In the fast-paced world of options trading, understanding the expiration date and time is paramount to making informed trading decisions. Expiration serves as the guillotine’s blade, dictating the fate of options contracts and the profits or losses that hang in the balance.

Image: www.fidelity.com

Options, derivatives that grant the right but not the obligation to buy or sell an underlying asset, have a finite lifespan. They come into existence with a set expiration date and time, at which point they cease to exist, along with any potential value. This article will delve into the mechanics of options expiration, providing a comprehensive guide for both seasoned traders and those venturing into this exciting arena for the first time.

Types of Expiration Dates

Options contracts typically fall into one of two categories based on their expiration dates:

1. American Options: As the name suggests, American options offer flexibility by allowing holders to exercise their rights to buy or sell the underlying asset at any time up until their expiration date and time. This feature provides traders with greater latitude in executing their trading strategies.

2. European Options: In contrast to American options, European options can only be exercised on their specified expiration date. This restriction reduces the flexibility of trading but simplifies the process by eliminating the need to monitor the option throughout its lifetime.

Expiration Time

The expiration time for options contracts is standardized across all U.S. exchanges. For stock options, the expiration time is 11:59:59 AM Eastern Time on the third Friday of each month. Index options, such as those based on the S&P 500 or Nasdaq 100, expire on the third Friday of March, June, September, and December.

It’s crucial to note that options expire worthless if they are not exercised before the expiration time. If an option is in-the-money, meaning it has intrinsic value, the holder must decide whether to exercise it or sell it in the market before it expires. Conversely, if an option is out-of-the-money, meaning it has no intrinsic value, it will expire worthless, and the holder will lose the premium paid at its purchase.

Implications of Expiration

The expiration date and time of options contracts have significant implications for trading strategies. Here are a few key points traders should consider:

1. Time Decay: As an option nears expiration, its value decays over time. This phenomenon is known as time decay or theta decay. The closer an option gets to its expiration date, the less time it has for the underlying asset’s price to move in a favorable direction, reducing its value.

2. Volatility: Implied volatility, a measure of expected price movement in the underlying asset, plays a crucial role in option pricing. As expiration approaches, implied volatility typically decreases, resulting in a drop in option premiums. This decline in value is due to the reduced uncertainty surrounding the future direction of the underlying asset’s price.

3. Risk Management: Managing risk is an essential aspect of options trading, and expiration dates play a vital role in this process. Traders should carefully consider the risk profile of an option contract, including the potential for total loss, before entering a trade. Proper due diligence can help minimize the risks associated with options trading.

Image: globaltradingsoftware.com

Example of Expiration Date and Time

Let’s consider an example to illustrate the significance of expiration date and time:

If an options trader purchases a call option on Apple stock with an expiration date of March 17, 2023, and an exercise price of $150, the option will expire worthless if Apple’s stock price is below $150 at 11:59:59 AM Eastern Time on that day. If Apple’s stock price is above $150 by that time, the trader can exercise the option to purchase 100 shares of Apple stock at $150 per share, regardless of the current market price.

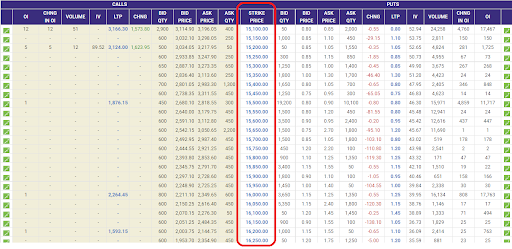

Options Trading Expiration Date Time

Image: tradesmartonline.in

Conclusion

Understanding the expiration date and time of options contracts is fundamental to successful trading. By grasping the concepts outlined in this article, traders can make informed decisions about when to enter and exit option positions, manage risk effectively, and capitalize on the opportunities presented by this dynamic market. Remember, the expiration date serves as the gateway to successful or unsuccessful executions, so always approach options trading with caution and a sound understanding of how these contracts operate.