masters

To excel in the arena of options trading, seeking guidance from seasoned experts is paramount. Here are valuable insights from industry leaders:

- “Options trading is not a get-rich-quick scheme. It requires hard work, discipline, and a deep understanding of market dynamics.” – Warren Buffett, renowned investor and CEO of Berkshire Hathaway.

- “Successful options trading involves managing risk and understanding your risk tolerance.” – Mark Sebastian, options trading educator and author.

- “Options provide unlimited potential for return, but also carry significant risk. Traders must respect the power of options and trade responsibly.” – Dan Passarelli, options trading strategist and author.

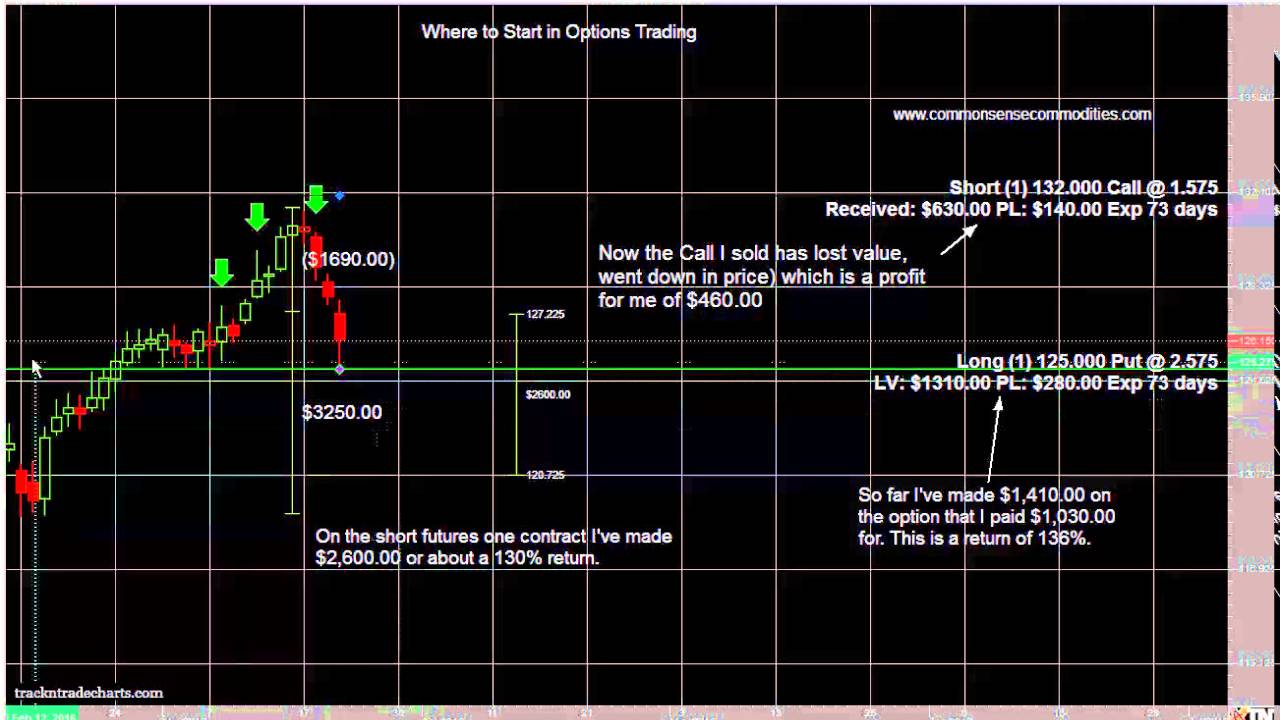

How To Be Rich Trading Options

Image: www.youtube.com

Embracing the Path to Financial Empowerment

Options trading offers a transformative pathway to financial wealth creation. By embracing its principles, implementing sound strategies, and continually seeking knowledge, you can unlock the potential for substantial financial gains. Remember, the journey to riches through options trading requires patience, discipline, and a unwavering commitment to mastering the intricacies of this remarkable market.