Natural gas, the fuel that powers our homes and industries, presents a dynamic realm where savvy traders can leverage the volatility of its price movements through the strategic use of gas options. This comprehensive guide will delve into the intricate world of gas options trading, empowering you with the knowledge and insights to navigate this complex market with confidence.

Embarking on the Gas Options Journey

Gas options, essentially contracts that grant the holder the right but not the obligation to buy or sell a specified amount of natural gas at a predetermined price on or before a certain date, offer a flexible and powerful tool for managing risk and potentially profiting from price fluctuations in the natural gas market.

Image: www.youtube.com

Understanding the Building Blocks

To master the art of gas options trading, a solid understanding of its foundational concepts is paramount. Futures contracts, the underlying assets traded in options markets, represent standardized agreements to buy or sell a specific quantity of natural gas at a set price on a predetermined future date. Options, on the other hand, provide the option but not the obligation to exercise the contract.

The price of an option contract, known as its premium, is influenced by various factors, including the underlying futures price, time to expiration, market volatility, and interest rates. By carefully considering these variables, traders can make informed decisions about buying or selling options.

Exploring Trading Strategies

Gas options trading offers traders a vast array of strategies designed to meet specific risk profiles and profit objectives. From hedging strategies to speculative gambits, traders can tailor their approach to align with their market outlook.

Covered calls involve selling an option contract while already owning the underlying futures position, generating income from the premium but limiting potential upside. Put options, on the other hand, allow traders to sell or buy the right to sell gas at a set price, safeguarding against potential price declines. Spreads, a more advanced strategy, combine multiple options contracts to create unique positions with specific risk and return profiles.

Seeking Expert Guidance

Navigating the complexities of gas options trading requires access to reliable and up-to-date information. Collaborating with experienced traders, financial advisors, and reputable brokers can provide valuable insights and guidance.

Investment platforms and online resources offer educational materials, market analysis, and real-time data to help traders make informed decisions. Staying abreast of industry news, economic developments, and geopolitical events that may impact gas prices is also crucial.

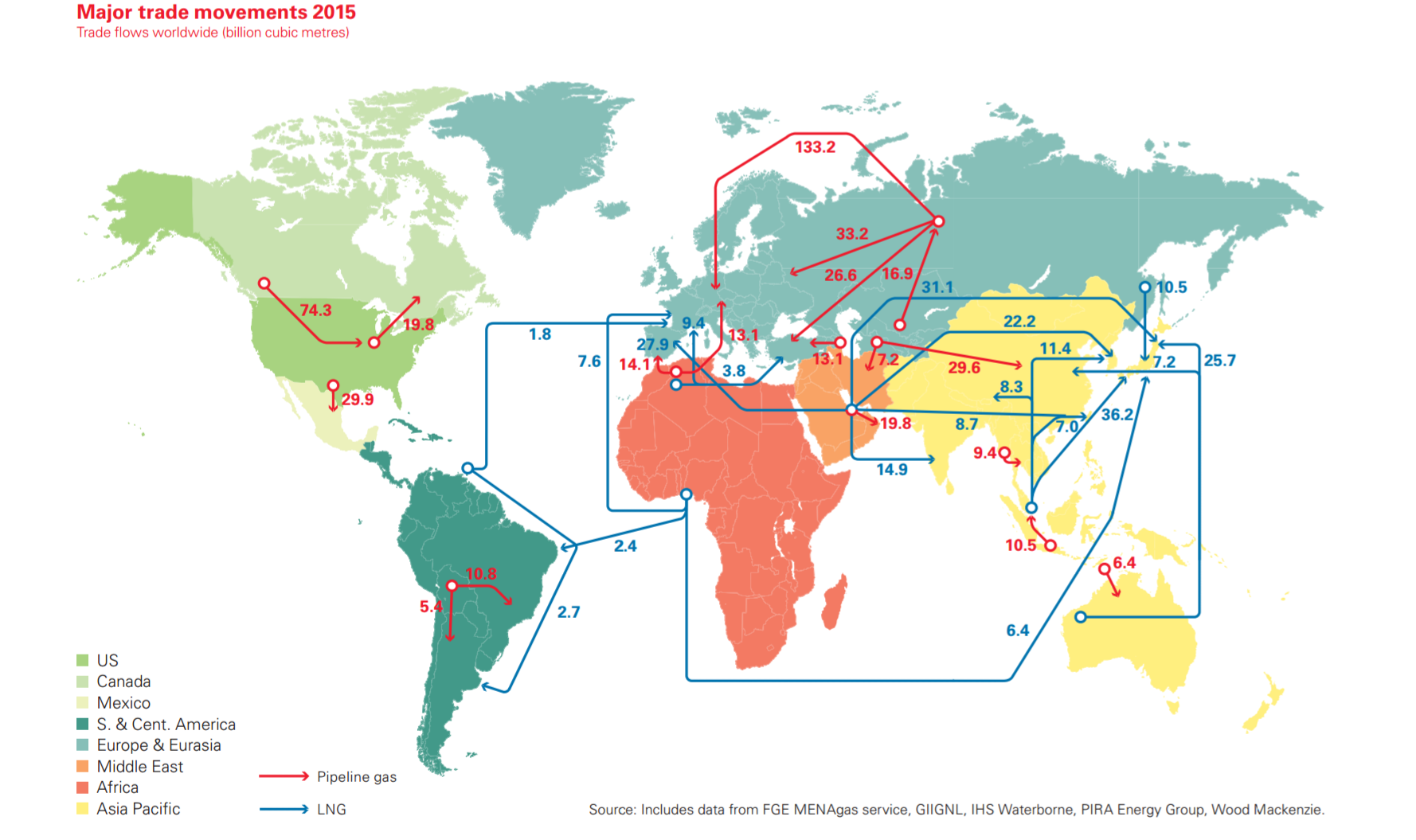

Image: seekingalpha.com

Gas Options Trading

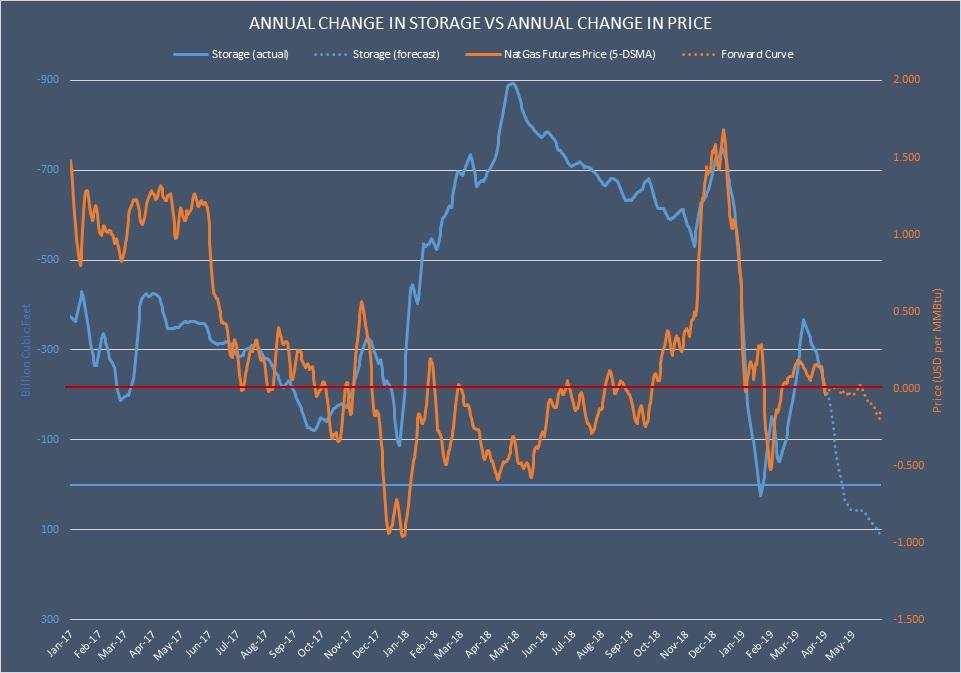

Image: thesoundingline.com

Conclusion

Gas options trading presents a captivating realm where traders can manage risk, capitalize on market opportunities, and potentially enhance their financial portfolio. By grasping the foundational concepts, analyzing the market, and seeking expert guidance, aspiring gas options traders can equip themselves with the knowledge and skills to navigate this dynamic market with confidence. Remember, thorough research, prudent decision-making, and a disciplined approach are key ingredients for successful gas options trading.