Imagine being able to understand the complex world of financial markets and make informed decisions to maximize your investment returns. Excel options trading offers such a possibility. Excel is a widely used spreadsheet application that provides a versatile platform to analyze, model, and execute options trading strategies. This article serves as a comprehensive guide to excel options trading, unlocking the valuable insights and techniques that can empower you in the financial arena.

Image: bugthinking.com

Unveiling Excel Options Trading: A Pathway to Enhanced Returns

Excel options trading is a sophisticated investment strategy that involves utilizing the powerful features of Microsoft Excel to analyze and trade options contracts. Options trading itself involves the buying or selling of contracts that convey the right (not the obligation) to buy or sell an underlying asset at a specified price on or before a specific date. By leveraging Excel’s analytical capabilities, traders can explore complex scenarios, simulate market conditions, and manage risk with greater precision.

The versatility of Excel enables traders to customize their approach, tailoring spreadsheets to their unique trading styles and preferences. Whether you’re a seasoned professional or a novice seeking to expand your financial knowledge, Excel options trading offers a powerful tool to enhance your decision-making and improve your investment outcomes.

Step into the Realm of Options Trading: Understanding the Fundamentals

Before delving into the world of Excel options trading, let’s establish a solid foundation by understanding the fundamentals of options trading. Options contracts are financial instruments that provide two basic rights: the right to buy (call option) or the right to sell (put option) an underlying asset at a specified price (strike price) on or before a specified date (expiration date). Traders can either buy or sell these contracts, speculating on the future price movements of the underlying asset.

Options trading introduces two key concepts: premium and leverage. Premium refers to the price paid to purchase an options contract, reflecting the market’s assessment of the likelihood of the option being exercised. Leverage, on the other hand, arises from the fact that options control a larger number of shares than their premium cost, allowing traders to gain significant exposure to the underlying asset with a modest investment.

Empowering Excel: Delving into its Analytical Capabilities

Excel serves as a powerful tool for options trading due to its robust analytical capabilities. The spreadsheet’s ability to perform complex calculations, create dynamic charts, and analyze historical data provides traders with invaluable insights for making informed decisions. Excel also offers a range of built-in functions specifically designed for financial analysis, such as the BLACK-SCHOLES function, which calculates the theoretical value of an option based on various factors.

By harnessing Excel’s analytical prowess, traders can engage in in-depth scenario analysis, simulating different market conditions and option strategies to gauge potential outcomes. The spreadsheet allows traders to create sophisticated models that incorporate historical data, technical indicators, and even Monte Carlo simulations, providing a comprehensive view of potential risks and rewards.

Image: www.mql5.com

Customizing Excel: Crafting a Personalized Trading Hub

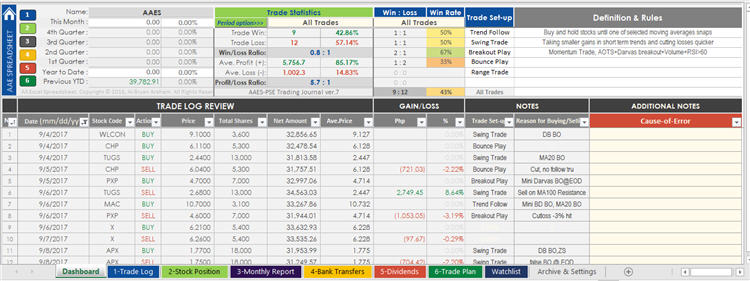

The beauty of Excel options trading lies in its customizable nature. Traders can tailor their spreadsheets to suit their unique trading styles and strategies. This involves creating custom formulas, designing interactive dashboards, and incorporating external data sources to augment their analysis.

Customization empowers traders to monitor market movements, track option prices, and manage their portfolios in a streamlined manner. Excel’s flexibility allows traders to adapt their spreadsheets as their trading strategies evolve, ensuring they remain aligned with their financial goals.

Navigating Options Trading with Confidence: Essential Strategies and Techniques

With a firm grasp of Excel’s capabilities, it’s time to explore the essential strategies and techniques that form the backbone of successful Excel options trading. From basic strategies like covered calls and cash-secured puts to advanced techniques involving multi-leg options spreads and volatility trading, Excel provides the tools to execute these strategies with precision.

Incorporating technical analysis and fundamental research into your Excel models adds an additional layer of sophistication, allowing you to make informed decisions based on both market trends and underlying company data. By understanding the nuances of options pricing and mastering various trading techniques, you can unlock the full potential of Excel options trading.

Exel Options Trading

Image: blog.deriscope.com

Understanding Options Greeks: Quantifying Risk and Return

Options Greeks are a set of metrics that measure the sensitivity of an option’s price to changes in various factors. By analyzing Greeks like delta, gamma, theta, and vega, traders can quantify the potential risks and rewards associated with different option strategies. Excel’s built-in Greek functions provide traders with instant access to these metrics, enabling them to make informed decisions and manage their portfolios effectively.

Understanding Greeks allows traders to fine-tune their strategies, hedging against adverse market conditions and maximizing profit potential. In the world of options trading, knowledge is power, and Greeks provide invaluable insights into the dynamic interplay of market forces.