In the realm of finance, futures and options are powerful financial instruments that empower investors to mitigate risks, seize opportunities, and amplify their potential gains. This article serves as a comprehensive guide to the intricate world of futures options trading, arming you with the knowledge you need to navigate this dynamic market.

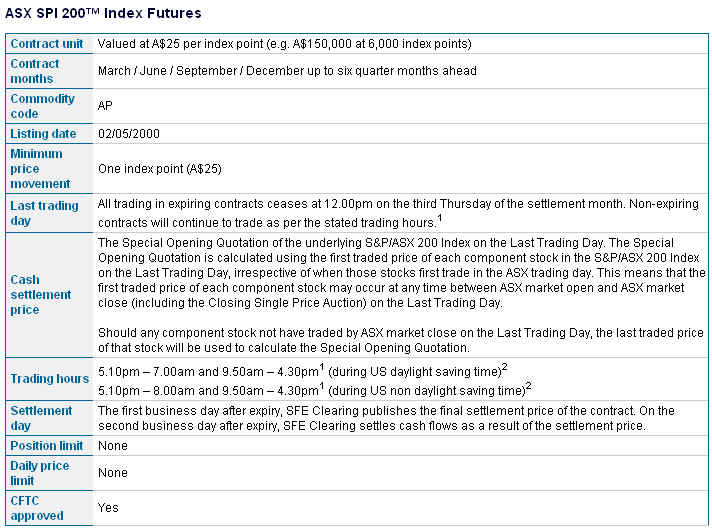

Image: pyqudow.web.fc2.com

Unlocking the Secrets of Futures and Options

Futures contracts are agreements to buy or sell a specific asset at a predetermined price on a specific date in the future. They act as insurance against price fluctuations, enabling investors to lock in today’s price for a future purchase or sale. Options, on the other hand, provide the right, but not the obligation, to buy or sell an asset at a fixed price within a specified time frame. By combining the power of futures and options, traders can craft complex strategies to maximize profits while managing risks.

Futures Options Trading Demystified

At its core, futures options trading involves using options to influence the outcome of futures contracts. This sophisticated strategy empowers traders to tailor their positions, enhancing their ability to capitalize on market movements and protect their investments.

- Call Options: Grant the right to buy an underlying asset at a specific price within a defined time frame. Traders use call options to profit from anticipated price increases.

- Put Options: Provide the right to sell an underlying asset at a specific price within a defined time frame. Traders turn to put options to capitalize on anticipated price declines.

Expert Insights: Unlocking Profits through Strategy

To succeed in futures options trading, it’s crucial to master the art of crafting effective trading strategies. Utilize the following insights from seasoned experts to maximize your success:

- Hedging: Leverage futures options to protect existing investments from potential losses due to adverse price fluctuations.

- Leverage: Amplify potential profits by using options to control a larger position size than your account balance allows.

- Speculation: Anticipate future market movements and use options to position yourself for significant gains.

Image: www.indiratrade.com

What Is Futures Options Trading

Image: healthylifey.com

Conclusion: Empowering Investors in the Financial Arena

Futures options trading is a powerful tool that can empower investors with the ability to enhance their financial strategies. By understanding the fundamentals, embracing expert guidance, and crafting tailored strategies, you can unlock the potential of this dynamic market. Dive into the world of futures options trading today and embark on a journey to financial success.