Uncover the World of Options Trading and Enhance Your Investment Strategies

When it comes to the world of investing, there are few strategies as exciting and potentially lucrative as options trading. Welcome to the intricate realm of edgewonk options trading – a specialized form of options trading characterized by advanced strategies and analytical techniques to maximize profits while minimizing risk. If you’re an ambitious investor seeking to ascend to the next level, this comprehensive guide will illuminate the captivating world of edgewonk options trading, equipping you with the knowledge and insights to navigate this thrilling investment landscape.

Image: www.youtube.com

Delving into the Nuances of EdgeWonk Options Trading

Options trading, in essence, is a sophisticated financial strategy involving the trading of derivative financial instruments known as options. These contracts convey the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a specified price, known as the strike price, on or before a designated date. Edgewonk options trading takes this concept a step further, introducing advanced technical analysis, statistical models, and proprietary algorithms to identify and exploit trading opportunities with precise timing and risk management.

The allure of edgewonk options trading lies in its potential for significant profits coupled with reduced risk when executed skillfully. By employing complex strategies such as multi-leg spreads, volatility trading, and algorithmic execution, edgewonk traders seek to maximize returns while minimizing losses, creating a compelling proposition for risk-averse investors seeking enhanced returns.

The Power of Options Trading Strategies

The core of edgewonk options trading lies in unlocking the potential of advanced options trading strategies. Here are some of the most commonly employed strategies, each with its unique characteristics and potential rewards:

Bull Call Spreads:

An ideal strategy for a bullish (upward trend) market, bull call spreads involve buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price with the same expiration date. This strategy aims to capture potential upside gains while limiting the profit potential and reducing the overall cost compared to outright buying a stock.

Bear Put Spreads:

Tailored for a bearish (downward trend) market, bear put spreads entail buying a put option at a lower strike price and concurrently selling a put option at a higher strike price with the same expiration date. This strategy seeks to profit from a decline in the underlying asset’s value, again with the advantage of reduced risk and lower upfront investment compared to directly selling a stock.

Iron Condors:

Combining elements of both bull call and bear put spreads, iron condors create a neutral to modestly bullish position. The strategy involves simultaneously buying and selling call and put options at different strike prices to capitalize on a relatively narrow range in the underlying asset’s price. Iron condors are designed to benefit from low volatility in the market.

Vertical Spreads:

Vertical spreads encompass a broad range of strategies that combine the buying and selling of options at the same strike price but with different expiration dates. Depending on the specific combination, vertical spreads can be structured to create a bullish or bearish bias and can provide varying levels of leverage and risk.

These represent just a glimpse of the diverse options trading strategies available to investors seeking to navigate the complexities of the financial markets. The key to successful edgewonk options trading lies in understanding the intricate details of these strategies, their potential risks and rewards, and the nuances of market timing.

Unveiling the EdgeWonk Trading Mindset

Beyond technical prowess, edgewonk options trading demands a distinct mindset – a blend of analytical rigor, risk management acumen, and emotional control. Successful edgewonk traders possess the following vital attributes:

Discipline and Patience:

Mastering edgewonk options trading requires unwavering discipline and patience. It’s not a get-rich-quick scheme; instead, it necessitates a commitment to continuous learning, diligent execution of meticulously researched strategies, and the capacity to wait for the opportune moments to capitalize on market trends.

Risk Management Foresight:

Edgewonk traders prioritize meticulous risk management. They meticulously evaluate potential risks associated with each trade, employing risk-limiting strategies such as options spreads, hedging, and strict position sizing to safeguard their capital and enhance their overall trading performance.

Adaptability and Agility:

The financial markets are inherently unpredictable, demanding adaptability and agility from investors. Edgewonk traders possess the agility to adjust their strategies based on evolving market conditions and quickly seize new opportunities. A willingness to adapt and embrace innovation is paramount in this ever-evolving trading landscape.

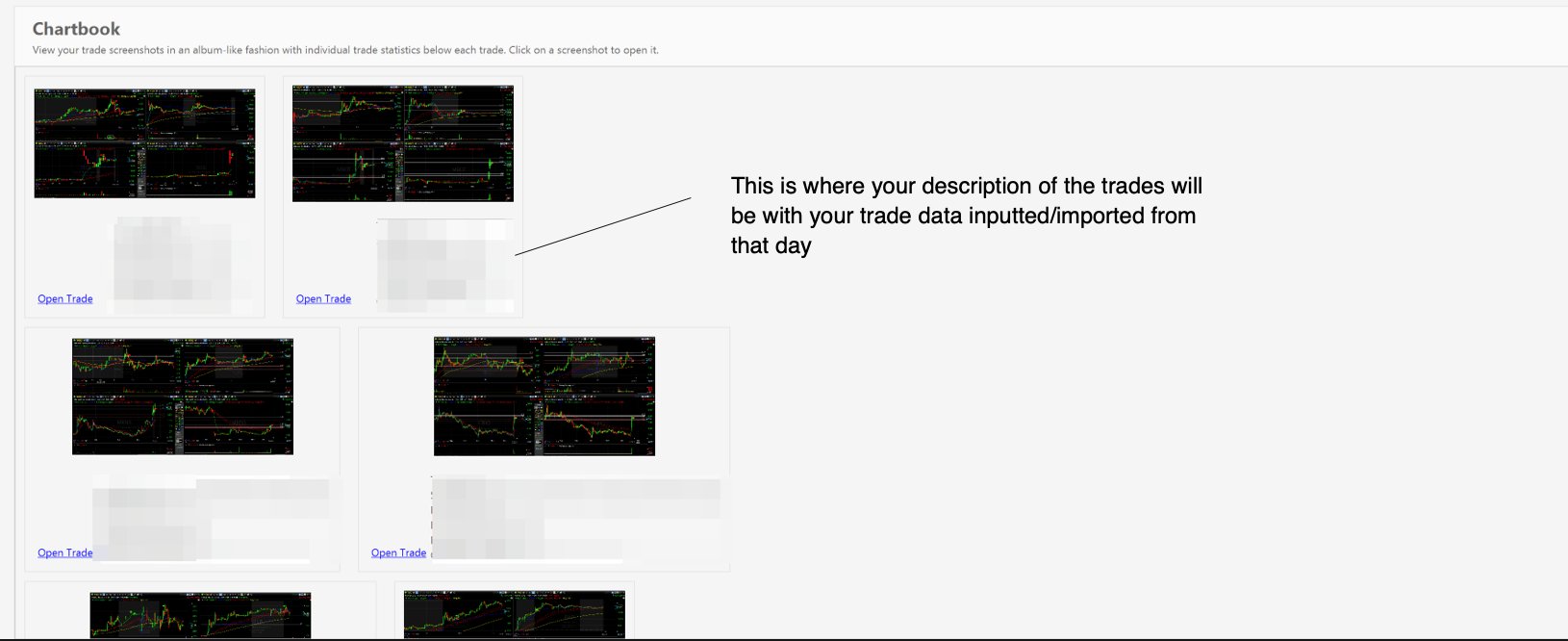

Image: daytradereview.com

Edgewonk Options Trading

Image: www.livestreamtrading.com

Conclusion: Embracing the EdgeWonk Trading Legacy

Edgewonk options trading offers a compelling investment approach, empowering individuals with the potential to outpace traditional market returns. However, it’s crucial to approach this domain with a deep understanding of its complexities and the associated risks. It’s highly recommended to seek guidance from experienced professionals, meticulously study trading strategies, and practice disciplined risk management techniques before venturing into the arena of edgewonk options trading. Remember, investing wisely entails a blend of knowledge, strategy, and emotional fortitude, enabling you to navigate the turbulent financial markets with confidence and a thirst for discovering new avenues of growth.