In the fast-paced world of finance, options trading offers a lucrative avenue for savvy investors to navigate market volatility and maximize profits. As a trader, it’s crucial to equip yourself with the right tools to optimize your trading strategies and stay ahead of the curve. Among these invaluable trading tools, Excel stands out with its unparalleled versatility and analytical prowess. This guide will delve into the realm of options trading tools in Excel, empowering you to harness the power of this spreadsheet software and become a master of the market.

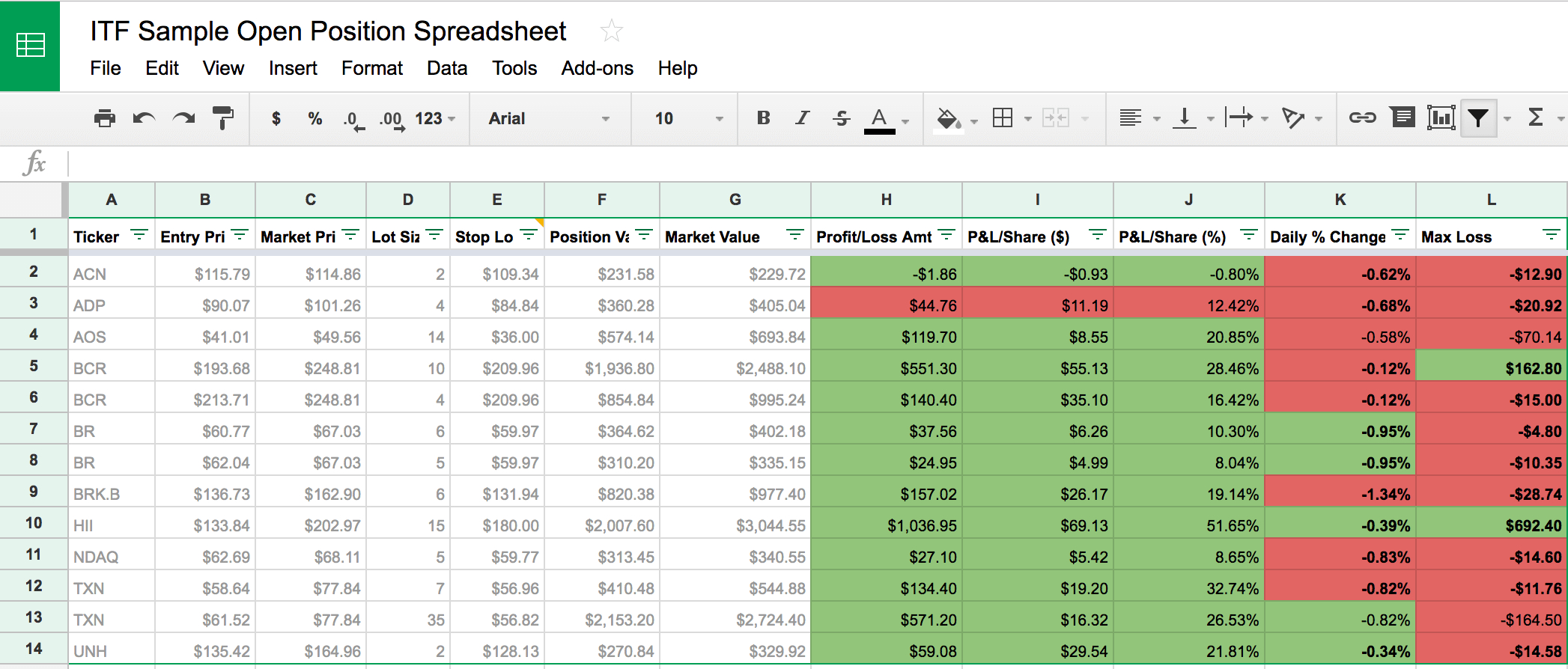

Image: db-excel.com

Options, as versatile financial instruments, provide traders with the right but not the obligation to buy or sell an underlying asset at a predetermined price on a specific date. Excel serves as an indispensable platform for seamless options trading, offering a comprehensive suite of tools tailored to meet traders’ diverse needs. Whether you’re a seasoned veteran or just starting your options trading journey, this article will provide you with actionable insights and expert advice to enhance your trading performance.

Tools of the Trade: Unveiling Excel’s Options Trading Toolkit

Excel offers a robust arsenal of options trading tools, each designed to empower traders with a deeper understanding of market dynamics and informed decision-making. Among these tools, the Black-Scholes model stands out as a cornerstone of options pricing, enabling traders to determine the fair value of an option contract based on critical factors such as the underlying asset’s price, volatility, time to expiration, and risk-free interest rate.

Beyond pricing, Excel also shines in scenario analysis, providing traders with the ability to simulate various market conditions and assess the potential outcomes of alternative trading strategies. This invaluable feature empowers traders to make well-informed decisions, minimizing risk and maximizing profit potential. Excel’s comprehensive charting capabilities offer a visual representation of market trends, empowering traders to spot patterns and identify trading opportunities that may not be apparent from numerical data alone.

Mastering the Art of Options Trading with Expert Tips

In the competitive arena of options trading, every edge counts. By incorporating these expert tips into your trading strategy, you can level up your skills and increase your chances of success:

**1. Define Your Trading Goals:** As the adage goes, “If you fail to plan, you plan to fail.” Before venturing into the options market, take the time to clearly define your trading goals, whether it’s generating income, hedging risk, or pursuing speculative profits. A well-defined trading plan will serve as a roadmap, guiding your decisions and preventing emotional impulses from clouding your judgment.

**2. Education is Paramount:** Options trading is a complex and ever-evolving field, and continuous education is vital for staying ahead of the curve. Immerse yourself in books, articles, and online courses to deepen your understanding of options trading strategies, risk management techniques, and market dynamics. Knowledge is the key to unlocking your full potential in this dynamic and rewarding arena.

FAQs to Clarify the Complexities of Options Trading

Q: What are the key differences between call options and put options?

A: Call options grant the buyer the right to buy an underlying asset at a predetermined price, while put options give the buyer the right to sell an underlying asset at a predetermined price. Call options are generally used when traders expect the underlying asset’s price to rise, while put options are used when traders expect the underlying asset’s price to fall.

Q: How do I calculate the profit or loss on an options trade?

A: The profit or loss on an options trade is determined by the difference between the option’s premium (price paid to acquire the option) and the intrinsic value (difference between the underlying asset’s current price and the option’s strike price) at the time of expiration or exercise.

Image: www.pinterest.com

Options Trading Tools Excel

Image: db-excel.com

Conclusion: Embrace the Power of Excel and Excel in Options Trading

Embracing the transformative power of Excel in options trading will propel you to greater heights of success in the financial markets. By leveraging the tools and techniques outlined in this guide, you can unlock a world of opportunities, make informed decisions, and secure your place among the elite traders who consistently outperform the market. Are you ready to unleash your trading potential with Excel? If so, join the ranks of savvy traders and unlock the boundless possibilities of options trading today!