Unlocking the Dynamics of Option Trading

In the labyrinthine realm of financial markets, the intricate art of option trading stands tall as a powerful instrument for managing risk and maximizing gains. However, navigating this multifaceted arena can be daunting, especially when it comes to understanding the nuances of pricing. Fidelity’s per-contract structure for option trades offers a unique perspective that necessitates careful examination.

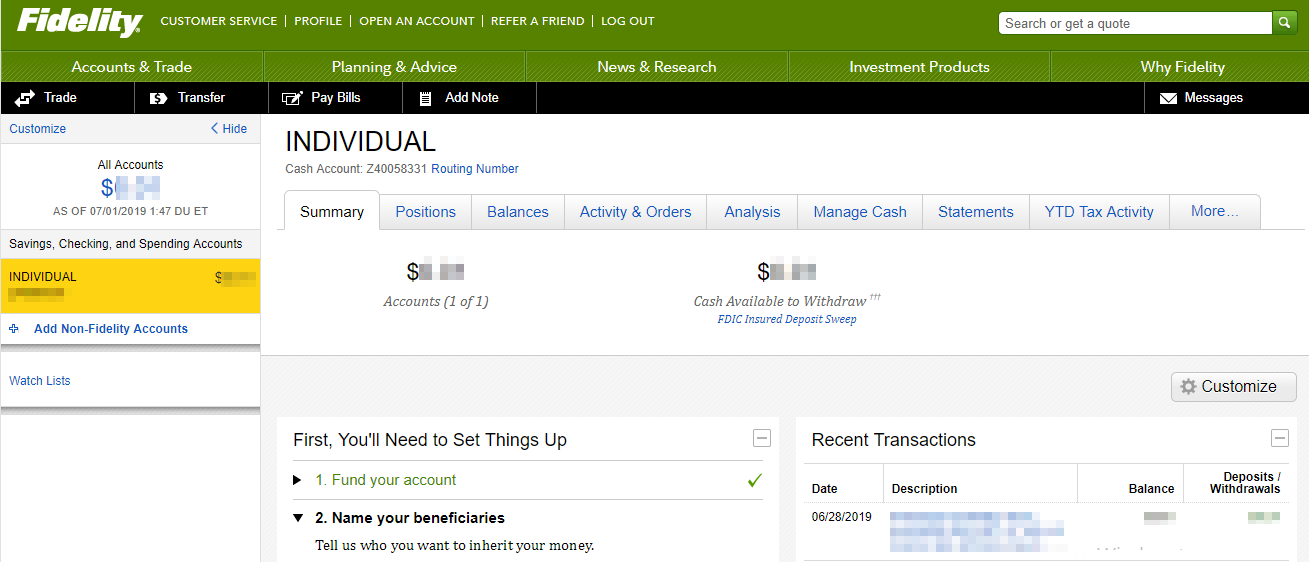

Image: www.stockbrokers.com

Before delving into the specifics, it’s imperative to glean foundational knowledge about option trading. Options, as derivative instruments, derive their value from the underlying assets they represent, such as stocks, commodities, or indices. They grant traders the right, but not the obligation, to buy or sell the underlying asset at a predetermined price (strike price) by a specified date (expiration date).

Per-Contract Pricing: Unraveling the Fidelity Model

Fidelity, a renowned financial services provider, employs a distinctive per-contract pricing structure for option trades. This approach assigns a set fee to each individual option contract traded, regardless of the number of shares it encompasses. Unlike traditional per-share commissions, which fluctuate based on the number of shares involved, Fidelity’s per-contract pricing offers a consistent fee structure, simplifying cost calculations.

The simplicity and cost transparency of Fidelity’s pricing model can be highly advantageous for option traders. It eliminates the complexities associated with calculating commissions based on share volume and ensures that traders can accurately anticipate their transaction costs upfront. This predictability enables traders to make informed decisions about their trades, minimizing unforeseen expenses.

Evolution and Trends in Fidelity’s Option Trading Landscape

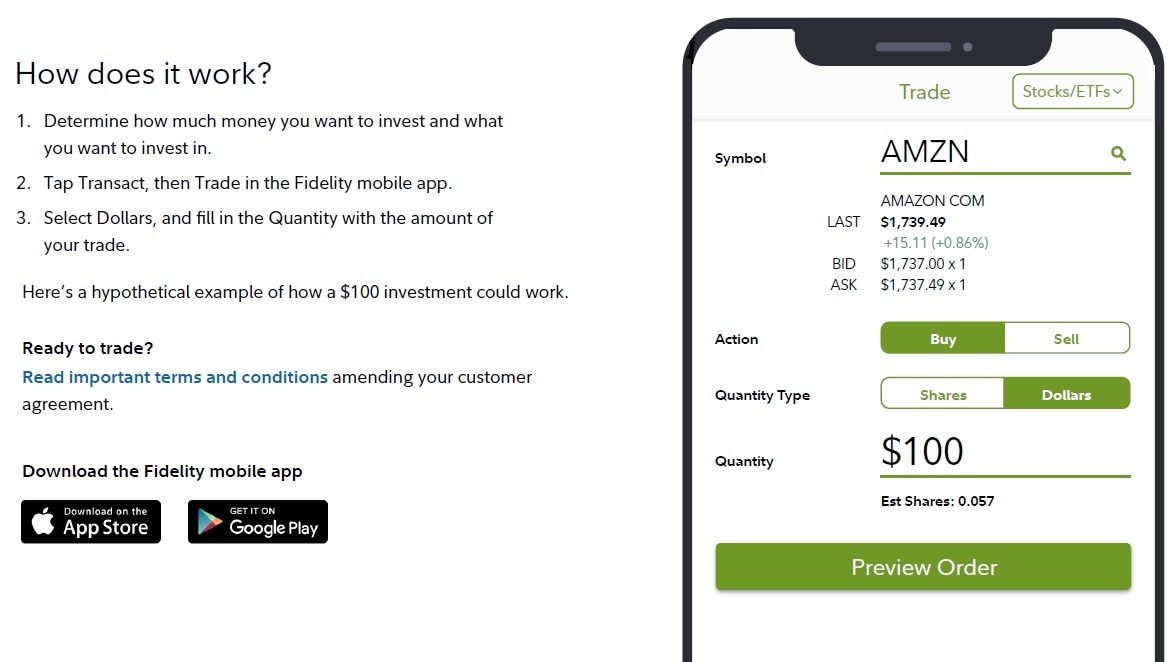

Fidelity has continually evolved its option trading platform to meet the ever-changing demands of the market. In recent years, the integration of cutting-edge technology has transformed the trading experience, providing real-time market data, advanced charting tools, and sophisticated risk management capabilities.

Parallel to technological advancements, Fidelity has introduced a suite of innovative features designed to enhance the overall trading environment. These features include the availability of complex multi-leg strategies, the expansion of tradable options on commodities and indices, and the launch of specialized platforms tailored specifically for options traders.

Tips and Expert Insights for Enhanced Trading

Navigating the intricate realm of option trading requires a blend of knowledge, strategy, and discipline. Seasoned traders have accumulated valuable insights over time that can help novice and experienced traders alike refine their approach. Here are some tips to consider:

- Define Clear Objectives: Before embarking on any trade, clearly define your investment goals and risk tolerance. This foundation will guide your trading decisions and prevent impulsive reactions.

- Master Fundamental Analysis: Thoroughly analyze the underlying asset to understand its price drivers, market conditions, and future prospects. This in-depth knowledge provides a solid basis for making informed trading decisions.

- Utilize Technical Analysis: Technical indicators and charting patterns can offer valuable insights into market trends and potential trading opportunities. Study these tools and incorporate them into your trading strategy.

- Manage Risk Effectively: Option trading carries inherent risks that must be carefully managed. Employ strategies such as stop-loss orders, position sizing, and hedging to minimize potential losses.

Image: www.calibrateindia.com

Frequently Asked Questions (FAQs) on Fidelity Option Trading

To further illuminate the topic of per-contract pricing in Fidelity option trading, let’s clarify some common queries:

- Question: Are there any additional fees besides the per-contract price?

Answer: Yes, other fees may apply, such as regulatory fees, exchange fees, and FINRA fees. Fidelity’s fee schedule provides a detailed breakdown of all applicable charges. - Question: Can I negotiate per-contract pricing with Fidelity?

Answer: Individual negotiation is generally not offered for per-contract pricing. However, Fidelity may consider adjustments for high-volume traders or those with a substantial account balance.

Fidelity Option Trading Per Contract

Image: www.fondazionealdorossi.org

Conclusion: A Gateway to Informed Trading Decisions

Fidelity’s per-contract pricing structure provides a cost-effective and transparent approach to option trading. By understanding the dynamics of this pricing model, traders can optimize their trading strategies, minimize transaction costs, and make well-informed decisions. The combination of Fidelity’s robust trading platform, innovative features, and expert advice empowers traders to navigate the complexities of the options market with greater confidence and finesse.

Are you intrigued by the world of option trading? Embark on this exciting journey today and unlock its potential for financial growth and risk management.