Are you navigating the complexities of the energy markets, seeking to manage risk and capitalize on opportunities? Our upcoming seminar on energy electricity hedging, trading futures, options, and derivatives is meticulously designed to empower you with the knowledge and strategies to succeed in this dynamic landscape.

Image: diversegy.com

This comprehensive seminar is meticulously crafted by industry experts who will delve into the intricacies of energy trading, providing you with the essential tools and insights to make informed decisions and achieve your financial goals. Join us and embark on a journey to master the art of energy hedging and derivatives trading.

Understanding Energy Electricity Hedging

Hedging has become a crucial risk management strategy in the energy sector, enabling market participants to mitigate price volatility and secure their financial positions. Our seminar will provide a detailed overview of energy hedging, covering its various types, methodologies, and applications in the electricity market. You will gain a profound understanding of how hedging can safeguard your portfolio and enhance your overall risk management strategy.

We will explore the specific challenges and opportunities associated with hedging electricity prices. Our industry experts will share their insights on how to identify hedging opportunities, select appropriate hedging instruments, and manage hedging positions effectively. By the end of this module, you will be well-equipped to implement robust hedging strategies that effectively mitigate risk and protect your financial interests.

Navigating the World of Trading Futures, Options & Derivatives

The energy markets offer a wide range of trading instruments, including futures, options, and derivatives, each with its unique characteristics and applications. Our seminar will provide an in-depth exploration of these instruments, equipping you with the knowledge and skills to utilize them effectively in your trading strategies.

We will delve into the mechanics of futures trading, explaining how to analyze futures contracts, manage risk, and identify trading opportunities. You will also learn the fundamentals of options trading, including the different types of options, their pricing, and how to use them for hedging and speculation. Additionally, our experts will provide insights into the world of energy derivatives, exploring their role in risk management and price discovery.

Latest Trends and Developments in Energy Trading

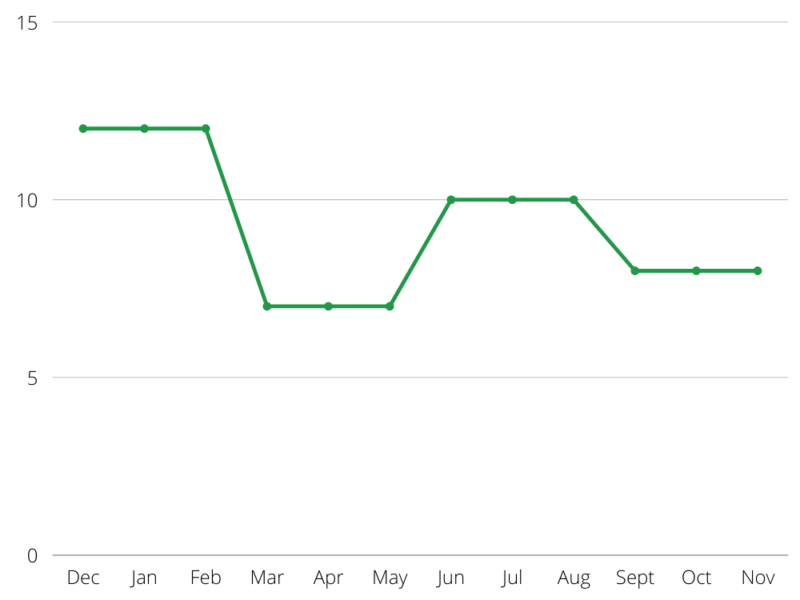

The energy markets are constantly evolving, driven by technological advancements, regulatory changes, and geopolitical events. Our seminar will provide you with the latest updates and insights into these emerging trends and developments, ensuring that you stay ahead of the curve and make informed trading decisions.

We will examine the impact of renewable energy sources on the electricity market, discuss the regulatory initiatives shaping the energy landscape, and analyze the geopolitical factors influencing energy prices. By staying abreast of these latest developments, you can adapt your trading strategies accordingly and seize opportunities in this ever-changing market.

Image: commodity.com

Tips and Expert Advice for Successful Trading

Our team of experienced traders will share their insights and expert advice to help you succeed in energy trading. We will cover topics such as risk management, technical analysis, and trading psychology, providing practical strategies and techniques that you can immediately apply to your own trading.

You will learn how to identify trading opportunities, develop a sound trading plan, and manage your emotions in the face of market fluctuations. Our experts will also share their tips on how to use market data and analysis tools effectively, enhancing your ability to make informed trading decisions and achieve consistent profitability.

Frequently Asked Questions (FAQs)

Q: Is this seminar suitable for beginners?

A: Yes, the seminar is designed to be accessible to both beginners and experienced traders. We will provide a comprehensive overview of the topics, ensuring that everyone can gain a solid understanding of energy hedging, futures, options, and derivatives.

Q: What level of prior knowledge is required?

A: A basic understanding of the energy markets and financial concepts will be beneficial. However, our experts will provide clear and detailed explanations throughout the seminar, ensuring that attendees with varying levels of experience can fully comprehend the material.

Q: Will there be opportunities to network with other traders?

A: Yes, the seminar will provide ample opportunities to connect with other traders, industry professionals, and our expert speakers. We encourage attendees to actively participate in the discussions and networking sessions to exchange insights and build valuable relationships.

Energy Electricity Hedging Trading Futures Options & Derivatives Seminar

Image: www.steag.com

Conclusion

Join our energy electricity hedging, trading futures, options & derivatives seminar and empower yourself with the knowledge, strategies, and expert guidance to navigate the complex energy markets with confidence and success. Whether you are a seasoned trader or new to the field, this seminar will provide you with the essential tools and insights to make informed decisions and achieve your financial goals.

Do you want to stay informed about the latest trends and developments in energy trading? Follow our blog and connect with us on social media for regular updates, expert insights, and exclusive opportunities.