Introduction: Unveiling the World of KuCoin Options Trading

In the fast-paced world of cryptocurrencies, options trading has emerged as a powerful tool for traders seeking to enhance their portfolio’s potential returns while mitigating risks. Among the numerous exchanges offering options trading, KuCoin stands out as a trusted and popular choice. This article aims to delve into the intricacies of KuCoin options trading, empowering you with the knowledge and understanding necessary to navigate this dynamic market effectively.

Image: www.bitcoinsensus.com

Understanding KuCoin Options: A Foundation for Profitable Trading

An option contract represents a financial agreement that grants the buyer (holder) the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as Bitcoin or Ethereum, at a predetermined price (strike price) on or before a specified date (expiration date). At the core of options trading lies the interplay between two key factors: premium and volatility. Premium refers to the price paid by the option buyer to acquire the option contract, while volatility measures the fluctuations in the underlying asset’s price.

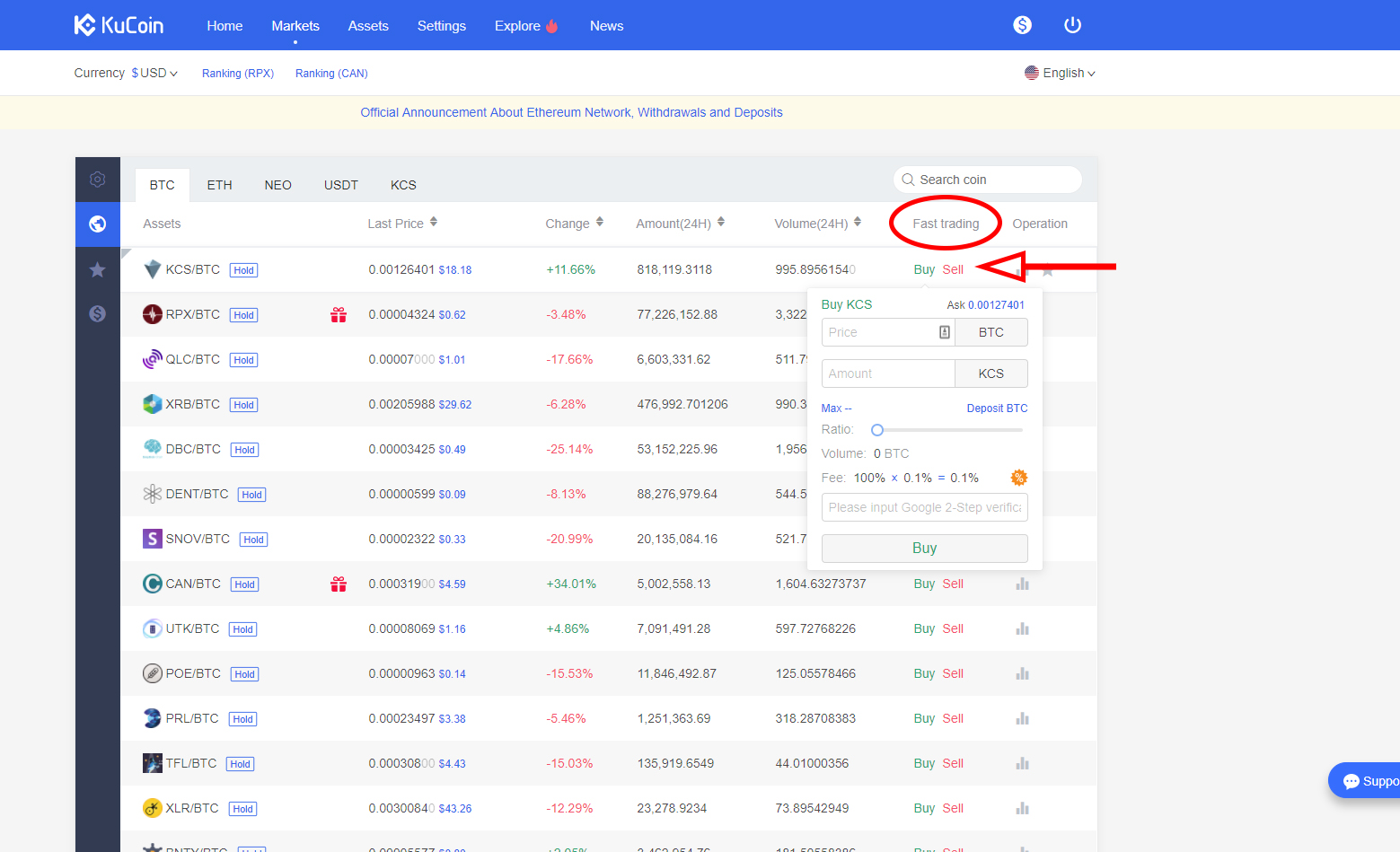

KuCoin’s Options Trading Interface: A User-Friendly Gateway

KuCoin’s options trading interface is designed with both beginner and experienced traders in mind. Upon accessing the options trading section, you’ll be presented with a user-friendly interface that displays a comprehensive overview of the available options contracts, including their respective strike prices, expiration dates, and implied volatility. The platform’s intuitive layout allows you to effortlessly place buy or sell orders for any desired option contract.

Understanding Option Greeks: Master the Dynamics of Options

When trading options, mastering the concept of Greeks becomes essential. Greeks are quantifiable measures that provide valuable insights into the risk and reward profile of an option contract. KuCoin seamlessly integrates Greeks into its options trading interface, providing traders with real-time and dynamic data. This enables you to analyze various aspects of an option contract, including its sensitivity to changes in the underlying asset’s price, time decay, and implied volatility.

Image: coindoo.com

Advanced Strategies for Enhancing Profitability

KuCoin empowers traders with a comprehensive suite of advanced trading strategies, catering to varying risk appetites and investment objectives. Spread trading, a popular strategy in options trading, involves simultaneously entering into multiple option contracts with different strike prices or expiration dates. This strategy can help reduce risk and generate income in various market conditions, making it an attractive option for both conservative and aggressive traders.

Kucoin Option Trading

Image: cryptocurrencyhaus.com

Conclusion: Embarking on a Rewarding Journey with KuCoin Options Trading

KuCoin options trading offers a compelling opportunity for traders to unlock new levels of profitability and diversification in the cryptocurrency market. By delving into the intricacies of option contracts and leveraging KuCoin’s user-friendly trading interface and advanced trading tools, you can harness the power of options to enhance your portfolio’s performance and navigate the dynamic cryptocurrency market with confidence and precision.