As a seasoned stock market enthusiast, I’ve always been fascinated by the enigmatic world of options trading. The allure of leveraging potential price movements and potentially reaping significant returns has captivated my curiosity. Among the vast array of options available, the SPY option holds a special place due to its inherent connection to the S&P 500 index, making it a fascinating instrument for traders.

Image: aeromir.com

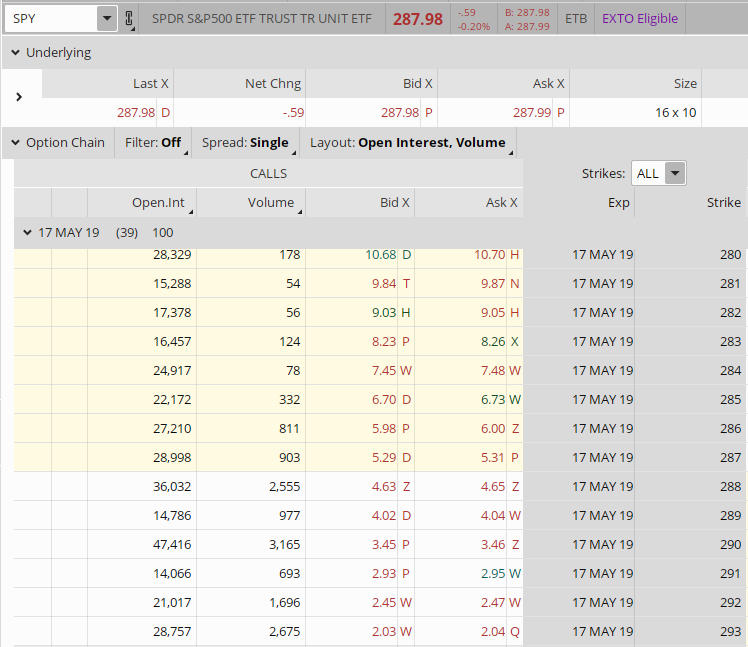

My trading journey has been characterized by relentless research and an insatiable desire to unravel the complexities of options trading. I’ve found that delving into the intricacies of SPY option volume can provide traders with valuable insights into market sentiment and potential trading opportunities.

Volume Speaks Louder Than Words: Unraveling the Significance of SPY Option Volume

Trading volume, in its essence, measures the total number of contracts that have been bought and sold within a specified timeframe. When it comes to SPY options, volume plays a particularly crucial role in deciphering market dynamics and prevailing investor sentiment.

High volume indicates a substantial number of transactions, implying increased participation from traders. This could signify a growing interest in the underlying asset, either due to escalating market activity or specific news events. Conversely, low volume suggests a lack of participation and interest, potentially indicating a market处于观望状态.

SPY Option Volume: An Indicator of Volatility and Market Trends

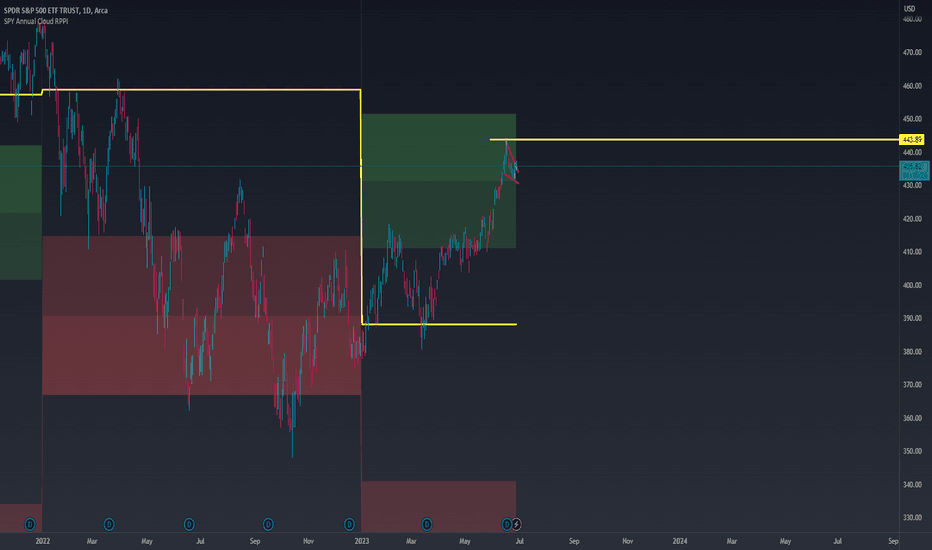

By examining SPY option volume, traders can gauge the level of volatility in the market. Elevated volume often coincides with periods of market turbulence, while subdued volume typically indicates a more stable environment.

Furthermore, volume can provide insights into market trends. For instance, a surge in volume during an uptrend suggests a continuation of the bullish sentiment, while a decline in volume during a downtrend may imply a potential trend reversal.

Expert Advice and Tips for Navigating SPY Option Trading Volume

To harness the power of SPY option volume effectively, it’s essential to incorporate expert advice and proven tips into your trading strategy.

Seasoned traders recommend paying close attention to volume changes in conjunction with other technical indicators such as price action, moving averages, and support and resistance levels. This holistic approach can enhance your ability to identify potential trading opportunities and make more informed decisions.

Image: www.netpicksetfinvestor.com

Frequently Asked Questions (FAQs) on SPY Option Trading Volume

To address some common queries regarding SPY option trading volume, here’s a concise FAQ section:

Q: How do I interpret high SPY option volume?

A: High volume may indicate increased participation, market activity, or heightened volatility.

Q: What does low SPY option volume suggest?

A: Low volume can imply a lack of participation, market stability, or a period of consolidation.

Q: How can volume help me identify trading opportunities?

A: Volume changes can provide insights into market sentiment and potential trend reversals, guiding you towards potential trading opportunities.

Spy Option Trading Volume

Image: myforexglobal.com

Conclusion: Embracing Volume as a Guiding Light in SPY Option Trading

SPY option trading volume stands as an indispensable tool for traders seeking to decipher market dynamics and formulate informed trading decisions. By incorporating volume analysis into your trading strategy, you can gain a deeper understanding of the market’s pulse and increase your chances of successful trades.

Whether you’re a seasoned trader or just embarking on your trading journey, I invite you to delve deeper into the world of SPY option volume. Embrace its insights and harness its power to navigate the often-choppy waters of the financial markets. Are you ready to unlock the secrets of SPY option trading volume and elevate your trading game?