In the labyrinth of financial markets, where risk and reward dance precariously, there exists a realm of intense activity known as high-volume option trading. This dynamic arena commands the attention of seasoned traders and investors alike, captivating them with its potential for substantial gains and inherent volatility.

Image: www.publicfinanceinternational.org

Understanding the Essence of High Volume Option Trading

At its core, option trading involves the purchase or sale of contracts between two parties, providing the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. High volume option trading, as the name suggests, entails trading a substantial number of these contracts in a single trading session or over a short period.

This amplified trading activity is often driven by institutional investors, hedge funds, and sophisticated traders seeking to capitalize on market inefficiencies or hedge against potential risks. The sheer volume involved can significantly impact market dynamics, influencing option prices and creating opportunities for profit-seeking traders.

Strategic Approaches in High Volume Option Trading

Navigating the waters of high volume option trading requires a strategic mindset and a comprehensive understanding of the forces at play. Seasoned traders employ various techniques to gain an edge in this competitive environment:

- Market Making: Market makers act as intermediaries, matching buy and sell orders and facilitating liquidity in the options market. They constantly quote prices for both sides of the option contract, capitalizing on the bid-ask spread.

- Arbitrage Trading: This strategy involves identifying and exploiting price discrepancies between different option contracts or between options and the underlying asset. Arbitrageurs seek to profit from these inefficiencies by simultaneously executing offsetting trades.

- Hedging Strategies: Many high volume option traders use options as hedging instruments to protect against potential losses in other investments or to manage risk in complex trading portfolios. For instance, hedging can involve employing options to counterbalance the movements of an underlying asset.

Advantages and Considerations in High Volume Option Trading

Engaging in high volume option trading presents several potential advantages:

- Increased Liquidity: The high trading volume associated with this domain provides increased liquidity, making it easier to execute trades quickly and efficiently.

- Volatility Exploits: The inherent volatility often associated with high volume option trading can provide opportunities for nimble traders to profit from price fluctuations.

- Income Generation: Selling options premiums can generate income for traders, particularly in markets with high implied volatility.

However, it is crucial to note that high volume option trading also carries significant risks that traders must carefully evaluate:

- Complexity: The high level of complexity in high volume option trading requires traders to have a thorough understanding of option contract dynamics, including the interplay of different variables.

- Volatility Risk: The very nature of high volume option trading exposes participants to heightened volatility, which can amplify both potential gains and losses.

- Margin Requirements: Trading options typically involves the use of margin, which can magnify both profits and potential losses, making risk management paramount.

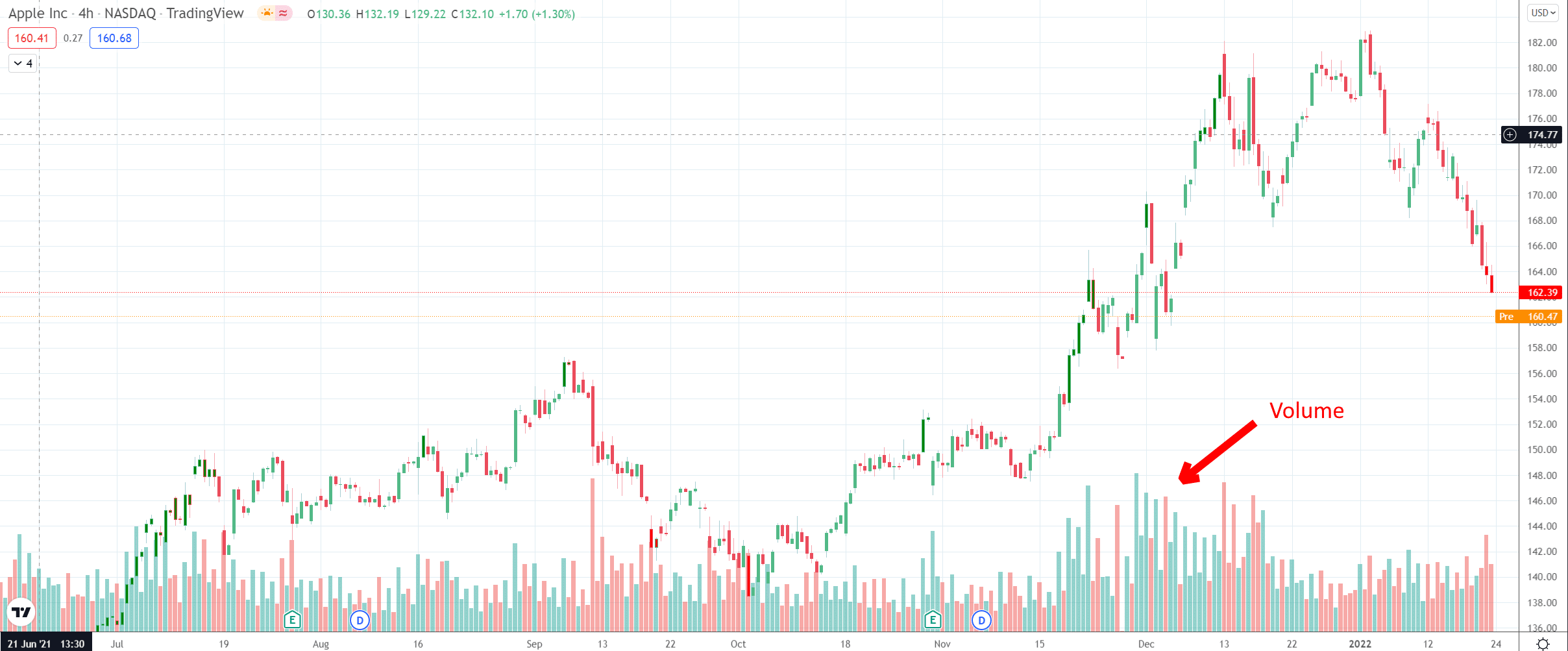

Image: fintrakk.com

High Volume Option Trading Means What

Image: www.indiacharts.com

Conclusion

High volume option trading is a fascinating and potentially lucrative facet of financial markets, but it demands a deep understanding of options strategies, market dynamics, and risk management techniques. By embracing these complexities, traders can navigate this arena effectively, unlocking the potential for substantial returns while mitigating risks.

As in any endeavor, knowledge is power. For those seeking to venture into the electrifying world of high volume option trading, meticulous research, continuous learning, and a disciplined approach are indispensable tools. With proper preparation and a prudent mindset, traders can harness the opportunities and navigate the challenges inherent to this dynamic and rewarding domain.