Introduction

Delve into the captivating world of financial trading where opportunities dance in the intricate symphony of futures and options. These potent instruments empower investors with the leverage to amplify profits and mitigate risks. Imagine discovering a hidden treasure trove where informed strategies unlock the path to financial empowerment. In this comprehensive guide, we will embark on a journey to unveil the secrets of futures and options trading strategies, equipping you with the knowledge and insights to navigate the ever-evolving markets.

Image: tradingtuitions.com

Understanding Futures and Options

Futures contracts are agreements to buy or sell a particular asset on a predetermined date at a fixed price. On the other hand, options grant the buyer the right, but not the obligation, to buy or sell an asset at a specific price within a certain timeframe. Understanding the nature of these instruments is paramount to effectively execute trading strategies.

Futures contracts are typically used to hedge against price fluctuations or speculate on future price movements. They allow investors to lock in prices today for transactions in the future, reducing the risk of adverse price changes. Options, on the other hand, offer flexibility in trading strategies. They allow investors to capitalize on price movements while limiting their potential losses. By purchasing an option, investors gain the right to exercise the option if the underlying asset meets the predetermined conditions.

Effective Trading Strategies

Mastering futures and options trading requires a comprehensive understanding of effective strategies tailored to specific market conditions. Here’s a glimpse into some widely employed strategies:

1. Spread Trading

Spread trading involves buying and selling different options or futures at varying strike prices with the same expiration date. The goal is to reduce risk and capitalize on price movements within a specific range. By simultaneously establishing multiple positions, traders aim to profit from fluctuations while limiting their overall exposure.

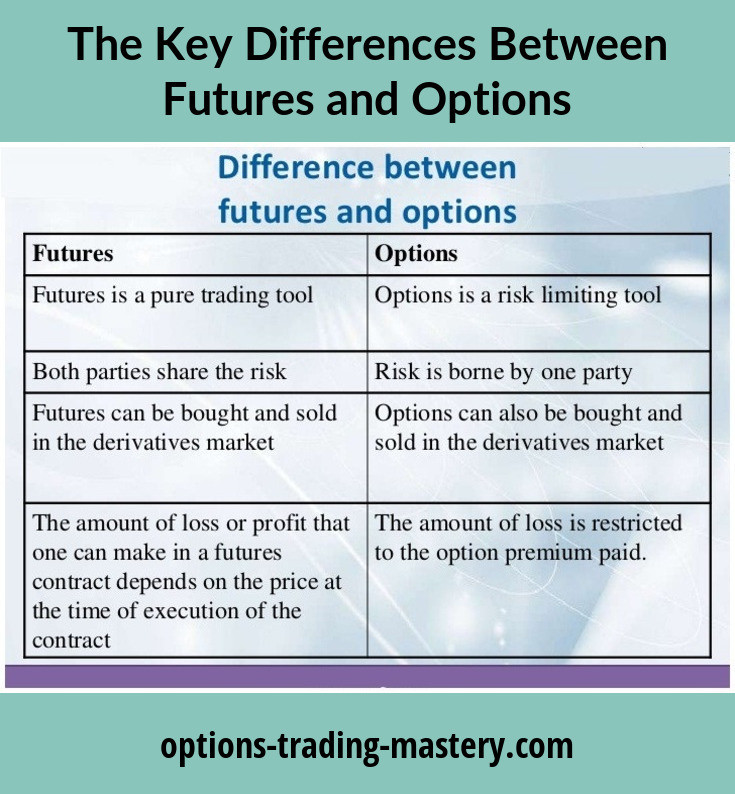

Image: www.options-trading-mastery.com

2. Scalping

Scalping is a short-term trading strategy that involves frequent buying and selling of futures or options within a short timeframe. Scalpers seek to exploit minor price fluctuations within a trading session to accumulate small profits. This strategy requires quick decision-making and precise timing.

3. Hedging

Hedging is a risk management strategy where futures or options are utilized to offset the potential losses of an existing position. By taking opposite positions in correlated instruments, investors aim to reduce the impact of adverse price movements on their overall portfolio.

Expert Tips and Advice

Navigating the complexities of futures and options trading demands both theoretical knowledge and practical insights. Drawing from the wisdom of experts and seasoned traders, here are some valuable tips to enhance your trading experience:

1. Start Small:

Begin with modest investments to build confidence and gain hands-on experience. Avoid risking excessive capital, especially during the initial learning curve.

2. Seek Education:

Continuously expand your knowledge base by attending webinars, reading books, and engaging in online courses. Stay abreast of industry trends and innovations.

3. Practice with Virtual Trading:

Utilize virtual trading platforms to test strategies and hone your skills without the pressure of real money. Simulate real-world trading conditions to gain invaluable experience.

Frequently Asked Questions (FAQs)

Futures And Option Trading Strategies

Image: www.jlcatj.gob.mx

Conclusion

Embracing futures and options trading strategies opens doors to a world of enhanced investment opportunities. By mastering the intricacies of these instruments, you empower yourself to mitigate risks, capitalize on price movements, and unlock the potential for substantial financial rewards. Whether you’re a seasoned trader or just starting your journey, remember that knowledge, experience, and a well-informed strategy are your most valuable assets in the dynamic world of financial markets. Are you ready to dive into the captivating realm of futures and options trading?