Introduction

For individuals seeking to diversify their retirement portfolios and capitalize on market opportunities, exploring futures options trading within IRA accounts presents an intriguing avenue. This strategy, however, requires a thorough understanding of the intricate world of futures options and the specific regulations governing their utilization within retirement accounts. In this article, we will delve into the nuances of futures options trading in IRA accounts, empowering investors with the knowledge and insights necessary to make informed decisions.

Image: tradewiththepros.com

Futures options, a formidable financial instrument, provide investors with the flexibility to speculate on the future direction of various underlying assets, including commodities, indices, and currencies. By harnessing the potential of leverage, futures options enable investors to magnify their returns while simultaneously exposing themselves to amplified risks. The incorporation of futures options within IRA accounts necessitates careful consideration of the intricate regulatory landscape and the implications for tax treatment.

Understanding Futures Options Trading

Futures options contracts bestow upon the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified future date. Unlike futures contracts, which bind the holder to fulfill the purchase or sale of the asset, options provide the flexibility to exercise the right or let it expire worthless. This flexibility, however, comes at a cost, as options contracts have a limited lifespan and require the payment of a premium upfront.

The allure of futures options stems from their versatility, offering investors the potential to capitalize on various market scenarios. For instance, an investor anticipating a bullish trend in the S&P 500 index may purchase a call option, granting them the right to buy the index at a predetermined price in the future. Conversely, an investor expecting a bearish trend could acquire a put option, conferring the right to sell the index at a specific price in the future.

Navigating the Regulatory Landscape

Trading futures options within IRA accounts presents a unique regulatory landscape that investors must navigate. The Internal Revenue Code (IRC) imposes specific rules and restrictions governing the utilization of these instruments within retirement accounts. Notably, futures options trading is permissible only within self-directed IRAs, which afford investors greater control over their investment decisions.

Furthermore, the IRC mandates that all profits and losses realized from futures options trading be recognized as ordinary income within the IRA, potentially resulting in higher tax liability upon withdrawal. This tax treatment contrasts with long-term capital gains, which enjoy favorable tax rates when held for a minimum of one year.

Tax Implications of Futures Options Trading

The tax implications of futures options trading within IRAs depend on the account type and the holding period of the contract. Contributions made to traditional IRAs are tax-deductible, but withdrawals are subject to ordinary income tax. Conversely, Roth IRAs offer tax-free withdrawals, provided certain eligibility requirements are met. However, early withdrawals from Roth IRAs may incur penalties and taxes.

With regard to holding periods, short-term futures options contracts, held for less than one year, are taxed as ordinary income upon expiration or exercise. Long-term futures options contracts, held for more than one year, may qualify for preferential long-term capital gains tax rates. It is crucial to consult with a qualified tax professional to determine the specific tax implications of futures options trading within IRAs.

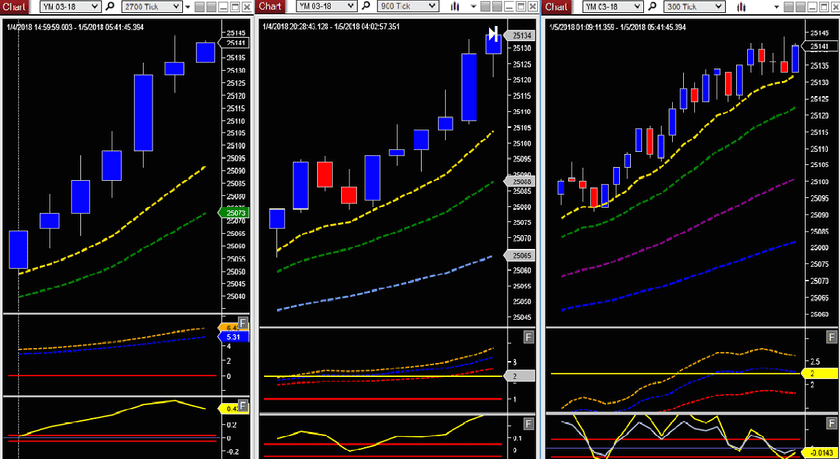

Image: tastytrade.com

Strategies for Futures Options Trading in IRAs

Investors contemplating futures options trading within IRAs should meticulously consider their investment objectives, risk tolerance, and time horizon. A prudent approach involves implementing well-defined strategies that align with their individual circumstances. Some commonly employed strategies include:

- Bull/Bear Spread: Involves simultaneously purchasing a call and selling a put option with different strike prices and expiration dates, enabling investors to profit from a neutral or mildly directional price movement.

- Collar: Combines selling a call option with buying a put option, establishing a defined range within which the underlying asset can fluctuate while limiting potential losses and maximizing gains.

- Protective Put: Involves purchasing a put option to hedge against potential downside risk in an underlying asset, providing downside protection without preventing further upside gains.

The Role of Robo-Advisors

For investors seeking a more hands-off approach to futures options trading, robo-advisors present a potential solution. These automated investment platforms incorporate algorithms to manage portfolios based on individual investor profiles. Some robo-advisors may offer options trading strategies within IRA accounts, enabling investors to access the benefits of futures options without the need for extensive research and trading expertise.

Futures Options Trading In Ira Accounts

Image: www.marketincometrader.com

Conclusion

Futures options trading in IRA accounts can be a powerful tool for sophisticated investors seeking to expand their retirement portfolios and capitalize on market opportunities. However, it is imperative to approach this strategy with caution, fully comprehending the inherent risks and regulatory constraints. By conducting thorough research, consulting with qualified professionals, and implementing well-defined investment strategies, investors can harness the potential of futures options within their IRAs while minimizing associated risks.