Embark on an adventure into the world of options trading with Edgewonk, a platform that has captured the attention of the renowned Reddit community. For the uninitiated, options trading presents a strategic approach to unlocking profit potential by speculating on the future movements of underlying assets, such as stocks. Unlike traditional stock buying and selling, options offer a versatile tool for investors to enhance their portfolio with both bullish and bearish strategies.

Image: optimusfutures.com

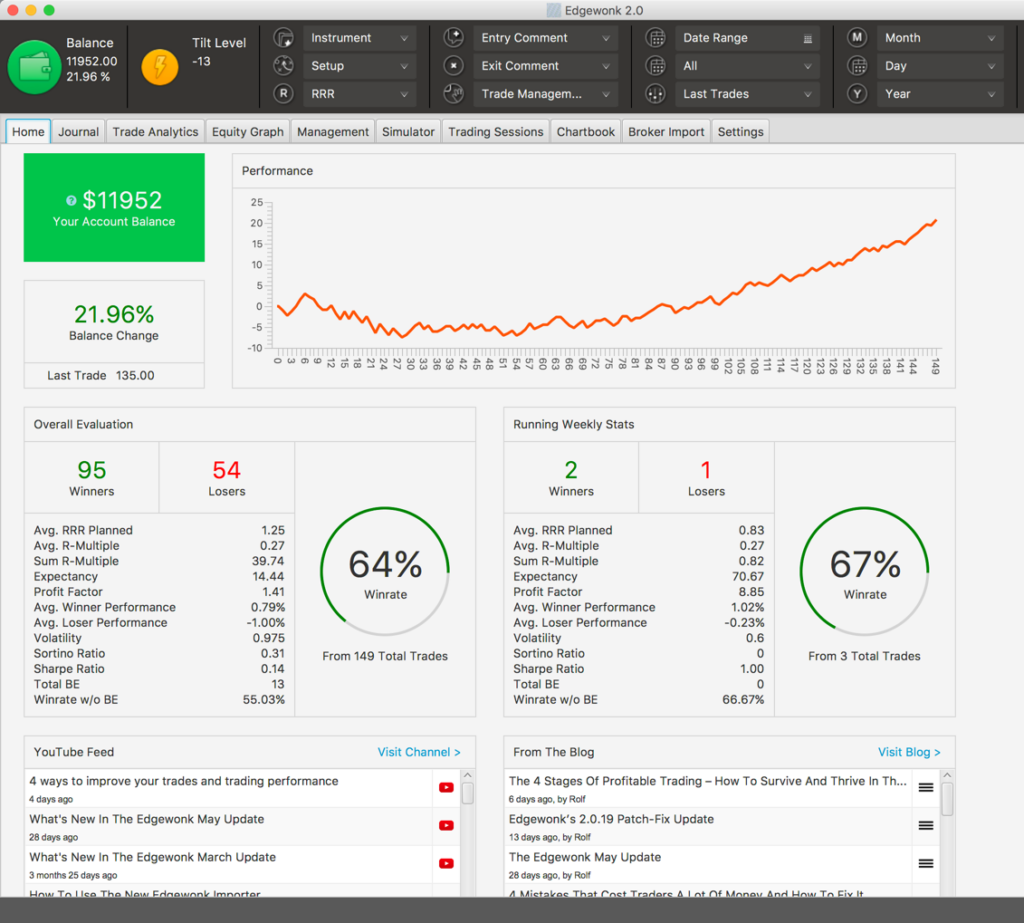

Edgewonk, the brainchild of experienced traders, provides a sophisticated platform tailored to the needs of both novice and seasoned options enthusiasts. Its intuitive interface empowers traders with advanced charting tools, in-depth analysis, and seamless trade execution. Dive into Reddit forums dedicated to Edgewonk options trading, where traders engage in lively discussions, sharing insights, strategies, and their experiences using the platform.

Delving into the Realm of Options

At its core, options trading revolves around contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility offers investors the potential to capitalize on price movements without committing to a direct purchase or sale of the underlying asset.

Options contracts are characterized by two key components: premium and leverage. Premium refers to the upfront cost of purchasing an option, while leverage magnifies the potential return on investment compared to traditional stock trading. However, it’s important to note that leverage comes with amplified risk, making it crucial for traders to manage their trades strategically.

Unlocking Trading Strategies with Edgewonk

Edgewonk’s platform empowers traders with a diverse arsenal of options strategies, each tailored to specific objectives. Whether it’s speculating on stock price direction, hedging against risk, or generating income through option premiums, Edgewonk provides the tools and resources to navigate the complexities of options trading.

- Covered Calls: Enhance your portfolio by selling (writing) call options on stocks you own. This strategy offers limited profit potential while generating additional income from option premiums.

- Cash-Secured Puts: Capture income by selling put options while holding cash as collateral. This strategy obligates you to buy the underlying asset if the option is exercised, allowing you to acquire stocks at a discounted price.

- Bull Call Spread: Construct a bullish strategy by purchasing a lower-strike call option while simultaneously selling a higher-strike call option. This strategy offers limited risk and a defined profit potential.

- Bear Put Spread: Craft a bearish strategy by selling a lower-strike put option and buying a higher-strike put option. This strategy benefits from a decline in the underlying asset’s price.

Image: www.youtube.com

Edgewonk Options Trading Reddit

Image: daytradereview.com

Reddit’s Edgewonk Community: Sharing Strategies, Learnings, and Insights

Reddit, the internet’s vast social news aggregator, plays a pivotal role in the Edgewonk options trading ecosystem. Traders leverage Reddit’s vibrant community to connect, exchange knowledge, and refine their strategies.

- r/Edgewonk: The official subreddit dedicated to Edgewonk options trading, serving as a hub for discussions, strategy insights, platform updates, and trader experiences.

- r/Options: A broader options trading community where Edgewonk users engage in discussions alongside traders using other platforms, exploring options-related topics, and sharing market insights.

- r/WallStreetBets: This subreddit, known for its often-volatile and speculative trading discussions