Introduction

Options trading is a complex and nuanced topic that can have a significant impact on stock prices. In this article, we’ll explore the basics of options trading and how it can affect the prices of stocks. We’ll also provide some tips and expert advice on how to navigate the options market.

Image: www.pinterest.com

What is Options Trading?

Options trading is a type of derivative contract that gives the buyer of the contract the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date. The buyer of an option pays a premium to the seller of the option in exchange for this right. There are two main types of options: calls and puts.

Calls give the buyer the right to buy an underlying asset at a specified price on or before a specified date. Puts give the buyer the right to sell an underlying asset at a specified price on or before a specified date.

How Options Trading Affects Stock Price

Options trading can affect stock prices in a number of ways. First, options trading can create demand for a stock. When there is a high level of demand for a stock, the price of the stock will typically increase. Second, options trading can create supply for a stock. When there is a high level of supply for a stock, the price of the stock will typically decrease.

In addition to creating demand and supply, options trading can also affect stock prices through the exercise of options. When an option is exercised, the buyer of the option has the right to buy or sell the underlying asset at a specified price. This can lead to a significant increase or decrease in the price of the stock, depending on whether the option is a call or a put.

Tips and Expert Advice

If you’re interested in trading options, there are a few things you should keep in mind. First, options trading is a complex and risky activity. You should only trade options if you have a good understanding of the risks involved. Second, you should always do your own research before trading options. Don’t rely on the advice of others, and make sure you understand the terms of the options contract before you buy or sell.

Here are a few tips from experts:

- Start by trading small. Don’t put all of your money into options trading at once.

- Don’t trade options on stocks that you don’t understand.

- Be patient. Options trading is not a get-rich-quick scheme. It takes time and effort to learn how to trade options successfully.

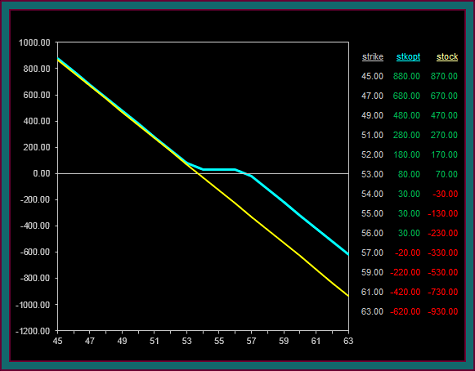

Image: derivfx.com

FAQ

Q: What is the difference between a call and a put option?

A: A call option gives the buyer the right to buy an underlying asset at a specified price on or before a specified date. A put option gives the buyer the right to sell an underlying asset at a specified price on or before a specified date.

Q: How can I learn more about options trading?

A: There are a number of resources available to help you learn more about options trading. You can read books, take courses, or attend seminars. You can also find a lot of information online.

Q: Is options trading a good way to make money?

A: Options trading can be a good way to make money, but it’s not without its risks. Before you start trading options, make sure you have a good understanding of the risks and how to trade options successfully.

How Does Options Trading Affect Stock Price

Image: tacticaltradingstrategies.com

Conclusion

Options trading is a complex and nuanced topic. However, by understanding the basics of options trading and how it can affect stock prices, you can make better decisions about whether or not to trade options. If you’re interested in learning more about options trading, there are a number of resources available to help you.

Would you like to learn more about options trading? If so, I encourage you to do some research and find out if it’s the right investment for you.