In the ever-evolving world of finance, options trading has emerged as a lucrative avenue for astute investors. Skill Nation, a renowned platform for online education, offers a comprehensive options trading course tailored to empower aspiring traders with the knowledge and skills to navigate this complex market.

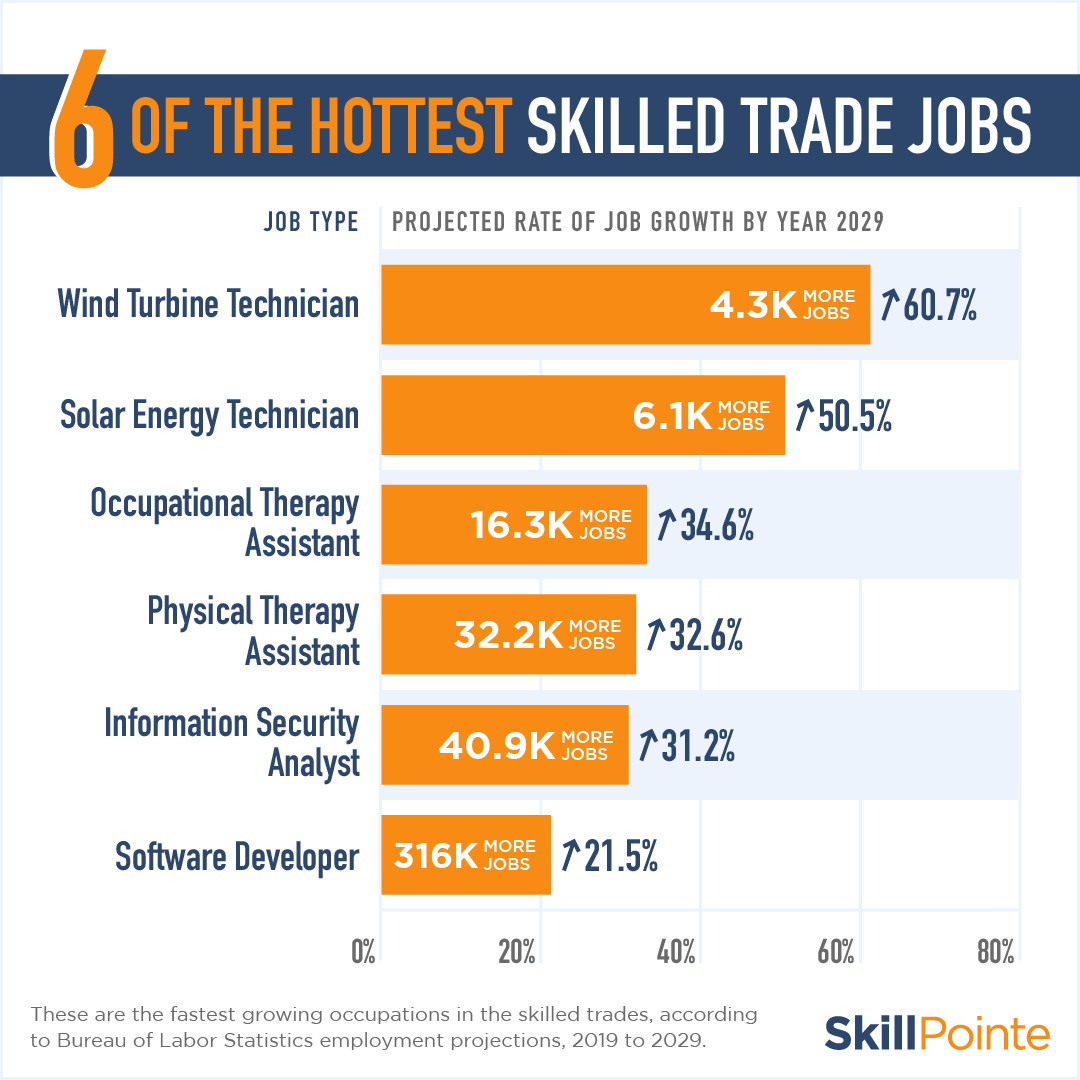

Image: skillpointe.com

Options trading involves the buying and selling of contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. These contracts provide traders with the potential for substantial returns while also mitigating risk exposure.

Embark on the Path to Options Trading Success

Skill Nation’s options trading course is meticulously designed to guide students through every aspect of this intricate discipline. The course covers a wide range of topics, including:

- Options terminology and concepts

- Understanding call and put options

- Strategies for managing risk and maximizing returns

- Technical analysis and chart reading

- Real-world market examples and case studies

With in-depth explanations, interactive exercises, and expert guidance, the course empowers students to gain a thorough understanding of the options market and make informed trading decisions.

Stay Abreast of the Latest Trends and Developments

The financial landscape is constantly evolving, and the options trading world is no exception. Skill Nation’s course remains up-to-date with the latest trends and developments through:

- Regular updates based on news sources and industry forums

- Insights from leading financial analysts and traders

- Inclusion of emerging strategies and technologies

By staying abreast of the latest developments, students can adapt their trading approaches and stay ahead of the curve.

Expert Tips and Advice for Aspiring Traders

In addition to comprehensive knowledge, the course also provides students with practical tips and expert advice to enhance their trading strategies. These include:

- Identifying high-probability trades using technical analysis

- Managing risk by understanding delta and hedging

- Capitalizing on market volatility to maximize returns

- Avoiding common pitfalls and mistakes in options trading

By implementing these valuable tips, students can increase their chances of success in the options market.

Image: www.studioloot.com

Frequently Asked Questions on Options Trading

To further assist students, the course includes a comprehensive FAQ section that addresses common questions on options trading:

- Q: What is the difference between calls and puts?

- A: Calls give the buyer the right to buy an asset, while puts give the buyer the right to sell an asset.

- Q: How can I use options to manage risk?

- A: By purchasing protective options, traders can limit their potential losses.

- Q: What are the risks of options trading?

- A: Options trading involves significant risks, including the potential for total loss of investment.

By addressing these frequently asked questions, the course provides students with a solid foundation in options trading.

Skill Nation Options Trading

Image: blog.getatrade.com

Conclusion

Skill Nation’s options trading course is a valuable resource for any aspiring trader seeking to unlock the lucrative power of options. Through a comprehensive curriculum and practical advice, the course empowers students with the knowledge, skills, and strategies necessary to navigate the options market with confidence.

Are you eager to become a master of options trading? Enroll in Skill Nation’s course today and take the first step toward financial freedom.