Have you ever wondered how to profit from stock market fluctuations without actually buying and holding the underlying stocks? The answer lies in the exciting world of options trading. With an option trading course free in Hindi, you can gain the knowledge and skills to navigate this financial landscape confidently.

Image: www.stockmarkethindi.in

An option is a contract that gives you the right, but not the obligation, to buy or sell an underlying asset, such as a stock or index, at a predetermined price on or before a specific date. This flexibility makes option trading a versatile tool for managing risk, enhancing returns, and generating income in financial markets.

Unveiling the Basics of Options Trading

Before you delve into the world of options trading, it’s essential to grasp some fundamental concepts. Options contracts come in two primary flavors: calls and puts. A call option grants you the right to buy an underlying asset at a specified price known as the strike price. On the other hand, a put option gives you the right to sell an underlying asset at the strike price.

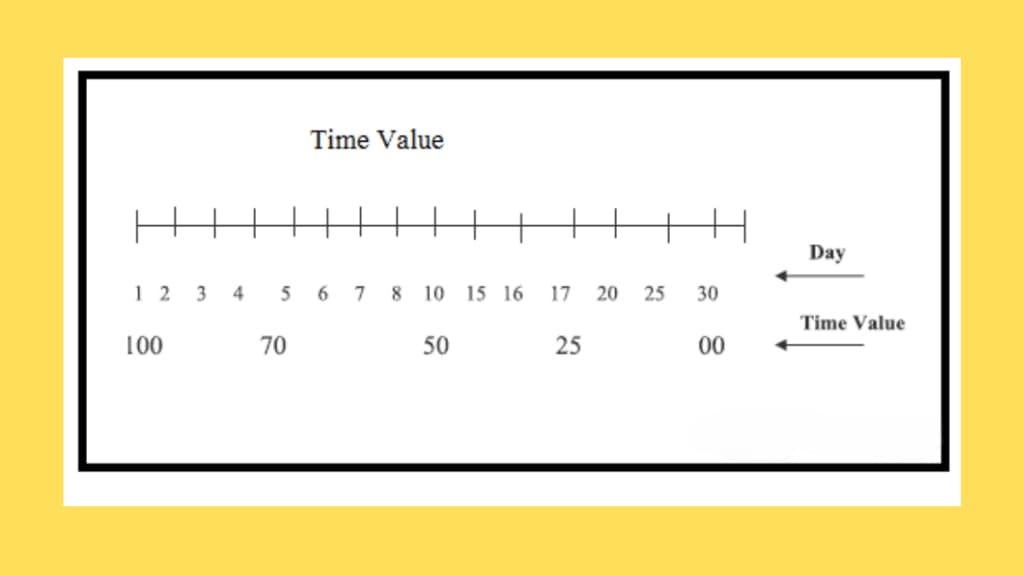

When you buy an option, you are paying a premium to the seller of the option. The premium is the price you pay for the right to exercise the option at a later date. The value of an option is determined by various factors, including the underlying asset’s price, time to expiration, volatility, and interest rates.

Navigating the Market Dynamics

To successfully navigate the options market, it is essential to understand how supply and demand affect option prices. When demand for a particular option is high, its premium will rise. Conversely, when demand is low, the premium will fall.

Option trading strategies vary based on the trader’s goals and risk tolerance. Some common strategies include buying and selling calls and puts to gain exposure to rising or falling stock prices. Others involve vertical spreads, which combine the purchase and sale of options at different strike prices and expiries.

Mastering the Art of Risk Management

Risk management is paramount in the world of options trading. By using proper risk management techniques, you can limit your potential losses while maximizing profit opportunities.

1. Understand Your Risk Tolerance: Assess your financial situation and determine how much money you are willing to risk in option trading. Avoid risking more than you can afford to lose.

2. Diversify Your Portfolio: Spread your risk across multiple options contracts, underlying assets, and trading strategies. This strategy reduces the impact of any single trade going against you.

3. Monitor Positions Regularly: Regularly monitor your open options positions and adjust them as needed. Volatility and market conditions can change rapidly, so staying up-to-date is crucial.

4. Use Limit Orders: Use limit orders when buying or selling options to specify the maximum price you are willing to pay or the minimum price you are willing to accept.

Image: simplykesil.weebly.com

Option Trading Course Free In Hindi

Image: sharemarkettime.com

FAQs on Option Trading

Q: Is option trading suitable for beginners?

A: Option trading involves significant risks and should not be attempted without proper education and understanding. Consider starting with a free option trading course in Hindi to gain foundational knowledge before venturing into the market.

Q: How much capital do I need to start option trading?

A: The capital required for option trading varies depending on the strategies you employ and the risk you are comfortable with. It is advisable to start with a small amount of capital and gradually increase it as you gain experience and confidence.

Q: What are the benefits of using an options trading platform?

A: An options trading platform provides a user-friendly interface, real-time data, and advanced tools for analysis and trade execution. It streamlines the trading process and enhances the overall trading experience.

By embracing the knowledge and skills imparted by a free option trading course in Hindi, you can unlock the potential of the options market. Remember to trade responsibly, manage risk effectively, and continuously learn to navigate this dynamic and rewarding financial landscape.

Are you intrigued by the world of option trading and eager to embark on your financial journey? Share your thoughts and questions in the comments section below. Let’s delve deeper into this fascinating topic together.