Are you ready to unlock the potential of futures options trading within your Individual Retirement Account (IRA)? Look no further than Tastyworks, the innovative trading platform that empowers you to maximize your retirement savings with a wide range of investment opportunities, including futures options.

Image: www.carloscoelhoassociados.pt

Navigating Futures Options Trading with Tastyworks

Futures options present a unique opportunity to enhance your investment strategies. They offer the potential to hedge against risk, speculate on price movements, and generate income through premiums. Tastyworks provides a user-friendly interface, advanced trading tools, and educational resources to help you navigate the futures options market with confidence.

Eligibility and Account Types

Individuals with self-directed IRAs can open a futures options trading account with Tastyworks. Traditional IRAs and Roth IRAs are both eligible for futures options trading. However, it’s crucial to note that contributions to futures options IRAs may be subject to income and age restrictions.

Trading Features and Margin Requirements

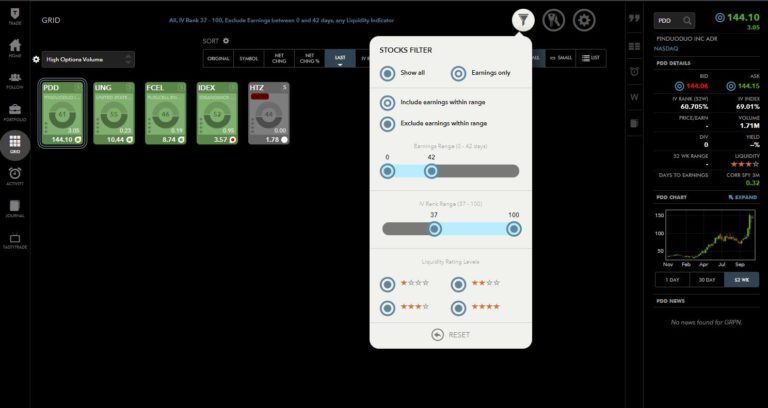

Tastyworks offers a comprehensive range of futures options contracts, including indices, commodities, currencies, and more. Traders benefit from competitive margin requirements and access to real-time market data. The platform’s customizable trading tools allow you to tailor your trading experience based on your specific preferences and risk tolerance.

Image: support.tastyworks.com

Unveiling the Latest Trends and Developments

The futures options market is constantly evolving, presenting both challenges and opportunities for traders. Staying abreast of the latest trends and developments is essential for informed decision-making. Tastyworks provides regular market updates, webinars, and educational webinars to keep traders up to speed on industry news and trading strategies.

Regulation and Compliance

Futures options trading in IRAs is subject to specific regulatory requirements. The Commodity Futures Trading Commission (CFTC) oversees futures trading, while the Internal Revenue Service (IRS) governs IRAs. Tastyworks adheres to all applicable regulations and provides traders with guidance on compliance matters.

Tips and Expert Advice for Futures Options Traders

To maximize your success in futures options trading, consider the following tips from expert traders:

- Understand the Basics: Before diving into futures options trading, it’s crucial to grasp the fundamental concepts and strategies.

- Start Small: Begin with small trade sizes until you gain confidence and experience in the futures options market.

- Manage Risk: Utilize stop-loss orders and other risk management techniques to protect your capital from potential losses.

- Monitor Market Trends: Stay informed about economic news and market events that may impact futures prices.

- Continuously Educate Yourself: Seek out educational resources, attend webinars, and keep abreast of industry developments to improve your trading knowledge.

FAQ on Futures Options Trading in IRAs

- Q: Can I hold futures options in my IRA?

A: Yes, self-directed IRAs can hold futures options contracts.

- Q: What are the tax implications of futures options trading in an IRA?

A: Earnings from futures options trading within an IRA are typically tax-deferred until withdrawn.

- Q: Are there any restrictions on the types of futures options I can trade in my IRA?

A: Eligible futures options contracts vary depending on the brokerage firm and your account type.

- Q: What are the margin requirements for futures options trading in an IRA?

A: Margin requirements vary based on the underlying futures contract and the brokerage firm.

- Q: Can I use leverage in futures options trading within my IRA?

A: Leverage is generally not permitted in IRAs due to regulatory restrictions.

- Q: Are there any other fees associated with futures options trading in an IRA?

A: Brokerage fees and exchange fees may apply to futures options trading.

Does Tastyworks Allow Futures Options Trading In Ira Account

Image: kagels-trading.com

Conclusion

Futures options trading in IRAs presents a compelling opportunity to diversify your retirement portfolio and potentially enhance your returns. Tastyworks offers an exceptional platform, expert guidance, and comprehensive educational resources to empower you on your futures options trading journey. Whether you’re a seasoned trader or just starting out, Tastyworks provides the tools and support to navigate the market with confidence.

Are you ready to explore the exciting world of futures options trading in your IRA? Visit Tastyworks today to open an account and unlock the potential of this powerful investment vehicle.