Introduction:

Step into the dynamic world of day trading options, where market volatility and calculated risks dance hand-in-hand. If you seek to harness the power of options trading and navigate its intricate landscape, tastyworks stands as a beacon of support. As we embark on this comprehensive guide, let’s unravel the secrets of day trading options with tastyworks and empower you to make informed decisions that can potentially yield lucrative returns.

Image: twitter.com

Navigating the World of tastyworks:

tastyworks, a leading brokerage platform, has carved a niche in the options trading arena. Its user-friendly interface and robust trading tools cater to both seasoned professionals and aspiring traders alike. Whether you’re a novice seeking guidance or an experienced trader yearning to hone your skills, tastyworks offers a comprehensive ecosystem to meet your needs.

Understanding Options Trading Fundamentals:

At the heart of day trading options lies a fundamental understanding of options contracts. These versatile financial instruments empower traders with the ability to speculate on the future price movements of underlying assets, such as stocks or indices. By understanding key concepts like calls, puts, premiums, and expiration dates, you can lay the foundation for effective trading strategies.

Mastering Day Trading Techniques:

Day trading options is an art form that requires discipline, strategy, and a keen eye for market patterns. Explore various day trading techniques, including scalping, news-based trading, and range trading. Each technique offers unique advantages and risks, suiting different trading styles and market conditions.

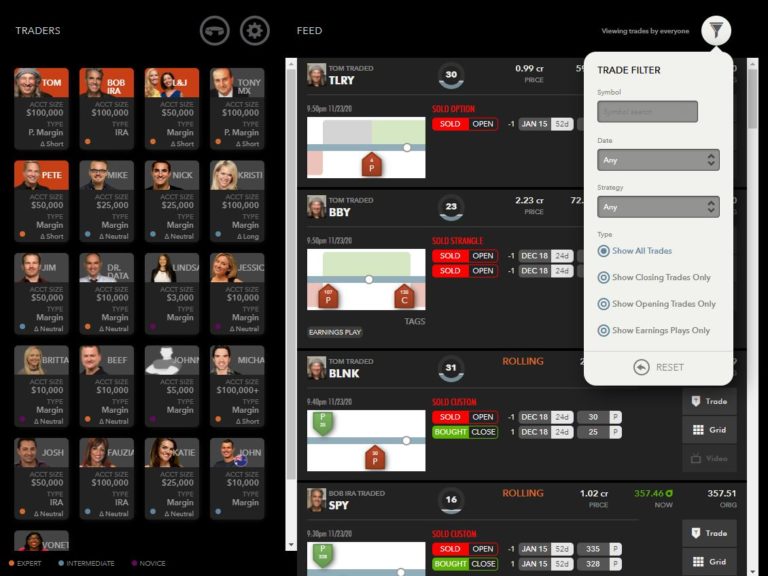

Image: www.youtube.com

Harnessing tastyworks Trading Tools:

tastyworks provides an array of innovative trading tools to empower traders. Leverage the power of thinkorswim, a comprehensive trading platform that offers advanced charting capabilities, real-time data, and customizable alerts. Unlock the insights hidden within tastytrade, a vast educational resource featuring webinars, live streams, and in-depth market analysis.

Risk Management and Trading Psychology:

In the high-stakes world of options trading, risk management is paramount. Embrace a disciplined approach to trading, setting clear risk parameters and adhering to them unwavering. Cultivate a healthy trading psychology, recognizing the emotional challenges that accompany market fluctuations.

Expert Insights:

Harness the wisdom of seasoned traders and market experts. Seek out trusted sources of information, such as tastyworks’ educational content and webinars. Engage with experienced traders in online forums or consider seeking mentorship from reputable professionals.

Actionable Tips for Success:

- Start small and gradually increase your trading size as you gain confidence.

- Utilize limit orders to manage risk and minimize slippage.

- Monitor open positions closely and adjust your strategies as market conditions evolve.

- Maintain a trading journal to track your performance and identify areas for improvement.

- Stay informed about market news and economic events that can impact option prices.

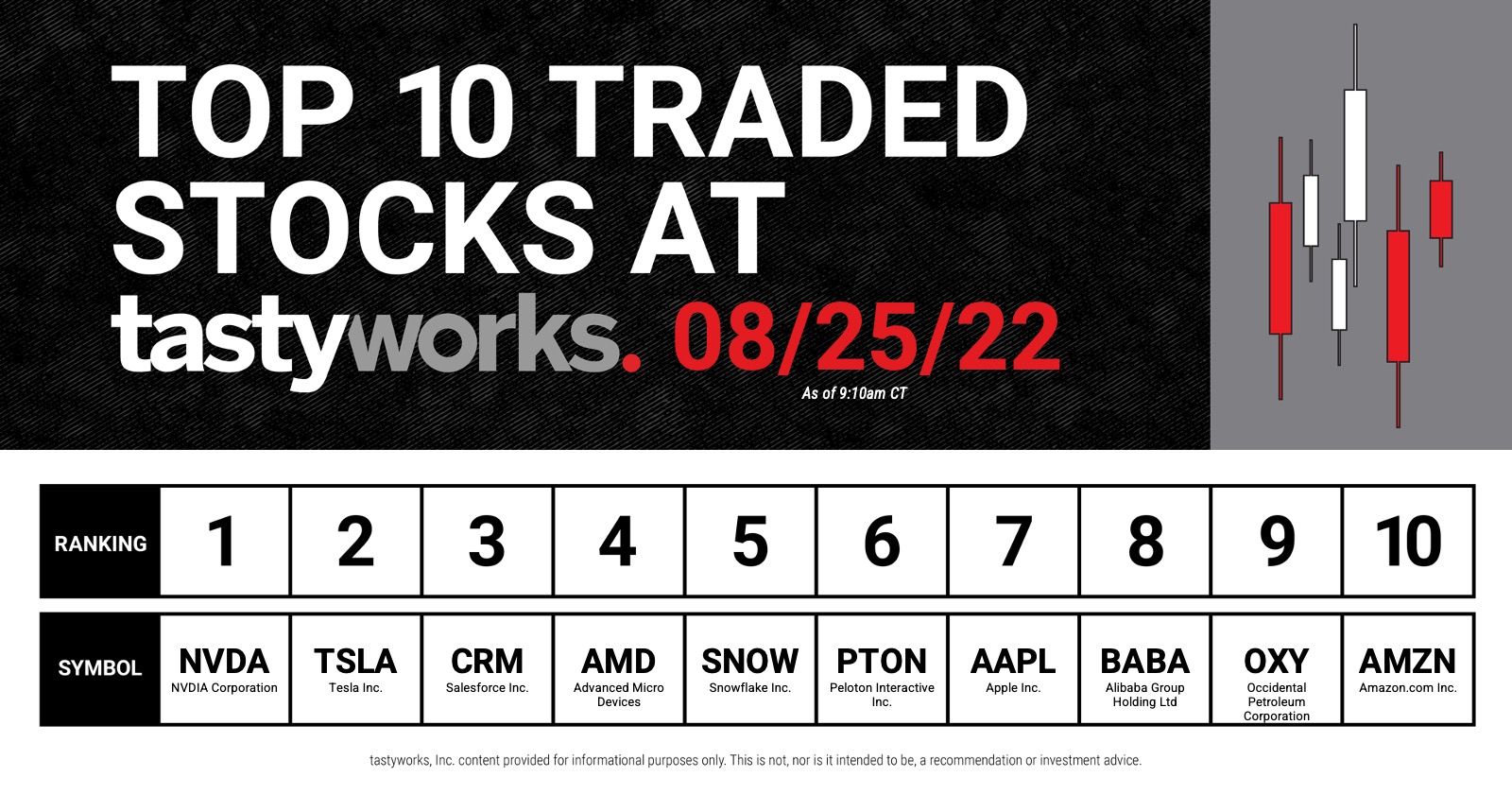

Tastyworks Day Trading Options

Image: kagels-trading.com

Conclusion:

Day trading options with tastyworks is a rewarding endeavor that can unlock the potential for substantial returns. By embracing the concepts outlined in this comprehensive guide, you’ll gain the knowledge, tools, and strategies necessary to navigate the market’s complexities. Remember to approach trading with discipline and a commitment to continuous learning, and you’ll be well-equipped to seize market opportunities and achieve your financial goals.